MAP Rewarder: MAPR Payouts to Delegators and Price Increase for Token-Holders for 2 Mar 2020 (16.4% APR, 17.7% APY)

Earn significant passive income with STEEM without locking SP by investing in MAPR tokens.

This week's distributed profits are 0.314%, equivalent to 16.4% APR and 17.7% APY.

This is higher than most individuals can earn from vesting their own STEEM.

Remember that MAPR has a unique distribution and pricing system. If you look at the MAPR tokens you, as delegator, have received today, multiply that number by the new official BUY Price and you get the same amount in STEEM as you would have done under the old system of just paying out STEEM transfers.

Token-holders receive no token distribution, unless they are also delegators. Their profit comes in the token price increase.

The added bonus is that if you don't sell this week's tokens, then next week their value will rise to at least the new BUY Price. This is how the token allows compounding of profits, for both delegators and token-holders.

Using the language of investment trusts, delegators hold "income" stakes where the "interest" is paid out in tokens, whereas token-holders have "capital" stakes where the profit is added to the token price.

A reminder that new delegations start to earn 2 days after the day of delegation. This means that the first week's payout will be lower than for a 7-day week. Also, as payouts are done on Mondays, delegating on a Saturday or Sunday will yield no distribution till the following week. This has always been in place and is to avoid people trying to game the distribution. The positive part is that there is no unstaking period for the tokens, merely the standard waiting time for undelegating.

MAPR: The Numbers

All these numbers relate to a 7-day period (Monday to Sunday) and calculated in STEEM per SP.

Value of Steem upvotes = APR 21.4% [1a], 12.2% [1b], 11.8% [1c]

Value of Steem author rewards payouts = APR 10.7% [2a], 6.1% [2b], 5.9% [2c]

Distributed MAPR payouts = 0.314% (APR 16.4%) [3]

Projected Compounded APY 17.7% [4]

MAPR BUY Price: 1.11614 STEEM [5]

MAPR SELL Price: 1.12730 STEEM [6]

[1] Theoretical maximum value of Steem upvotes, assuming 10 full upvotes at 100% power for 7 days, averaged over 7 days and expressed as an APR. This calculation was performed for an SP of 1 million STEEM to be as close as possible to linearity. Your own upvote will be somewhere between 50-100% of this value.

The values are now calculated for three levels of voting power: 1 million SP (a); 10,000 SP (b); and 1,000 SP (c).

[2] Theoretical value of Steem upvote author rewards, assuming 50% curation rewards, 50-50 split of post payouts and SBD print rate, averaged over 7 days and expressed as an APR. Your own author rewards will be somewhere between 50-100% of this value.

[3] MAP Rewarder distributed payout sent to delegators this week as tokens and the MAPR price adjusted to reflect this.

[4] Equivalent compounded yield as an APY for this week's distribution in [3].

[5] Our BUY price is the price you may sell your MAPR tokens such that their value in STEEM is the same as if this week's distribution was done by direct STEEM transfer.

[6] Our SELL price is about 1% above the BUY price.

Our MAPR distribution [3] is much higher than the average blockchain author rewards [2].

Our payout [3] is now significantly higher than most users can achieve [2a, b & c]

and

higher than most users can even generate with a full vote [1b, 1c].

Profits will be paid today in the new MAPR tokens.

MAPR News

I have made a change to the data presented above, with [4] now being a calculation showing the compounded rate of return for a year. Most delegators and token-holders are keeping their tokens, hence compounding the weekly profits. This new calculation is thus a better measure of returns for most MAPR members.

We have recently been flat at around the 16.5% APR mark. I do hope this increases soon as we are working behind the scenes on a new voter. However, in terms of the whole Steem economy and the earnings of the vast majority of Steemians, this remains significantly above average. A look at Dlease shows yields of about 12.5% but those require large delegations and lengthy periods.

The STEEM price has been highly volatile during the last 2 weeks, and with SBD dipping above and below the $1, this has had a negative effect, even though the average figure for the blockchain has edged up a little. This is largely due to an increasing reward pool which is a consequence of a continued decrease in activity. That diminishing rshares activity results in fewer earning opportunities. So although this all happens somewhat slowly, the hourly swings in prices do affect post payouts and can result in as much as a 10% drop for an "unlucky" post.

We are also seeing a continued trickle of new delegators, which is good to see. As I have said before, it takes a couple of weeks for new delegations to truly be reflected in our income, so all will be fine in time.

One other thing to mention is that, in an effort to diversify, I find that so many other tokens just cannot hold up their yield or their price. So I have had to adjust some token holdings, most of them lower. The numbers are also very sensitive to changes, for example, just 5 STEEM can make a difference of 0.3% APR either way.

The new reward curve means that MAPR income is now even higher compared to the average user than it was before. Sure, it has dropped slightly in money terms due to the same reward curve changes, but compared with one's own personal SP, either delegating or buying MAPR tokens can produce very attractive income.

Indeed, by investing in MAPR, whether as a delegator or by buying tokens, you will be earning close to the same percentage as a whale. Sure, it won't be the same amount but it is the same percentage - and with a non-linear curve that's important. As most MAPR members are hodling, the APY rate of about 18.0% is closer to the true yield for most people.

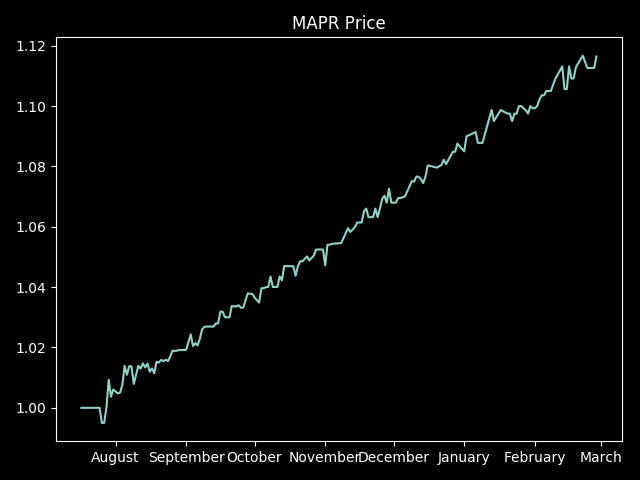

Although our weekly returns are variable, here is a graph of how we have been performing since the MAPR token was launched. (Thanks to @gerber for the discord-bot.)

MAP Rewarder, without the token, has been in operation some 24 months, so you can extrapolate back from that graph to get an idea of our returns to members. We celebrate 2 years of operations at the start of February.

This graph is a record of actual transactions on the Steem Engine exchange so it can, in practise, deviate from this apparently-straight line. This can happen if there are large buyers or sellers that can use up all the tokens at a particular price-point. At the moment, we are largely seeing buy-and-hold trades and the market behaves more like a shop than an exchange. So this is just a reminder that it is a marketplace and you can leave open orders to either buy below our own current price, or sell slightly above it.

Finally, there is not very much I wish to say about the Tron acquisition of Steemit. Our one focus here at MAP FinTech is the economic model of the Steem blockchain. So the one thing we seek clarity on is the future of this economy and whether a STEEM-TRON token will still be based on the Steem blockchain as it now exists.

The Steem economy is poorly - if at all - understood by most Steemians, including those who seem closest to developing apps for it. This has always struck me as astonishing and is the source of many badly designed changes. The problem with failing to take into account consequences and feedback loops is that you can end up failing to achieve what you thought you set out to do. These are not unintended consequences, they are just the logical outcomes that were never considered - or at least never presented to the public.

For the latest twist to the Tron saga, please read these two posts on Soft Fork 0.22.2 and Justin Sun's response and keep up to date with all Steem news by following @pennsif.

See you next week!

Next rewards distribution will be on Monday 2 March.

[BUY MAXUV] - [READ MAXUV]

[BUY MAPR] - [READ MAP REWARDER]

[BUY MAPXV] - [READ MAPXV]

ONECENT: The First Strategic Token Investment Game (STIG)

I think you deserve some $trdo

Congratulations @pixelfan, you successfuly trended the post shared by @accelerator!

@accelerator will receive 1.02303000 TRDO & @pixelfan will get 0.68202000 TRDO curation in 3 Days from Post Created Date!

"Call TRDO, Your Comment Worth Something!"

To view or trade TRDO go to steem-engine.com

Join TRDO Discord Channel or Join TRDO Web Site

View or trade

BEER.Hey @accelerator, here is a little bit of

BEERfrom @pixresteemer for you. Enjoy it!Learn how to earn FREE BEER each day by staking.

!trendovoter

thanks

Congratulations @mapxv, 47.72% upvote has been shared with your successful call on the post that shared by @accelerator!

Support @trendotoken projects by delegating : 100SP , 200SP , 500SP , 1000SP , 2000SP

Thank you for being a part of the INCOME entertainment Fund, where builders are sought and supported!

This service is managed by @ecoinstant.

$trendotoken

$trendotoken

Congratulations @busbecq, you successfuly trended the post shared by @accelerator!

@accelerator will receive 4.64485388 TRDO & @busbecq will get 3.09656925 TRDO curation in 3 Days from Post Created Date!

"Call TRDO, Your Comment Worth Something!"

To view or trade TRDO go to steem-engine.com

Join TRDO Discord Channel or Join TRDO Web Site

$trendotoken

Congratulations @map10k, you successfuly trended the post shared by @accelerator!

@accelerator will receive 3.99895988 TRDO & @map10k will get 2.66597325 TRDO curation in 3 Days from Post Created Date!

"Call TRDO, Your Comment Worth Something!"

To view or trade TRDO go to steem-engine.com

Join TRDO Discord Channel or Join TRDO Web Site

Congratulations @accelerator, your post successfully recieved 9.66684376 TRDO from below listed TRENDO callers:

To view or trade TRDO go to steem-engine.com

Join TRDO Discord Channel or Join TRDO Web Site