BTC rises above $71K, spot bitcoin ETF flows turn positive again

Spot Bitcoin exchange-traded funds are seeing positive inflows again following five days of outflows.

The net aggregate flow of money to the recently released batch of spot Bitcoin exchange-traded funds (ETFs) is positive for the first time since March 15.

A net inflow of $15.4 million was recorded on March 25, bucking a trend that had seen net outflows of $887 million over the previous week.

Even though the amount of new money coming in yesterday was the lowest since January 26, it represents a reversal of the trend as Bitcoin prices rise after their pre-halving dip.

Bitcoin ETFs are back in Black

According to Farside Investors' preliminary statistics, Grayscale's GBTC experienced a $350 million withdrawal on March 25. Analyst projections to the contrary show that GBTC outflows have not abated and are still having an impact on total ETF flow numbers.

Bitcoin ETF Flow (US$ million) (2024-03-25)

TOTAL NET FLOW: 15.4

(Provisional data)

I BIT: 35.5

FBTC: 261.8

BITB: 14

ARKB: 0

BTCO: 18.5

EZBC: 20.5

BRRR: 11.2

HODL: 4

BTCW: 0

GBTC: -350.1

For all the data & disclaimers, visit:https://t.co/4ISlrCgZdk

Farside Investors (@FarsideUK) March 26, 2024

Since the mid-January conversion of its GBTC fund to a spot ETF, Grayscale has lost 273,335 BTC. There are presently $24.7 billion in assets under management for the fund's remaining 347,552 Bitcoin.

Fidelity, which received a $262 million inflow for its FBTC fund, which has an AUM of $7.2 billion, has helped to enhance today's flow estimates.

BlackRock, which has been in the lead thus far, only brought in $35.5 million, significantly less than its average. With an AUM of $13.4 billion, the IBIT fund still falls short of what Grayscale possesses when combined.

It is "unheard of for a new ETF" that BlackRock and Fidelity have experienced inflows for 50 straight days, according to Bloomberg ETF expert Eric Balchunas.

To everyone celebrating, happy 50 Straight Days of Inflows. This chart of the top ETFs based on "active" inflow streaks reveals that $IBIT and $FBTC are the most popular, demonstrating how unusual 50 days are (albeit still a long way from breaking the record of 160 days set by $JEPI) for new ETFs. using pic.twitter.com/Ty7u5Z4xjx from @thetrinianalyst

Eric Balchunas (@EricBalchunas) March 25, 2024

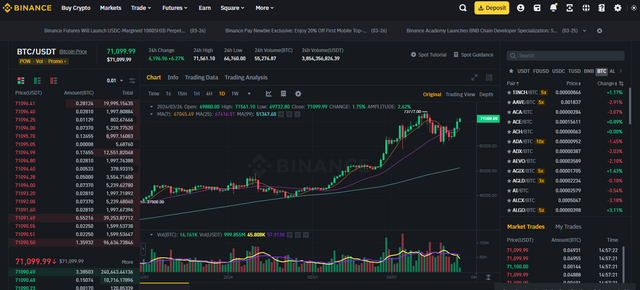

The shift in the ETF flow trend coincides with a spike in Bitcoin prices to $71,000 in late-morrow trade on March 25. At the time of writing on Tuesday morning during the Asian trading session, the asset had retained gains and was trading at $70,641.

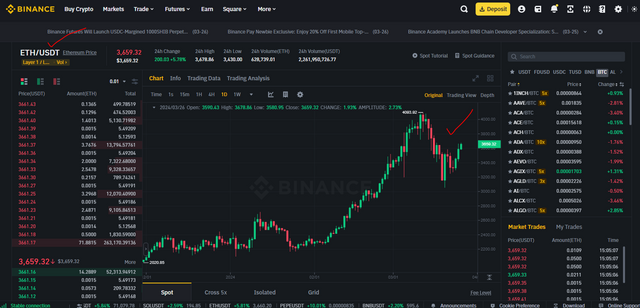

Ethereum ETF Odds Adjusted

The odds for spot Ethereum ETF approval have been adjusted once more by insiders. On March 26, Balchunas stated, "We are holding the line at 25% odds, although it is a very pessimistic 25%."

"There seems to be a deliberate lack of participation as opposed to procrastination. No intelligence or encouraging signals are to be found. I hope they approve it, but right now it doesn't seem promising.

Craig Salm, chief legal officer at Grayscale, stated that he was unfazed and that he "believes the ETFs should be approved" before going on to say:

"I don't believe that the perception of regulators' lack of involvement should be a predictor of any certain result. These problems were all resolved and showed no differences between spot BTC and ETH ETFs.

Chief Legal Officer of Grayscale made some intriguing remarks.