Avoiding Double Taxation with Adsense and Foreign Revenue in India

If you hve an income from the adsense and the foreign revenue through freelancing, we have some of the interesting scene here we need the income tax resdence ceritificate. I suppose it may not be easy to get it so you have to consult wiht the same from people.

A tax residency certificate (TRC) is a document issued by the tax authorities of a country, certifying that an individual or entity is a tax resident of that country. In the case of India, the tax residency certificate is issued by the Income Tax Department.

To acquire a tax residency certificate in India, you need to follow these steps:

Determine your residential status: Before applying for a tax residency certificate, you need to determine your residential status in India. This is based on the number of days you have spent in India during a financial year.

Gather the required documents: The documents required to apply for a tax residency certificate in India include:

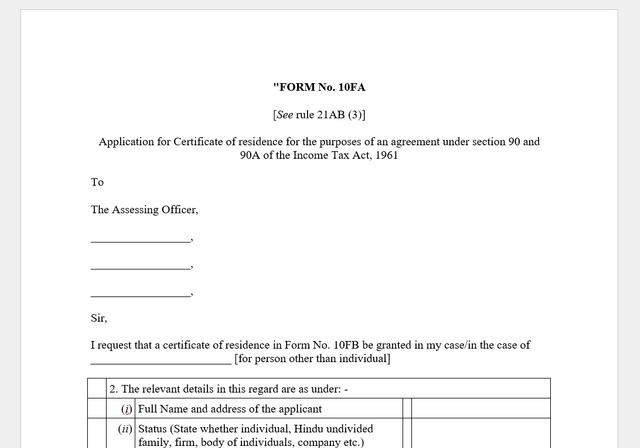

- Completed application form (Form 10FA)

- Proof of your residential status in India (e.g., copy of passport, bank statements, utility bills)

- Copy of your PAN (Permanent Account Number) card

Submit the application: You can submit the application for a tax residency certificate in the following ways:

- Online: You can apply for the tax residency certificate online through the e-filing portal of the Income Tax Department.

- Offline: You can submit the physical application form along with the required documents at the nearest Income Tax office.

Pay the application fee: There is a nominal fee associated with the application for a tax residency certificate. The fee can be paid online or through a demand draft.

Wait for the certificate: The Income Tax Department will process your application and issue the tax residency certificate within a few weeks, usually around 2-4 weeks.

It's important to note that the tax residency certificate is valid for a specific financial year and needs to be renewed annually if you continue to meet the criteria for being a tax resident in India.

The tax residency certificate is often required for various purposes, such as claiming tax treaty benefits, opening bank accounts, or securing investments in other countries.