TRON and Steemit Integration- Part 3

With the recent TRX integration in Steemitwallet, the users in the Steem ecosystem now have an additional stream of income in the form of TRX, a top 20 coin in market cap.

The Steem users are celebrating this event and are now motivated to set their post payout "100% power up". By doing so, they are earning more TRX tokens, they are also helping this ecosystem to build the resources(SP) for sustainability and that is also helping the supply/demand equation in favor of STEEM.

But a section of the users basically those who earn a living from this ecosystem, whose activities and engagement are pivotal to the basic income, are in dilemma to how to use liquid TRX rewards to ensure their minimum daily spending power for their survival, at the same time they seek to benefit from store-of-value of TRX. I said "dilemma" because the next Altcoin rally is likely to trigger and the entire crypto market is anticipating such a rally anytime soon.

So being a top 20 coin, TRX is very much on the horizon to join the rally. Those who want regular income from the Steem ecosystem are looking at the liquid rewards TRX for such a cause. But they will be mathematically in a loss (if they sell it now) if in the near term TRX appreciates in value as a result of the Altcoin rally.

If you sell liquid TRX rewards, it is literally a loss at this moment, as the market is all set for a rally(not financial advice though, but the probability is quite high). And if you don't sell, you will restrict your spending power which will question your survival(those who are struggling with their basic income).

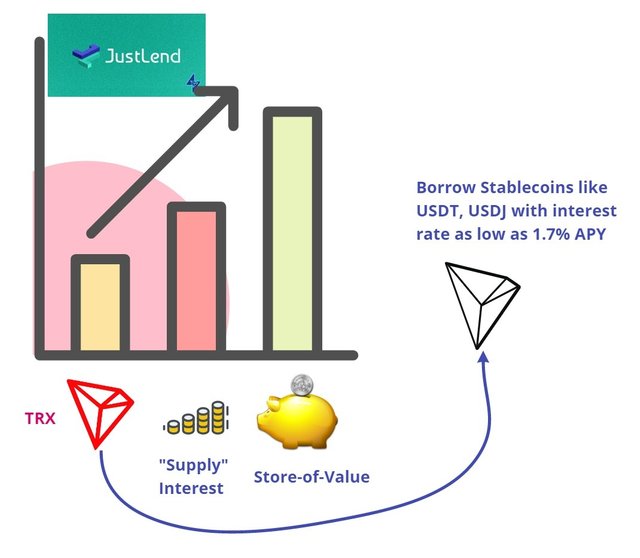

So the best way out is to contribute your liquid TRX to the supply pool of JustLend, and then use that as collateral to borrow USDT or USDJ(stable coins). The interest rate is as low as 1.76% at the moment(however it fluctuates depending on the demand & liquidity in the supply pool).

So this publication aims to guide you on "How to contribute your TRX to the supply pool in JustLend and How to use it as collateral to take a loan in another token or same token, and How to repay it, etc."

Brief Overview of JustLend

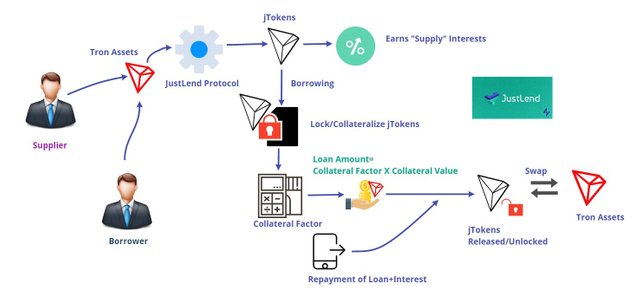

JustLend is a decentralized money market protocol powered by smart contracts in the Tron ecosystem where the Tron assets are pooled and based on the liquidity in the pool and demand of the assets(borrowing side), the interest rate is determined.

So unlike the traditional p2p protocol, here the users/actors(suppliers, Borrowers) interact with the pool, and the floating interest rate(Borrowing Rate, Supplying Rate) is determined by an algorithm & accrued at each block.

If the liquidity is higher in the supply pool, and the demand for the token(to borrow) is lower, then the interest rate decreases and vice versa.

A supplier is basically the one who contributes the assets to the pool and earn an interest rate.

A Borrower is the one who collateralizes the asset and borrows another asset(or same asset) at a certain interest rate determined by the algorithm.

The interest rate is floating and is accrued at every block(3 seconds).

There is a collateral factor that varies from 0 to 1, with a lower value indicates low liquidity and a high value indicates better liquidity. The collateral factor multiplied by the collateral value is the loan amount for the borrower.

At any given time, (Collateral value) has to be greater than (Loan value + Accumulated interest), otherwise, it will be deemed unsafe and hence will trigger the liquidation of the asset.

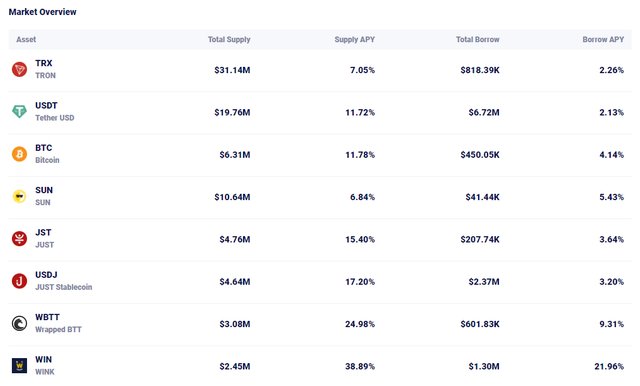

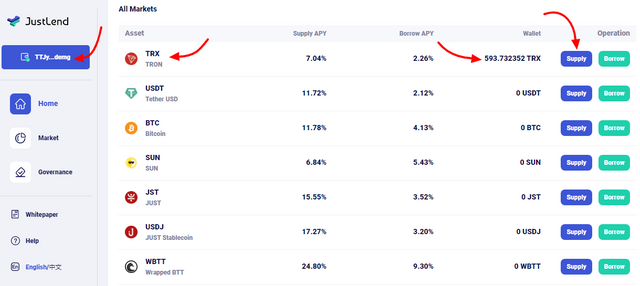

There are 8 different markets: TRX, SUN, USDT, USDJ, BTC, WINK, WBTT, JST, etc. You can supply any of the token and you will be issued jtokens, e.g. if you contribute TRX to the Supply Pool, then you will be issued jTRX tokens, you can use that as collateral to borrow another asset(or same asset). If you use it as collateral it will be locked until you repay the borrowed asset.

Put simply, for a Borrower, the collateral will be locked, for a supplier, there is no such restriction, they will keep earning & accumulating the floating interest rate each block(3 seconds) and at any given time they can pull out their tokens from the pool.

How does it work?

.jpg)

How do I supply TRX tokens & earn an interest rate in JustLend?

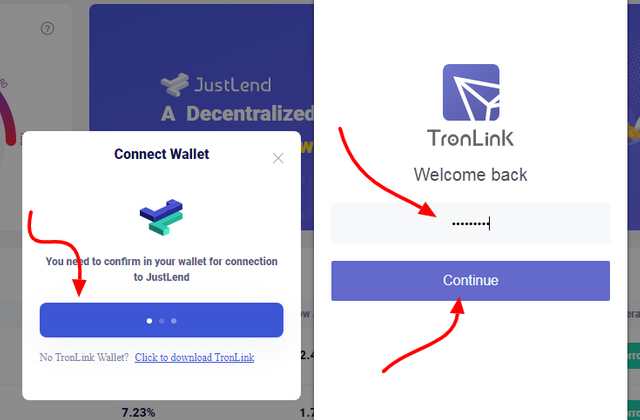

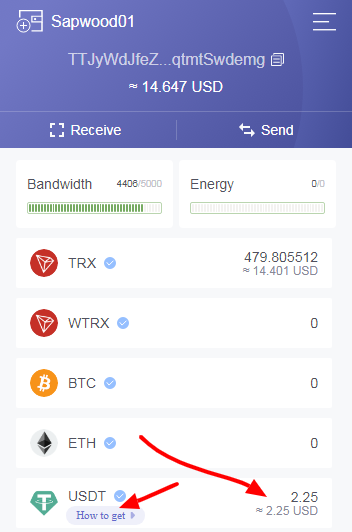

Click on "Connect Wallet"(Make sure you have already installed TronLink Wallet in your Browser to interact with JustLend) & connect your TronLink Wallet. I assume you know how to import your Tron Account(associated with your Steemitwallet) to TronLink Wallet. If you have done that your TRX balance of Steemitwallet will automatically reflect in your TronLink Wallet and you can further use it in JustLend.

Your wallet balance will be reflected against the relevant markets/assets in JustLend(after you connect your wallet).

There are two options: Supply & Borrow. The interest rate for both Supply & Borrow is indicated in this section.

Click on "Supply" in TRX Market.

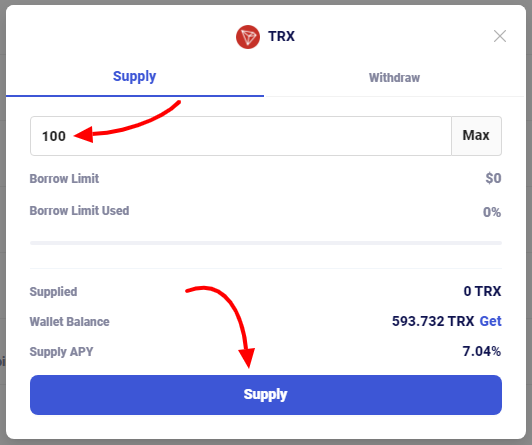

Enter the amount of TRX you want to supply to the pool and then hit the "Supply" button.

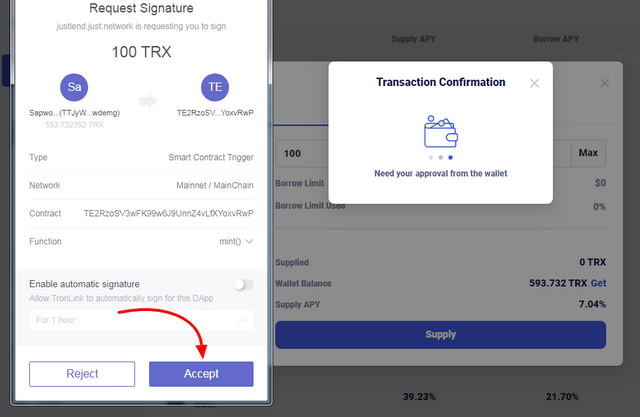

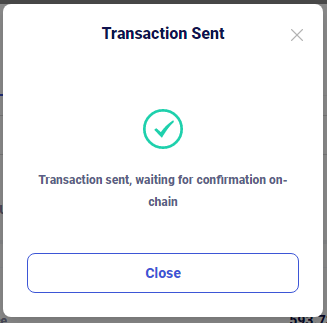

You need to confirm this transaction in your TronLink Wallet(will pop-up automatically), click on "Accept".

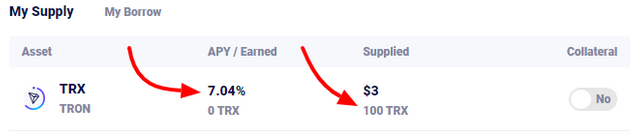

Voila! Your Supply of TRX will now start accruing interest rate(as indicated) every 3 seconds. (You can withdraw your supply at any point)

Also you can find jTRX tokens in your TronLink Wallet, that is issued against the supply of Tron assets to the pool.

.png)

.png)

.png)

.png)

.png)

.png)

.png)

How do I collateralize TRX tokens and borrow another asset in JustLend?

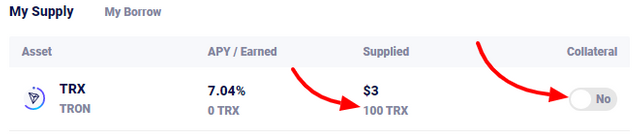

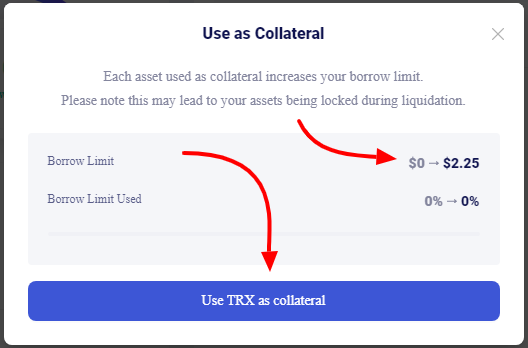

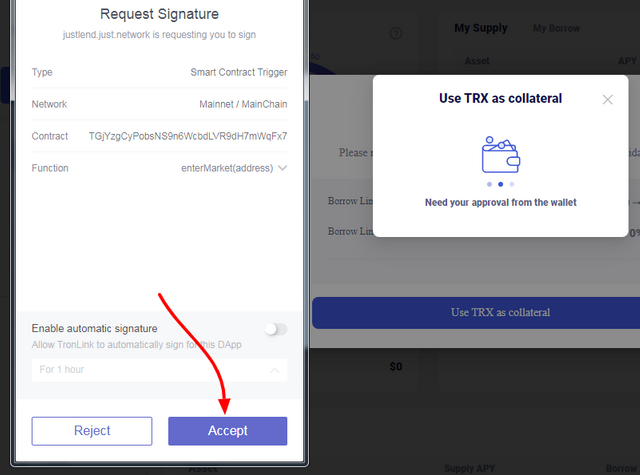

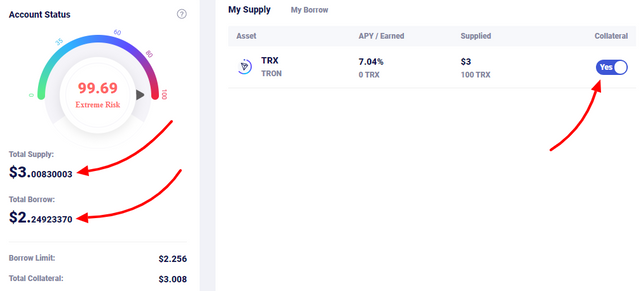

If you have already supplied a token to the pool, the next step is to collateralize it to borrow another asset. There is a column "Collateral" under which there is a slider(which is disabled by default), you need to enable it, when you do that a pop-up will appear which will show you the borrowing limit, at the moment for TRX it is showing as 75% of the collateral value, that means the collateral factor is 0.75. Click on "Use TRX as collateral", and then it will ask for your signature to authorize it, Click on Accept.

Now go to the "Markets" again. And click another asset to borrow. Technically as you are issued jTRX tokens, that is used as collateral now to borrow any listed asset from the Market. Please note that the interest rate varies from one asset to the other.

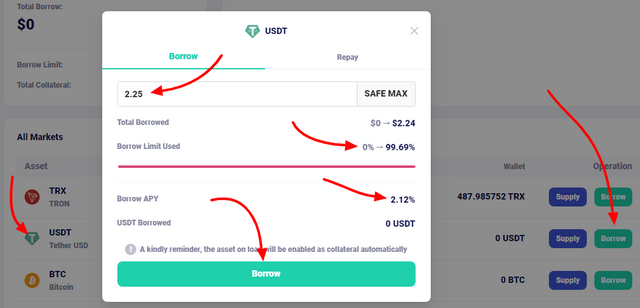

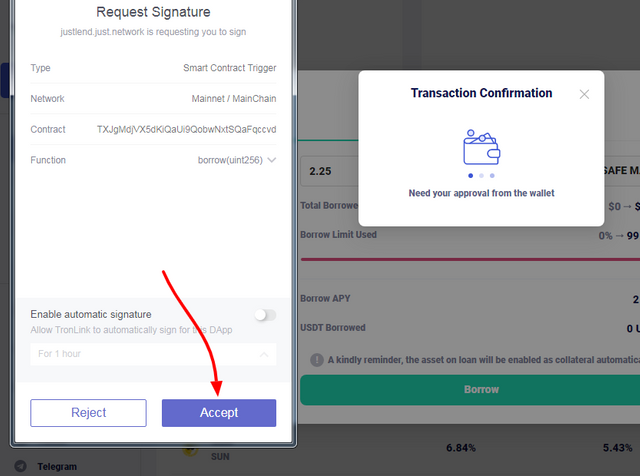

If you have supplied TRX to the pool and collateralized it, the smart strategy is to borrow a stablecoin (although you can borrow any asset as per your requirement). Let's say I will borrow USDT against the collateralized TRX. So click on "Borrow" in the USDT market.

A pop-up will appear requesting your signature, click on "Accept".

Voila! Your USDT is now delivered to your Tron Wallet.

Here the interest rate will be charged every 3 seconds. So you need to make sure the Borrowed asset value+interest should always be less than the Collateral value. Otherwise, it will trigger the liquidation of your collateral.

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

How do I Repay?

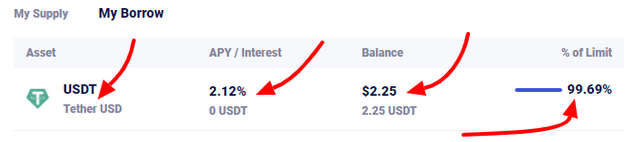

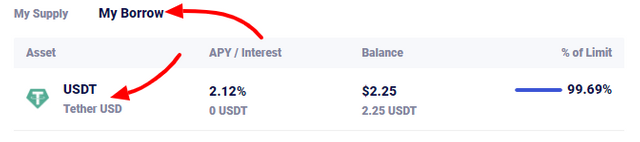

Click on "My Borrow".

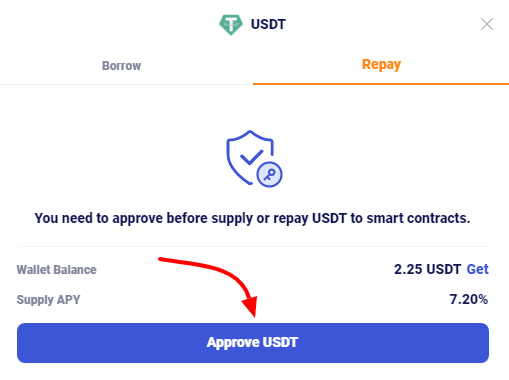

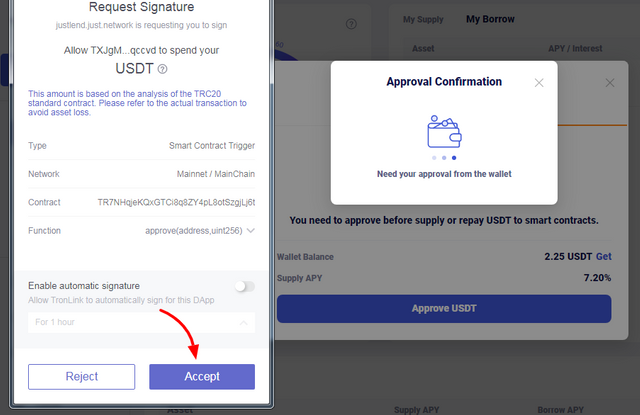

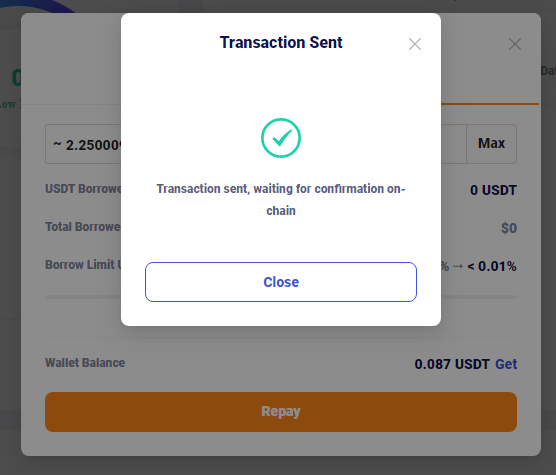

Then click on the asset. A pop-up will appear asking you to approve. Click on "Approve USDT".

Then enter the amount to repay. Authorize the transaction by clicking on "Accept".

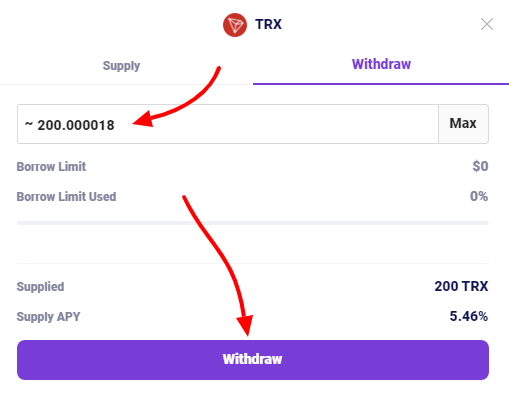

Your loan amount is paid now and your collateral is free. Either you enjoy "Supply" interest or you can withdraw it, as per your requirement.

.png)

.png)

.png)

.png)

.png)

How do the Steem users leverage JustLend to their advantage with their TRX earning in Steem Blockchain?

Some of the users prefer HODL with their TRX rewards in Steemitwallet. They should make use of JustLend to their advantage-- they can make their TRX earn an APY of more than 5.4%, with absolute control of the fund and the beauty is that they can withdraw at any point in time.

Some of the users simply selling their TRX tokens for their survival and to meet their basic income. For them, I would suggest to collateralize their TRX in JustLend and borrow USDT(interest rate is as low as 1.7% APY). By doing so, they can get better value for their TRX tokens when the altcoin season kicks off (it could happen any time soon, not financial advice though). Even if they need to repay the loan, it will be USDT, so it will be a cost-effective strategy.

.jpg)

Conclusion

Most of the Steem users seek to strike a balance between consolidating SP(by selecting 100% powered up reward) & making proper use of liquid TRX rewards which are being distributed in Steem Blockchain in a ratio of 1SP: 1 TRX token. While there are many other ways to strategise, I found JustLend as one of the most flexible use-cases for the average Steem Users(the common middle class).

In my assessment with JustLend, one can benefit from the Store-of-value of TRX tokens and also the daily needs, daily spending power to meet the basic income can be accomplished, if they borrow USDT, USDJ tokens from JustLend(using TRX as collateral) with an interest rate as low as 1.7% APY.

Thank you.

Cc:-

@steemitblog

@steemcurator01

@steemcurator02

DISCLAIMER

This is not financial advice, nor a guarantee or promise in regards to any result that may be obtained from using the above content. So it should not be considered as financial and/or investment advice. No person should make any kind of financial decision without first consulting their financial adviser and/or conducting their research and due diligence.

It is just complicated to do. I can just "Freeze" my TRX and earn 8% APY I think it is better in my opinion :D

It depends, how you strategize it.

Thank you.

I didn't think it was too bad but I did try it out admittedly only for a couple of days, which isn't really long enough but I didn't earn anything. Is it the case that someone has to borrow your TRX or the asset you are putting up for you to earn interest?. I mean its not a pool thing? If so then just getting the 8% by freezing does seem a more sensible route.

oh ok very accurate this post! I will definitely consider it. Thanks sapwood

What a detailed and fully transparent explanation by you.. As usual... Although I have put some of my trx as vote to earn roi from there. I'll also try lending my trx thank you for this tutorial.

#affable #onepercent #India

Thank you.

Thank you for taking part in the TRON and Steemit Integration Celebration Challenge.

And thank you for setting your post to 100% Powerup.

Keep following @steemitblog for the latest updates.

The Steemit Team

Thank you so much.

Steem on.

Good to see about JustLend, new I heard. The decentralized lending platform for supply, borrow & earn anytime.

#india #affable

Thank you.

Wow! Very helpfull post! Thanks for sharing... I resteem right now

Thank you.

Interesting.

Thanks for sharing.

You got a resteem.

A damn good post @sapwood!

"At any given time, (Collateral value) has to be greater than (Loan value + Accumulated interest), otherwise, it will be deemed unsafe and hence will trigger the liquidation of the asset."

This sentence is what stood out for me. Securing debt with collateral that has any significant price volatility can be risky. But I do understand the context, if you're on the right side of the trade so to speak, then this can be an effective way to access capital.

Nice info.