ICO REVIEW WHAT IS HASHGARD?

- Ideas of technology

Vision: Hashgard provides one-stop blockchain solutions for digital asset management.

( )!

)!

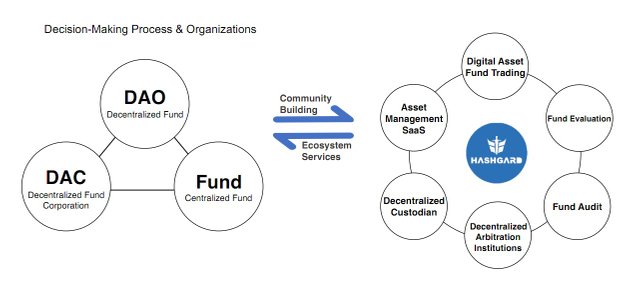

Hashgard owns a large number of business modules, including high performance chain data, advanced versions of self-managed asset organization, smart contract systems designed for asset management. It has the ability to systematically support the release, management, reliability, solution, auditing, process control, and arbitration of disputes over decentralized assets.

Hashgard will address key points in digital finance while protecting the assets of investors through technological innovation and ecosystem building.

Hashgard created an ecosystem that included

DAO Asset Management: Investors, managers, fund managers, etc. can set up a DAO-style autonomous organization to ensure the standardization of fund operations through smart contracts.

Decentralized fund companies: Individuals empower technology, link global talent, and build DACs managing assets more efficiently.

Decentralization Fund: Supports the DAO model and different decentralized financial products.

SAAS Asset Management System: Provides digital asset investors with professional asset management, investment management, risk control, financial management, group collaboration and other functions.

Digital Asset Exchange: A platform for digital asset fund investors to register, redeem and exchange treasury shares.

Decentralized arbitration system: Supports the creation of an arbitration DAO to deal with business disputes in the community.

Decentralized supervisor: Guarantees asset security through cross-deals and custodial service provider.

Solutions of Hashgard

Enhanced DAO autonomy: Digital assets based on blockchain technology have features such ascrosstemporal, cross-subject, and anonymity. Traditional observation is very difficult and expensive. At this stage, the introduction of blockchain core self-management can really help the industry promote self-discipline and standardization.

Finance including distribution: Hashgard can empower the design and release of distributed digital financial products and allow global investors to participate on a basis of their risk preferences.

Code-granting contract regulation: Hashgard includes a series of smart contract lists designed particularly for asset management. Fund managers, managers, third-party organizations, etc., when appointed by the investor, must follow the equivalent restrictions based on the smart contract.

The activity-level data on chain and privacy protection: The activity-level data in the Hashgard cannot be faked and will be protected by password. Fund managers and other fund-raising parties, on the one hand, will have their primary business data encrypted and stored through private keys, which will only be opened to the authorized person. On the other hand, they can reveal investment decisions, risk management, account management, financial management and other activity-level data to investors in order to prove the truth and reliability of efficiency.

Ecosystem Development

Hashgard is an open, highly expanded ecosystem. In the future, Hashgard will expand its deep cooperation with other ecosystems in terms of identity authentication, content distribution, market prediction, asset lending, reliable data authentication, cross-chain cooperation and so with a view to joining hands to build the infrastructure in digital finance. There is a module for hierarchical applications on the chain.

- Development Team & Advisory Board

( )

)

Charlie Xu: Founder

Strategic manager of Fenbushi Capital, managing partner of BKFund. Having Graduated from Anhui University, Charlie served high-tech companies such as HKUST, Huawei and ZTE, etc. With 13-year-experience in the field of R & D, marketing, management, he was selected as the " Excellent National Initiative and Entrepreneur ", advisor of the Ministry of Education. He is also an early participant and investor in the blockchain industry.

Tom Huang: Co-founder, COO

Senior analyst at Fenbushi Capital, co-founder of BKFund. Tom graduated from Macau University inFinance, and is a management coach in Fortune Dreyfus of Fortune 100i. Later, he joined Fenbushi Capital so as to focus on the research and investment of the blockchain industry.

Frank Yang: Technical Director

Former senior trainer of the company ZTE. Frank graduated from Xidian University in Security and Encryption, has 16 years of experience in software development, 6 years of experience in the project.

Bo Shen:

Co-Founder of Fenbushi Capital. He is a pioneer in blockchain and founder of Bitshares, FBS capital. In addition, Bo Shen founded and is managing the early Ethereum investment partners of Kyber and Quantstamp. He has extensive experience in traditional finance: securities, hedge funds, investment

James Gong:

Founder of CYBEX and Blockchain pencil

David Lee:

Professor of Social Sciences, Blockasset Ventures' partner

Haifeng Xi:

Co-founder of IRIS, former CTO of Wancloud

Min zhang:

Managing partner of Heli Capital Fund

Sunny Lu:

Co-founder and CEO of Vechain

Eva Foo:

Founder of Scry.info

- Roadmap

Version: Ginunga (4.2018)

The beta versionof the Hashgard SaaS system was released, providing activity-level asset managementfunction and core algorithms for digital asset management which has been developed.

Version: Yggdrasil (12.2018)

The Hashgard SaaS system provides API key exchange, risk control management, group collaboration and other functions. Release of Hashgard test network on the public chain.

Version: Bifrost: (6.2019)

Releasing Hashgard's main public network, providing asset release, asset management, asset custody, and other functions based on blockchain technology.

With the roadmap currently fixed the first version of Ginunga, the beta version has not yet been launched. Instead, the alpha version has been released.

- Current product

Website, whitepaper, communication channels

- Communities

Telegraph: 38979 members (20/06/2018)

Twitter: 4205 followers (20/06/2018)

Medium: 1.2k followers (20/06/2018)

The numbers are only temporary. At the moment of readers following post, the number of subscribers increases, which is different from the one listed above.

- Token Allocation, Sales Policy: TBA

Token Metric: Completed, only sold to investment institution. Single individuals may own a Hashgard (airdrop) token through feedback for alpha and beta versions of Hashgard.

- Contact information:

Website: https://www.hashgard.io/?utm_source=icoanalytics#/

White paper: https://www.hashgard.io/static/hashgard-overview.0aaba2d6.pdf

Twitter: https://twitter.com/Hashgard1

Facebook: https://www.facebook.com/gard.hash.5 (personal page)

Telegram: https://t.me/hashgardeng

Medium: https://medium.com/@hashgard

Reddit: https://www.reddit.com/r/Hashgard/

Linkedin: https://www.linkedin.com/company/hashgard/

Conclusion

Advantages:

Idea: The idea comes from reality, addressing the problem of the loophole in digital asset management. It adds the combination of the concepts in terms of centralization and decentralization to establish a digital asset management ecosystem

The Development Team: The development team has a firm foundation and is well-connected with FenbushiCapital (and BK Fund) - one of the leading investment funds in the world. Thus, Hashgard's capital are guaranteed. Moreover, with the skills of the R & D team, the blockchain platform promises to be a product that is well accepted by the public.

Advisors: The team has extensive experience in both traditional business and digital finance.

The community: The community of project in the media such as Telegram is very large and expanding rapidly.

Drawbacks

Roadmap: Roadmap has some changes from beta to alpha. The first version of the Hashgard SaaS Asset Management Platform was slower than the two-month plan (based on information released on Hashgard's Medium).

- So far, there have been some unpublished information, such as Hardcap, details of Token Metric ( will be announced soon)

Some media channels: Hashgard has not had a Facebook channel yet.