The Wisdom of the Long HODL

It is at times like this that one must understand the supreme importance of the long HODL. Anyone familiar with the work of Daniel Kahneman and Amos Tversky, (recently popularized in Michael Lewis's The Undoing Project) will at least be familiar with some of the psychology of what happens inside the human brain when markets plummet. Basically, we just don't think straight. Humans are wired to respond far too drastically to a perceived loss, without accurately being able to judge the actual loss. What this means is, that if you bought bitcoin some time ago for 1000, and watched it rise over Christmas to 20,000, and yesterday saw it plummet to $8000, your brain is not thinking, "Hey, this is fantastic! It's been the worst FUD month ever and I'm still up $7000!" No. It's thinking, "Oh no! I'm down $13,000!"

Worse, if you bought in at $20,000, you are also more likely to panic sell now, not because you have calculated the odds, but because you have told yourself a story in which you see your future self feeling like an idiot. Much of this irrational response is in fact ego kicking in. When we invest, we aren't actually just in it for the money. We also want to be right, and feel like we were smart, and if we see a future where we may possibly turn out to have been stupid, we will avoid that at all costs, because we are more afraid of the emotional cost of feeling regret, than we are of the certain financial cost. Surprising but true. We factor in emotional cost when we make financial decisions.

The truth is, (in my personal and unprofessional opinion) HODLing is the only sensible thing to do in times of FUD. For one thing, it is very likely that the market is being manipulated right now precisely to generate panic selling and open the market for newcomers. I can't help noticing that mainstream media is not being particularly accurate in their reporting. I have also noticed that some mainstream media outlets manage investment portfolios for clients and this strikes me as a conflict of interest. If you were one of the world's leading financial news outlets, and had observed that your reports caused drastic swings in the crypto market, wouldn't you take advantage of that? This would be especially true if you had just opened up new investments in crypto, after the Christmas boom.

The only certain way to protect yourself from market manipulation is to HODL. As long as you hold your investments, nobody can take advantage of you by buying your coins at below their value.

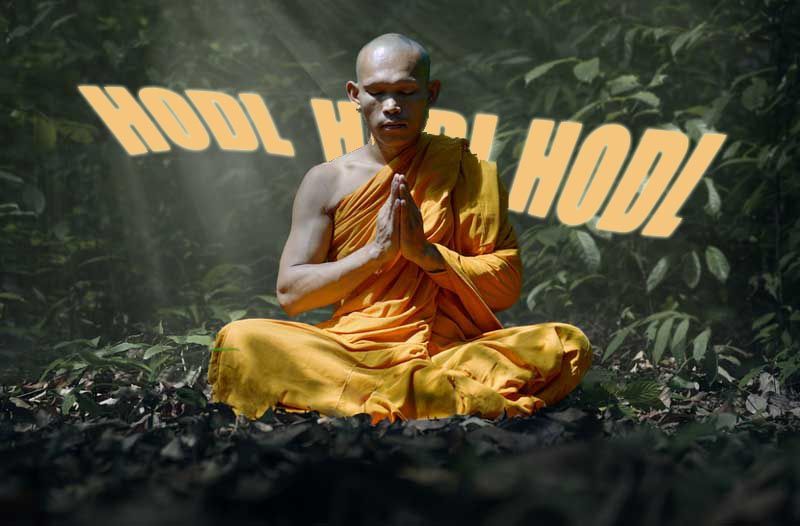

It is difficult to find the inner fortitude to HODL when times get tough, but it is character building, if nothing else.

So, close your eyes, take a few deep breaths, and just HODL!