HOMELEND WITH BLOCKCHAIN P2P TECHNOLOGY

Homelend is being developed as a blockchain solution that will significantly increase the housing financing possibilities for many individuals and families. Our value proposition is socially sensitive and anchored in a P2P progressive approach that aims to use technology for society’s benefit.

Nonetheless, Homelend is also based on a sound and profitable business model, which consciously reaches out to address an underserved market. On the one hand, Homelend creates an investment opportunity for many individuals, with a solution that unites a traditional industry as real estate, with an innovative technology like blockchain. On the other hand, it makes possible for many individuals (who due to various circumstances, including current limitations in the traditional credit risks models, do not possess a solid credit score but are otherwise creditworthy) to access to housing financing and solve one of their most basic aspirations: having a home of their own.

This chapter will discuss Homelend’s go-to-market strategy as well as revenue sources and monetization opportunities.

Homelend will develop three different P2P lending methods: pure crowdfunding, pooling, and auction. In each of them, the flow of financial resources is controlled and executed by smart contracts, without middlemen or financial intermediaries. Also, the splitting of mortgage loans into “slices” is present in each method. The difference between the methods arises from the specific approach used to and a pre-approved mortgage loan.

Peer-to-peer (P2P) lending, also known as “alternative finance,” is the process by which individuals can borrow and lend from each other without the intervention of banks or other financial intermediaries. It was made possible thanks to the Internet revolution. P2P lending platforms such as Prosper and Lending Club have been in operation for more than a decade in the U.S18. In fact, the market has outgrown expectations: ten years ago, experts estimated a US$10 billion market size for U.S.19. In reality, at the end of 2016 the market size was US$34.5 billion20.

Blockchain technology creates new possibilities for P2P lending. It’s now considered the next step in digital ledger technology (DLT), after decentralized money payments surged in the form of bitcoin and other crypto-currencies. Indeed, the immutability, transparency, and security provided by DLT makes it possible to record transactions, among them loans, without banks or other financial entities acting as middlemen.

Check out our video :

The Homelend Advantage :

From manual & lengthy, to Streamlined & Efficient

By embedding pre-defined business logic into smart contracts, digitizing documentation and eliminating unnecessarily

processes, Homelend will automatically execute an end-to-end origination process, cutting it down from 50 days to

less than 20.From Ambiguous & Clunky to Transparent & User-Friendly

Homelend aims to create a lending process that is not only smart, but also simple and fair. It will enable borrowers will

be able to easily apply for a loan, track their application status at all times and interact directly with mortgage lenders.From Costly Intermediation to Cost-Effective & Middleman-Free

The immutability, security and transparency provided by DLT makes it possible to record transactions, including loans,

without banks acting as middlemen. This will reduce costs for both borrowers and lenders, while minimizing the

distance between them.

- From Vulnerable & Unreliable to Trusted & Secure

Centralization and paper-based processes are the key factors behind the insecurity and vulnerability that characterize

the traditional mortgage industry. The unique characteristics of DLT and smart contracts enable Homelend to provide a

platform for people to transact large amounts of money in a trusted, transparent, and secure way.

The Homelend Token (HMD)

Timetable

Pre-Sale.......................March 1, 2018

Crowdsale.................TBD

Closure........................TBD

Specifications

Symbol.............................HMD

Total Supply................250,000,000

Standard........................ERC-20

Face Value....................1 ETH= 1,600 HMD

Accepted Currencies...BTC, ETH, USD

Softcap.............................US$ 5,000,000

Hardcap...........................US$ 30,000,000

Bonuses (ETH/HMD)

Week 1................................20%

Week 2...............................15%

Week 3................................10%

Week 4 and After.......0%

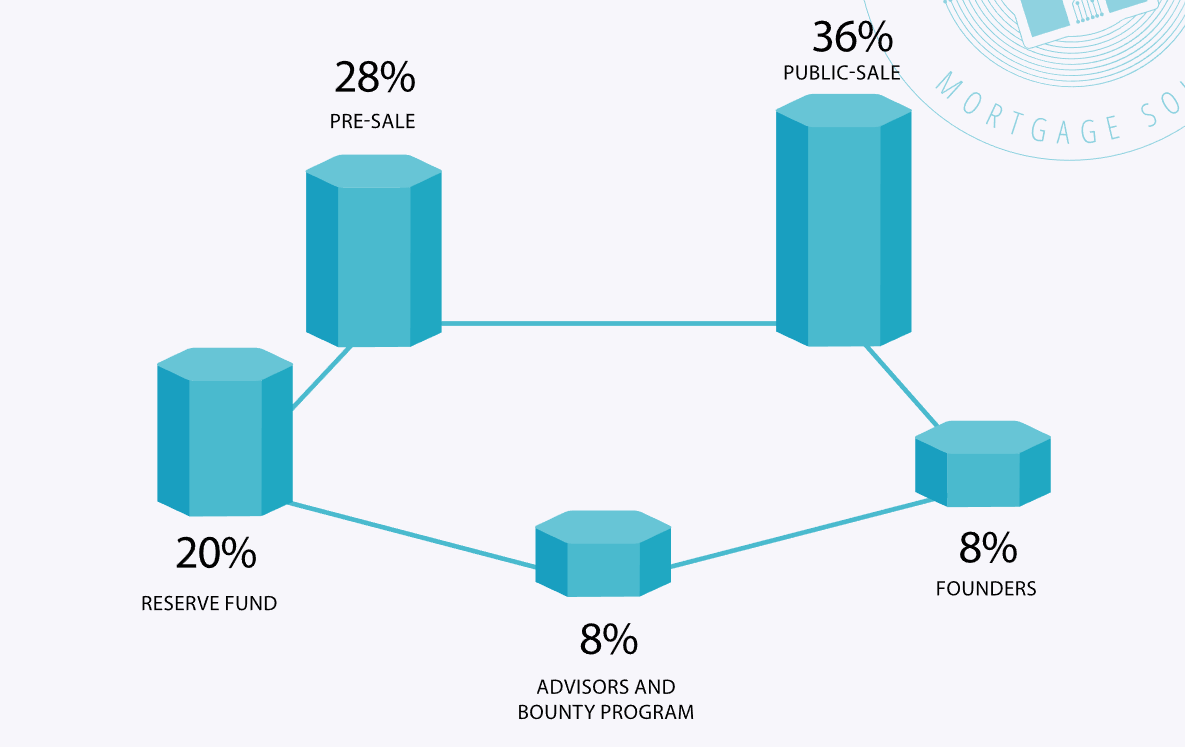

TOKEN ALLOCATION

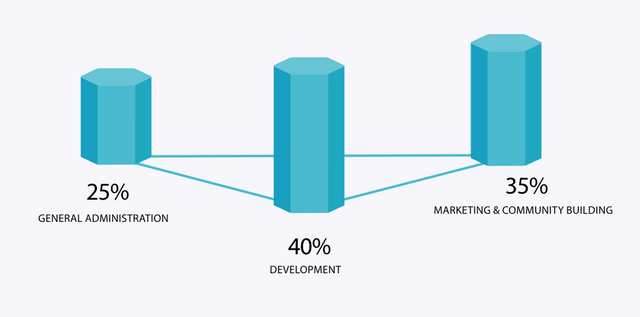

USE OF PROCEEDS

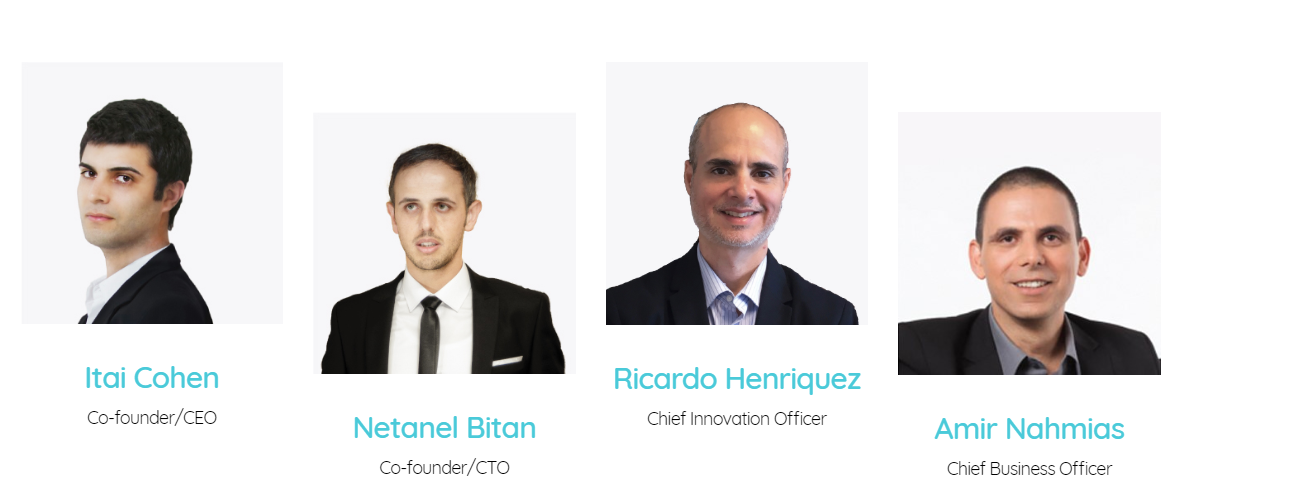

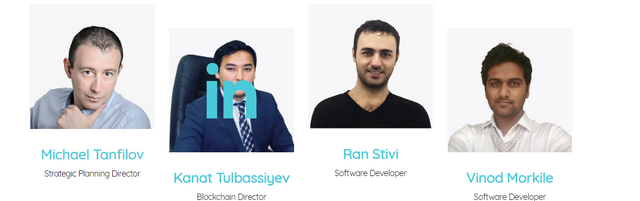

OUR TEAM

Homelend is being developed by a global team with extensive experience in blockchain technology. The company is based in Israel, known as the “Start-up nation” due to its innovative and entrepreneurial environment. In fact, the number of Israeli companies listed on NASDAQ trails only that of USA and China35; and Israel has more venture capital and startups per capita than any other country in the world.

For more information follow us on :

Website: https://homelend.io/

Telegram: https://t.me/HomelendPlatform/

Facebook: https://www.facebook.com/HMDHomelend/

Twitter: https://twitter.com/homelendhmd

Author : shalamenda

https://bitcointalk.org/index.php?action=profile;u=2076279;sa=summary