HomeLend – A mortgage crowfunding platform

Blockchain technology is still relatively new, but we have seen adoption of P2P ledger systems from the financial sector. This technology has been used in currency transactions, money transfers, the creation of financial securities and help retailers manage their inventories.

One sector has suddenly lagged behind in adopting blockchain as mortgage lending and servicing businesses. Blockchain, and the smart deal, in particular, offer great efficiency in the way we create, transfer and record assets and titles. However, most lenders are still out of date with this advanced technology.

And this is the moment of HomeLend

New mortgage companies are being designed to allow crypto investors to receive loans from digital assets as a form of mortgage. Such a platform, gaining recognition, is HomeLend. Designed to run on blockchain technology, the HomeLend infrastructure allows investors to make a profit on digital assets without losing ownership of these assets. Once the loan has been repaid, the collateral will be transferred to the borrower and the reimbursements will be transferred to the lender.

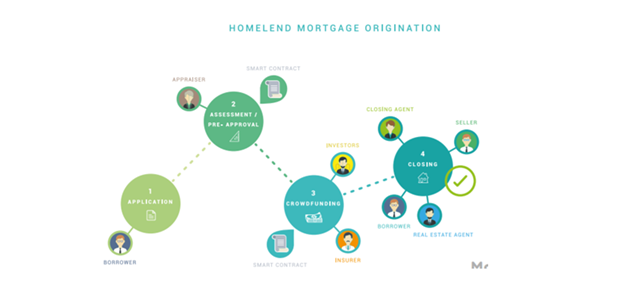

Homelend is building a peer-to-peer mortgage lending platform, decentralized. HomeLend's vision is to revolutionize the mortgage lending industry, making it more efficient, cost effective and customer focused. It opens the door for many people want to own homes, land, vehicles ... while still ensuring their daily lives. Parties can interact with each other on the HomeLend marketplace. Homelend will be an end-to-end system that handles all stages of the mortgage process - from the initial stage of the application to the final stage of your final mortgage payment.

How it works?

Borrowers will be able to access three different types of P2P lending on a Homelike basis, including capital mobilization from community, pooled and auction. In each of these lending modalities, financial flows are controlled and executed by smart contracts without intermediaries or financial intermediaries. Each funding method can also split a mortgage into "slices".

- Community mobilization: Funding from the community is the simplest funding method on Homelend. Potential lenders can find investment opportunities in the form of "slice" mortgage. The borrower's loan will be divided into smaller fractions, and smaller lenders may offer a mortgage loan (by cash) in exchange for a fixed rate based on terms of mortgage.

- Pooled method: Bring economic flexibility to Homelend's lending system. Investors are still buying different "slices" of mortgages, although smart contracts allow lenders to buy before loans are approved.

- Auction method: Allows investors to bid on different mortgages as an investment opportunity. For example, you might find buyers with good credit ratings offering good interest rate. You compete with other investors to provide part of that mortgage loan. The main difference with the auction method is that there is no financial buffer involved in this process. The advantage is that the lender can provide the borrower with better terms than those who are pre-approved by the foundation if they choose to do so.

Features and benefits of Homelend

- Reasonable and effective: Today's mortgage registration process is manual and lengthy. Homelend wants to use the blockchain and smart deals to make it affordable and effective. Homelend will embed predefined business logic into smart contracts, digitize documents and eliminate unnecessary processes. Homelend specifically aims to cut the mortgage investment process from start to finish from 50 days to less than 20 days.

- Transparent and user-friendly: Homelend seeks to eliminate today's vague and ambiguous mortgage registration process and replace it with a transparent and user-friendly process. Homelend will create a simple, just and fair lending process that will allow borrowers to easily apply for loans, monitor their application status at all times, and interact directly with mortgage lenders.

- Cost-effective with no intermediate: Homelend will introduce a cost effective mortgage application process from the middleman. Blockchain will replace the intermediaries, providing a way for the two sides to distrust each other. All transaction data will be recorded in blockchain, allowing borrowers and lenders to maintain maximum transparency throughout the transaction.

- Reliable and security: Homelend aims to use blockchain to process mortgage-related data in a more reliable, transparent and secure way than ever before.

Conclusion

Today, the scale of the capital mobilization market is expanding. It is estimated to be worth over $ 30 billion. Homelend has hit this market, this can be considered as the advantage of the project. In addition, with three types of capital mobilization, both the lender and the borrower receive benefits from the financial flow. This creates a healthy ecosystem and it will grow sustainably. However, there are a number of projects that recognize the potential of this market, and have developed a similar platform. This will be a limitation of the project when it comes to competing with other competitors. I think this is normal too. Business without competition is a bit boring :D

If you have any opinions about the project, please leave below the comment section. Thank for reading!

Useful links

Website: https://www.homelend.io

Whitepaper: https://www.homelend.io/files/Whitepaper.pdf

Bitcointalk ANN: https://bitcointalk.org/index.php?topic=3407541

Telegram: https://t.me/HomelendPlatform

Facebook: https://www.facebook.com/HMDHomelend

Medium: https://medium.com/homelendblog

Reddit: https://www.reddit.com/r/Homelend

LinkedIn: https://www.linkedin.com/company/18236177

Twitter: https://twitter.com/HomelendHMD

Author:

Bitcointalk username: kld_hp

Bitcointalk profile link: https://bitcointalk.org/index.php?action=profile;u=1014734