Exploring Canada's Housing Bubble

An Analysis of Canada’s New Housing Price Index in Response to Changes in Interest Rates, the Consumer Price Index and the Value of the Canadian Dollar in Relation to the Chinese Yuan Renminbi

Canada’s houses have seen an unsustainably high boom in prices in the last decade. Still, Governor Stephen Poloz of the Bank Of Canada has passed the use of the term “bubble” off as mere fear mongering (Freeman, 2015). A bubble is defined as the artificial or speculative price of assets that is far from their intrinsic value. As the story of a bubble played out until the 2007-8 crash, Americans were similarly assured that they did not have any to worry about and that real estate was still the sector to consume and invest in. As we learn from history, not only is it important to not fall for the illusion of a healthy economy for the well being of one’s own personal finances, it is vital to hold the central planners and private companies responsible for their actions and policies, while not falling for scapegoats. This study looks at economic trends since the 1980s and aims to find correlations between interest rates, inflation and the value of the Canadian Dollar, on housing prices using empirical evidence. The study finds inflation steadily increasing while housing prices accelerate, an overall drop in the value of the Canadian Dollar in relation to the Chinese Yuan Renminbi leading to housing prices going up inversely, and sharp interest rates dips are followed by long term house price increases, while interest rate increases are followed by plateaus.

Outline Of The Economic Issue

The economy is made up of individuals and groups making economic decisions and trading scare resources they value subjectively. When it comes to the real estate sector, many parties are involved. Home buyers with a scarcity of capital face the decision of either mortgaging a home and paying the bank back over time with interest, or renting a house and regularly paying the landlord. Mortgages can be payed back in fixed rates or variable rates based on interest rates at given times. For investors, investing in houses as opposed to a different market is an economic choice. According to an interesting report by The National Bank, one third of Vancouver homes were bought by people from Mainland China in 2015 (News 1130 Staff, 2016). Finally when it comes to start up or expansion projects in real estate, it takes scarce land, labour and capital to build houses.

A government’s central bank has power over the entire economy, across many sectors. Its policies, with the intention to manipulate the economy depending on its state, affects the market in many ways. It sets a target interest rate range at which it incentivizes private banks to loan money out at. Low interest rates incentives borrowing, spending and inflation and the opposite is true for high interest rates. A central bank’s most distinct quality however, is its legal monopoly on the printing of money, and with more money being pumped into the economy, inflation is one of the outcomes.

Methodology

This study looks at the economic trends of Canada since the 1980s. It compares, combines and analyzes the trends of interest/mortgage rates, the Consumer Price Index and the exchange rate of the Canadian Dollar to the Chinese Yuan Renminbi, all in relation to the New Housing Price Index. Graphs presenting this data are collected from tradingeconomics.com, theglobeandmail.com, news1130.com, xe.com and overlapped, lined up and compared. Each new graph has two y-axes with one of them showing the New Housing Price Index. The original graph for the Consumer Price Index was created manually using raw data.

Findings and Interpretation

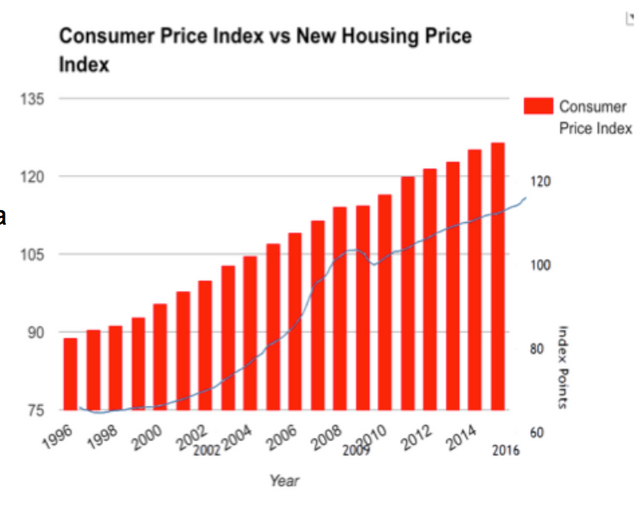

(Figure 1.0b) Graph comparing New Housing Price Index and Consumer Price Index

Graph 1.0b shows inflation steadily increasing, but housing prices accelerating, so the bubble isn’t caused only by inflation. This is one indication that the housing price boom could be a bubble

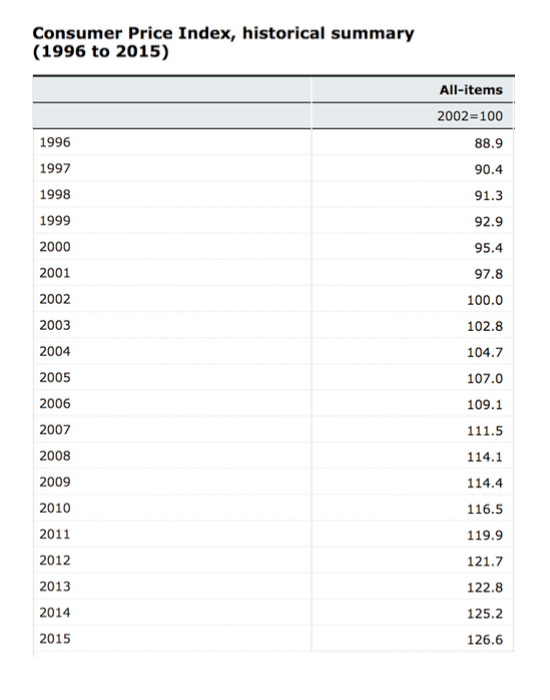

(Figure 1.0a) raw data of the Consumer Price Index of Canada from Stats Canada

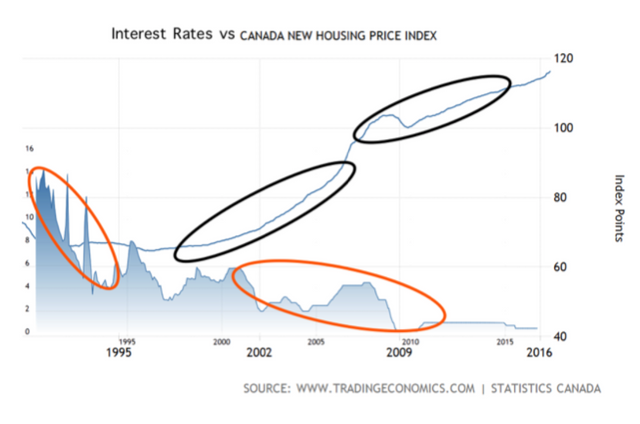

(Figure 2.0) Combined graph of mortgage rates and the New Housing Price Index from 1960-2009)

(Figure 2.1) graph combining interest rates and the New Housing Price Index

In both Figure 2.0 and 2.1, low interest and mortgage rates result in a long term impact on housing prices. Sharp interest rates dips are followed by long term house price increases, while interest rate increases are followed by plateaus.

Low interest rates incentivize home owners to mortgage more expensive houses and long term projects are started with the assumption that demand in the market is from stable capital, as opposed to unstable credit. This is a major reason as to why the housing price boom could be a bubble.

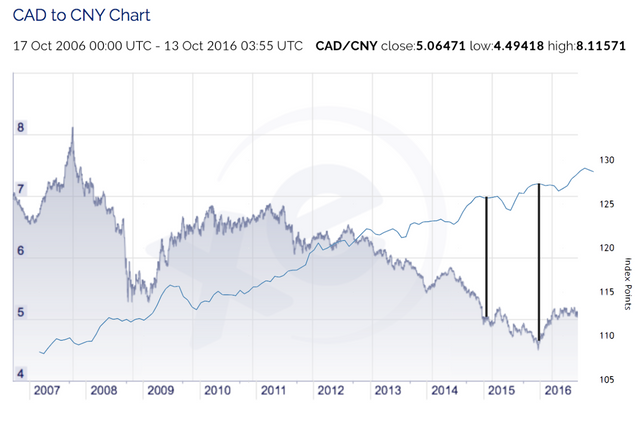

(Figure 3.0) graph combining the Canadian Dollar value compared to the Chinese Yuan Renminbi with the New Housing Price Index

Original currency exchange graph from XE.com

Figure shows that since 2007, there has been an overall drop in the value of the Canadian Dollar compared to Chinese currency, so Chinese investors are incentivized to invest in Canadian markets because it is cheaper for them. However, as the bubble grows and prices become too high for enough demand, the massive drop in Canadian Dollar value since 2013 does not result in an equally large price increase. Still however, as Chinese investors see dips in the value of the dollar, housing prices instantly increase; again most likely due to investments.

Conclusion and Directions For Further Study

In conclusion, this study finds inflation steadily increasing while housing prices accelerate, an overall drop in the value of the Canadian Dollar in relation to the Chinese Yuan Renminbi leading to housing prices going up inversely, and sharp interest rates dips are followed by long term house price increases, while interest rate increases are followed by plateaus.

The study raises questions as to whether the housing market is a bubble. New studies could be done, looking at the United States housing market before 2008 to analyze the buildup to the crash and to look for a correlation between the current Canadian housing market and the American bubble leading up to the crash. This study looks at the housing market on the large scale (the whole of Canada), so breaking it down to provinces and studying housing prices there could show more accurate answers. This is because Canada is densely populated and not equally scattered. A new field study could also look at Vancouver’s and Toronto’s house prices and comparing the two, because one area is flooded with Chinese investment and the other is heavily populated. Incentivized borrowing due to low interest rates is explored in this study, so studying Canadian household debt levels in response to low interest rates and their ability to pay back mortgages could also reveal a lot about the housing market. This study could also look deeper, finding out whether most people take out fixed rate or variable rate loans in Canada.

This study has two flaws. One of them is comparing mortgage rates of a certain period and interest rates of a different period. A new study would keep it consistent. The second error is in the methodology. Since the graphs are combined manually, it can not be assured that they are exactly in line. The x-axis representing time, the dates are only roughly lined up. This could certainly need to an error in findings and interpretation. New studies dealing with combined graphs can avoid this problem by making them manually with raw data.

Bibliography

"Canada Interest Rates." Trading Economics. n.d. Accessed October 1, 2016. http:// www.tradingeconomics.com/canada/interest-rate.

"Canada New Housing Price Index." Trading Economics. n.d. Accessed October 1, 2016. http:// www.tradingeconomics.com/canada/housing-index.

"Consumer Price Index, historical summary (1996 to 2015)." Statistics Canada. n.d. Accessed October 4, 2016. http://www.statcan.gc.ca/tables-tableaux/sum-som/l01/cst01/econ46a- eng.htm.

Freeman, Sunny. "Canadian Housing 'Bubble' Fears Are Baseless, Poloz Says." The Huffington Post. April 28, 2015. Accessed October 9, 2016. http://www.huffingtonpost.ca/2015/04/28/ canada-housing-bubble_n_7164364.html.

Gehringer, Agnieszka, and Thomas Mayer. "Understanding low interest rates." Flossbach von Storch Research Institute. September 23, 2015. Accessed October 1, 2016. http:// www.fvs-ri.com/files/unterstanding_low_interest_rates_3.pdf.

News 1130 Staff. "Why do Chinese buyers find Canada such an attractive investment for real estate?" News 1130. May 29, 2016. Accessed October 9, 2016. http:// www.news1130.com/2016/05/29/chinese-home-canada-attractive-investment/.

"Remember when: What have we learned from the 1980s and that 21% interest rate?" The Globe and Mail. May 14, 2015. Accessed October 3, 2016. http://www.theglobeandmail.com/ real-estate/the-market/remember-when-what-have-we-learned-from-80s-interest-rates/ article24398735/.

"XE Currency Converter - Live Rates: CAD to CNY." XE. October 2, 2016. Accessed October 2, 2016.

http://www.xe.com/currencyconverter/convert/?Amount=1&From=CAD&To=CNY.

nice work i hear it's a crazy bubble up there right now

Crazy indeed