SALT token vs CoinLoan Token

SALT token vs CoinLoan Token

[SALT Website] ~~~~ [CoinLoan Website]

ICO STRUCTURE: Winner-CLT

SALT

Whether they know it or not the SALT ico structure has left many investors in an unfavourable position.

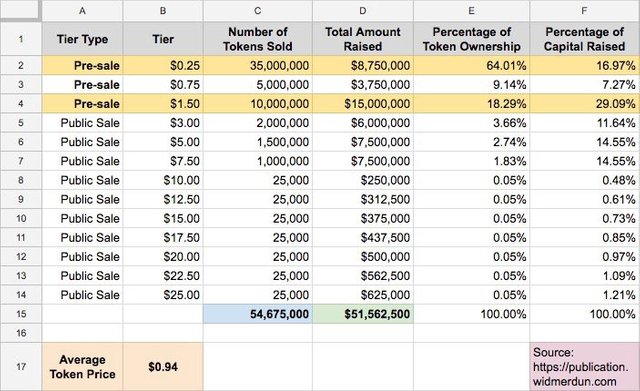

The average token price is calculated to be $0.94, with 82% of pre-sale tokens bought by early investors. This includes the team, TaaS etc Erik Vorhees etc. This large token concentration attributed to pre-sale investors will create resistance levels between $2.00-$3.00.

CLT

The planned CoinLoan token structure ensures that ownership of tokens is fairly split among each tier. The Pre-ICO, currently running now at this link, has a cap of $5mn. With Pre-ICO investors only holding 10% of tokens the distribution is even, preventing mass dumping by early stage investors. This facilitates a steady growth when it becomes listed on exchanges. I expect the main ICO round to reach the $4.00 or $5.00 tier (highlighted), raising at least $39mn.

BUSINESS MODEL / DEVELOPMENT: Draw

The business models of both companies are virtually identical. One notable difference is SALT’s varying membership fees. Furthermore, SALT has completed key milestones positioning itself much further along in development . This includes securing a bank partnership, securing a license to take out loans and almost developing a core platform.

However, SALTs advanced progress makes CoinLoan Token more attractive. First while markets for large caps cryptos show trending behaviour, small caps realise most of their increase on news, and their decrease on lack of news. With CoinLoan behind in development, they will be able to release many development announcements over the coming months. I believe this will induce “FOMO”, from investors who did not invest at ICO stages.

Note: Similar comparative analysis lead me to achieve a 9.9x return on Monaco ($MCO), after I realised its business model was almost identical to TenX, the only difference being Monaco was at an earlier stage of development.

EXPERIENCE: Winner-SALT

SALT’s core team

Shawn Owen, CEO — “A serial entrepreneur with experience in management and ownership of enterprise operations. Shawn became involved with blockchain technology through his advocacy of bitcoin in early 2011.” Although it must be noted that Owen’s previous only includes management of restaurants and bars. His LinkedIn does not mention any involvement in tech related enterprises.Phil Cowan, CTO — “17 years of experience in application architecture development and design solutions. Prior to acting as CEO of Ideas By Nature, he spent seven years as a web application developer and graphic designer at LSDi Consulting, Wombat Interactive and ASAP, Inc.”Ben Yablon, Chief Strategy Officer — “15 years of legal expertise centered on emerging financial technology platforms and regulatory compliance as a partner at Atlas Law Group.”Erik Voorhees, Advisor— “CEO & Founder of ShapeShift, and previously founded Satoshi Dice and Coinapult.”

CoinLoan's core team

Alex Faliushin, CEO — “Alex is an entrepreneur with 7-years experience in Finances and IT. He specializes in international payment solutions, organization of accepting and processing payments in high-risk industries.

Absorbed into fintech and blockchain technologies.”Mike Shokin, Advisor— Mike is a financial analyst with exposure to corporate finance that he is expending into Bitcoin and Blockchain derivatives. His experience includes working as an equity research analyst with ING Barings and teaching at NYU. Mike has advanced degrees in finance from Baruch College, New York and SOAS, London and is a Chartered Financial Analyst.Eugene Landaum, Lead Developer — Full stack Developer for 3 years. Software Developer for IT Security Group, which focus on specialise in developing security solutions for payment processing and blockchain technologies.

SUMMARY: Winners CLT

Not to undermine the relevance of the lions share of my analysis, but the most important factor worth considering is ICO structure. SALT’s distribution structure only warrants an entry at a maximum price of $2.35-$3, while it currently trades around $1.950-$2.40. On the other hand the relative lack of experience behind the SALT team may be cause for concern for investors who only invest in projects backed by big names. However CLT investors can take solace in (CTO) Max Sapelov’s confirmation that CoinLoan are in the process of securing a large investor to back the project.

Provisional CLT Investment Strategy

- Enter at Pre-ICO, through this link

- Upon a 2x–3x increase in coin price, liquidate a portion of holdings equal to initial investment

- Sell when news of core platform development completion induces “Fomo”

- Watch CLT prices for favourably re-entry

Note: I have assumed the CoinLoan main ICO stage follows an even token distribution between each token price round.

FULL DISCLOSURE: As you may have sensed by the tone of this article, I have invested in SALT. A solid business model, fair ICO distribution, full core team including programmers and the second mover advantage will ensure CLT ride the slipstream of SALT. Soon reaching parity in terms of popularity and market cap.

Congratulations @byakugancrypto! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPCongratulations @byakugancrypto! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!