Risk-balancing in a mutual fund

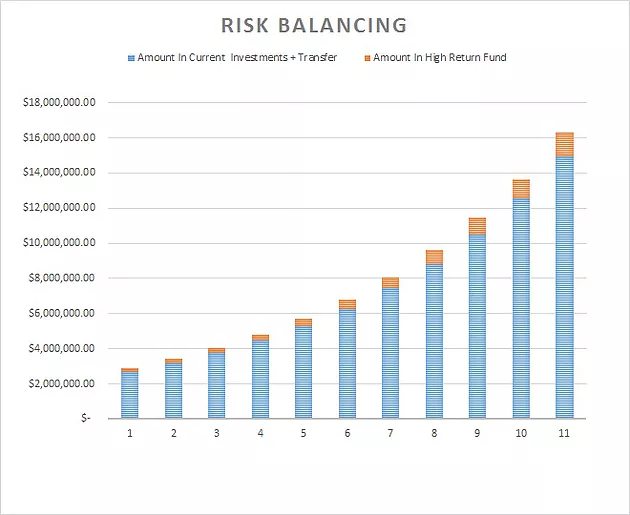

Perhaps the most tangible and noticeable impact of a high-risk, high return product can be seen when it is included in the portfolio of a mutual fund. Mutual funds can be an integral component of long-term investing, especially when considering self-managed superannuation. One doesn’t need to allocate much of the mutual fund’s overall mix to an active, high-yield product such as Countinghouse’s algorithmic trading system in order to see a significant increase in returns over time. Figure One uses data from the case study below to visually represent just how small a percentage of the mutual fund needs to be with an active, high-return investment while still making a considerable overall difference in profitability.

Figure One: Shows the relatively small allocation of a mutual fund’s pool to an active, high-return product. This small allocation has a comparatively big impact on increased profitability.

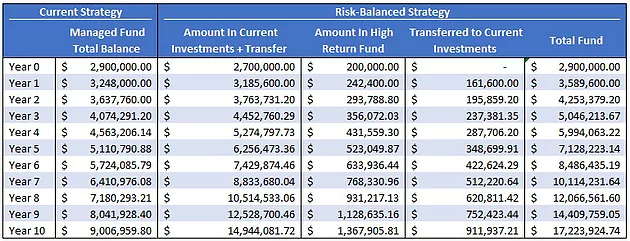

In our case study today, we look at a mutual fund manager with a pool of 2.9 million, making twelve percent per annum on average. We then contrast this approach with a more risk-balanced strategy, taking 200 thousand of that pooled fund and investing in an active, high-yield investment product, moving 40% of the profit back into passive investments at the 12 month mark (Table One and Figure Two). If you’ve read the previous blogs, you will recognise this as a typical de-risking drawdown and money management example we provide, acknowledging the importance of treating active investments with the appropriate methodology.

Table One: Standard/passive mutual fund as compared with risk-balanced portfolio including active, high-return product.

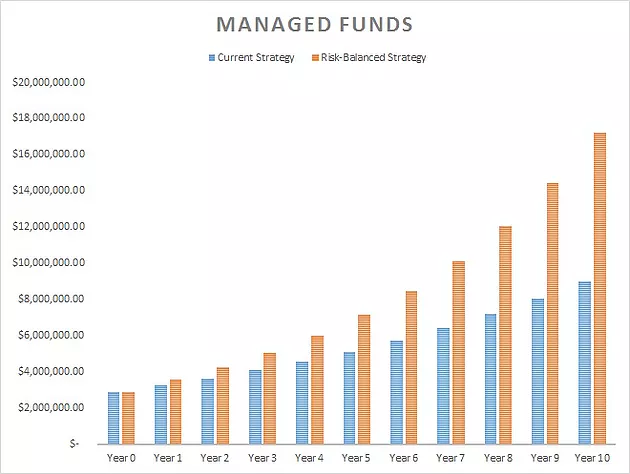

Figure Two: Increased profitability from the risk-balanced portfolio over time.

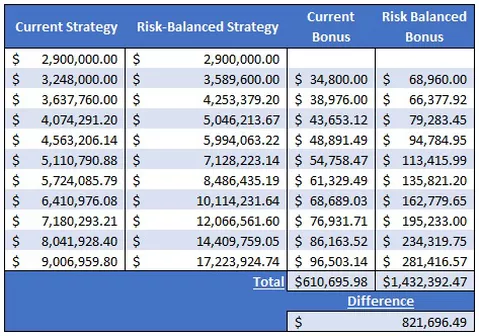

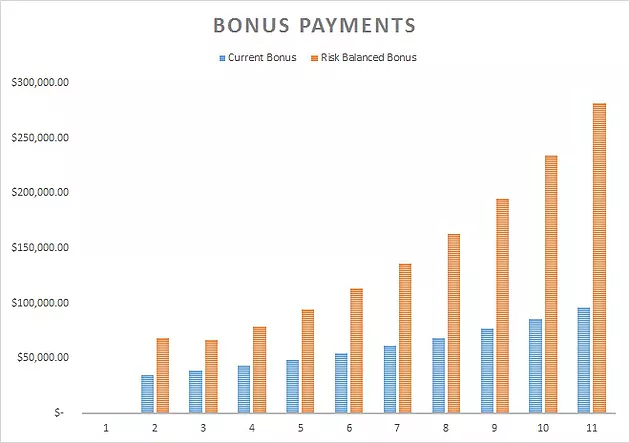

The mutual fund would see increased profitability, and the mutual fund manager would yield a more substantial yearly bonus income (based on 10 percent profit paid as commission). Table Two and Figure Three show this hypothetical difference in bonus income for the mutual fund manager.

Table Two: Higher commission for a mutual fund manager over time

Figure Three: Showing increased commission for a mutual fund manager overseeing a blended-risk portfolio.

Countinghouse believes that balancing risk in investment portfolios delivers substantial returns when handled correctly with regards to money management and drawdown strategies. If a professional investor is unused to integrating active, high-yield products into their mix, joining a mutual fund that does deal with this investment type could be a potential solution.

we really have to balance those risks you are right

Wow this is great

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://www.sec.gov/reportspubs/investor-publications/investorpubsinwsmfhtm.html

With the high volatility of crypto markets Balancing risks is a worthy strategy

A good strategy in this situation, the market is like a swing.

Nice post, I really enthusiastic with Countinghouse project

Counting House Count for Crypto world...Great Project

Counting House is deep mathematical principles, combined with expertise in human and market psychology in order to bolster their investment portfolio and deliver market-beating returns

Visit Please : https://www.countinghousefund.com/ico

#CHT #Countinghouse #hedgefund

Tim Dawson,Mike Pomery is our Director

Visit Please : https://www.countinghousefund.com/ico

#CHT #Countinghouse #hedgefund

Counting House is deep mathematical principles, combined with expertise in human and market psychology in order to bolster their investment portfolio and deliver market-beating returns

Visit Please : https://www.countinghousefund.com/ico

#CHT #Countinghouse #hedgefund