Can Genesis Vision Be The Catalyzing Solution to ICO Regulation Amid Jamie Dimon’s Public Deception, China Ban & SEC Charges?

The article below is originally published here. I am the original author of this work and am syndicating it to Steemit as well as Medium and a couple other platforms like InvestFeed to better reach my target audience of Initial Coin Offering investors, cryptocurrency traders, and traditional finance people, thank you!

Initial Coin Offerings have been a major source of capital for innovative projects across the world as they are a low-cost/low-barrier, innovative methods to raise funds. On September 29th the U.S. SEC filed fraud charges against the operator of two ICO’s, just weeks after the “Great China Ban,” South Korea followed suit days ago. Those of us in the industry are watching closely and eagerly seeking solutions to stifle the already volatile state of the market — growth becomes extremely difficult during periods of instability. Despite the volatility and lack of solutions, the cryptocurrency markets continue to maintain stability after the shakeup.

Government regulators have good reason to be concerned as we have been hearing about the abundance of scams going on in the cryptocurrency community. From Slack Channel phishing to ICOs being hacked or landing pages being duplicated with an alternative scam address. With all the talks about the banning and regulation of Initial Coin Offerings (ICOs), I thought I would create an article about:

- some of the statistics and history of ICOs;

- why the regulation of ICOs is necessary, but needs to be done properly & delicately; and

- why Genesis Vision project has the potential to create the required bridge to fill a similar gap that JPMorgan is after.

Little Bit of ICO History

First off, the term ‘Initial Coin Offering’ is synonymous with Token Sale, Crowdsale, Initial Token Offering or Token Generation Event. They’re all different ways to issue a blockchain coin or token to potential community members interested in backing the project. Bitcoin’s initial disbursement is not be considered an ICO because it was airdropped to users who downloaded to Proof-of-Work program, supporting the network operations.

The first noted ICO was the Mastercoin project (OMNI) which had officially launched on July 31, 2013, years after the White Paper was published. The fundraiser lasted 1-month and funds were to build digital tokens that the Bitcoin protocol uses to conduct transactions. [1] The Founder, J.R. Willett, gave off the idea that the tokens would become more valuable as the platform was being developed, realizing a return on their initial contribution to the project.[2] Despite the many red flags and claims of being a scam, a total of 5,000 BTC was raised from around 500 contributors (about $500k at the time).[3][4]

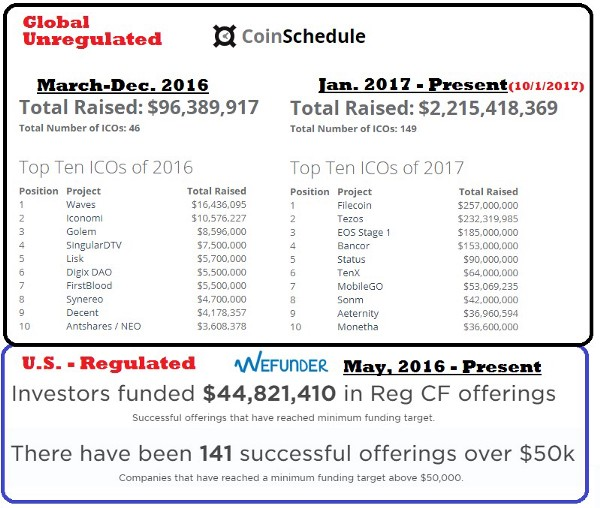

Let’s get to some statistics to better understand why ICOs are such a controversial topic across the globe. _Abov_e, I have created a comparison you WILL NOT see anywhere else. Why? Because very few people even know about the U.S. Equity Crowdfunding regulations passed in May 2016 after 3 1/2 years. The Jump-start Our Business Startups (JOBS) Act, birthed “Regulation Crowdfunding,” an SEC regulation allowing any startup to file with the SEC to raise up to $1.07 million from anybody in the United States. The creation of these rules was intended to spur innovation, create jobs, and allowed ALL American citizens to finally access high-risk, potentially high-return investment opportunities.

Unfortunately, the cost-of-compliance is simply too high for a startup to afford, a characteristic instantly noticeable in the visual above — ICOs in 9-months of 2017 have outperformed U.S. startups by nearly 50x in capital raised AND more companies raised those funds…does it look like heavy regulation is the answer to spurring innovation? I would say, no.

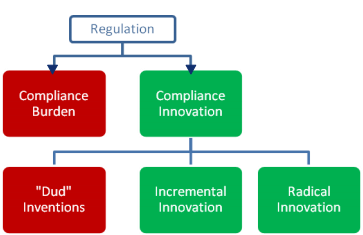

Report: Information Technology & Innovation Foundation

Now, this is a hyper-growth scenario, easier to compare regulated and unregulated capital markets when taking into account there are few markets as volatile as the cryptocurrency markets and few new markets as regulated as equity crowdfunding — both around similar age, intended to have very similar outcomes — innovative solutions. The quickly sinking powerhouse that the U.S. is compared with the most hungry, zealous global entrepreneurs. I’ll let you look further into why regulation hurts innovation yourself, but I think we can all agree that costly regulations hurt the ability for companies to afford innovating . Every decision relies on costs and revenue, not the solution to the core problem being solved. I recommend taking a look at the report from the picture above.

Why Do We Need Regulation?

Join ANY ICO Slack Channel — the amount of people falling for Slack-bot phishing scams AFTER the ICO is almost scary, millions. Technology has progressed in a way that has left humanity on a spectrum of tech savvy-ness, leaving those on the caveman-side of the spectrum most vulnerable. Pooling our resources together as a specifies in order to protect our long-term survival is important in 2017 — those who were scammed have no regulatory agency to rely on to hold the market accountable.

JPMorgan Chase

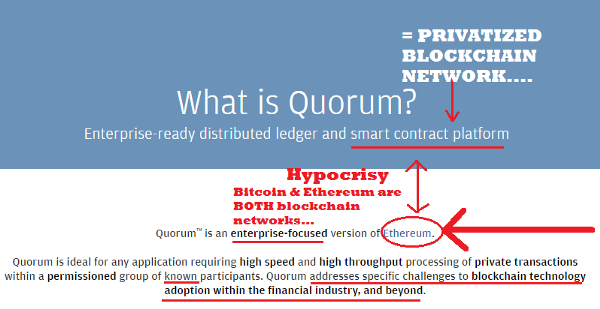

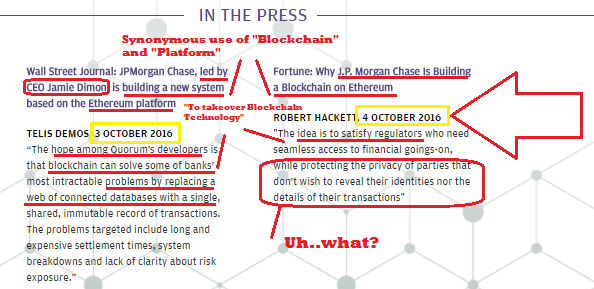

Aside from the aforementioned scams, governments can benefit greatly by harnessing the benefits created by the blockchain technology. I also, personally believe that large institutions have simply gone rampant with power. For example, JPMorgan Chase Bank has their own privatized blockchain technology. Yet, their CEO, Jamie Dimon, came out to the public a few weeks ago saying “Bitcoin was a fraud” and that it “will be shut down.” So, how is Bitcoin any more a fraud than, say, Ethereum? (Bloomberg, CBSNews, CNN Money)

JPMorgan Chase

Trust me, you’ll appreciate this research. See why the blockchain community does not like institutions? Yup, you’re seeing that right. JPMorgan has their own version of Ethereum to offer to clients — “Smart Contract Platform.” Or…privatized blockchain network? I’m not sure I can believe my eyes…but wait, THERE’S MORE!

JPMorgan’s Quorum

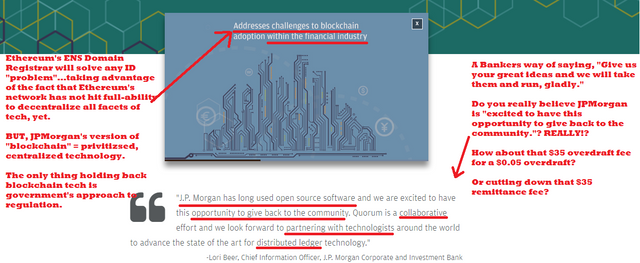

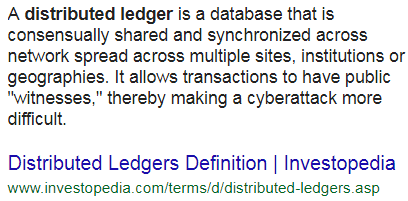

Okay, okay…maybe I’m being a little bit harsh with my speculations; but, are they even using the right vocabulary here? Look look at the definition of Distributed Ledgers below— PUBLIC witnesses, multiple sites, consensually shared…all of these words don’t mesh well with what we see in the large picture above, do they? I have just one more piece of Due Diligence here — the statements from JPMorgan’s Ringleader himself!

Investopedia.com, Distributed Ledgers Definition

Why do we need government regulation? Because the government is an integral part of society and is not going anywhere over night — it’s baked in. Looking at the picture below, along with all of the other evidence I presented to you — would you rather support JPMorgan, who is lying to the public AND clearly working on a large-scale takeover tactic?

The Kicker — Bottom of the Page

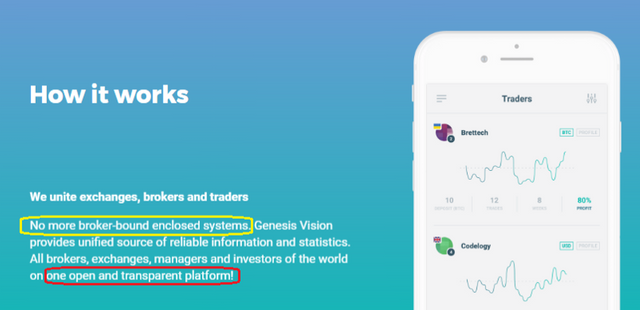

OR would you rather trust a global-minded startup, developed by technical Founders who has strategically built their business model with transparency at the core? Oh yeah, and instead of bringing blockchain mainstream through corporate takeover — Genesis Vision is building on a true distributed ledger, utilizing mutually beneficial partnerships with various institutions, websites, and applications — on and off the blockchain.

GV is [creating a more symbiotic relationship](GV is creating a more symbiotic relationship as opposed to the media-driven, deceptive corporate takeover tactics by JPMorgan Chase and their leadership. When has Jamie Dimon been on an Ask Me Anything, live? Can you go into JPMorgan Chase’s Telegram Channel and ask their team questions, real-time? They don’t have one.) as opposed to the media-driven, deceptive corporate takeover tactics by JPMorgan Chase and their leadership. When has Jamie Dimon been on an Ask Me Anything, live? Can you go into JPMorgan Chase’s Telegram Channel and ask their team questions, real-time? They don’t have one.

#1 — Genesis Vision Strives for Transparency Amidst Opaque ICOs

Genesis Vision is going above and beyond to create a transparent ecosystem by first initiating The Financial Commission, “an independent self-regulatory organization and external dispute resolution body, primarily dedicated to FOREX.” Not only that — the report was done by The Financial Commission’s brand new ICO Certification Committee (ICC), the FIRST ICO rated by the new committee. I don’t know about you, but I feel like FOREX is the perfect bridge between cryptocurrency and the mainstream world — GV was the first ICO audited by their brand new committee; great steps toward commercialization already! I recommend diving into the report here for more validation/transparent look into the project.

The Leadership Team was even able to garnish a 4.5 ICO rating from ICOBench, a “Stable+” rating from ICORating, and had their Smart Contracts audited by Zerion, the same company responsible for creating the Waves 2 Ethereum Gateway and audited not just Waves ICO in 2016, but the Humaniq project ICO as well — integrating alternative blockchains like Waves is another step toward being “the glue” between mainstream and cryptocurrency worlds. Which prompts the question — what type of leadership do you appreciate more:

A. The CEO of one of the largest banks in the world, talking false negatives about Bitcoin, and building their own blockchain technology, OR

B. A newer startup striving for transparency and pairing with existing businesses such as Tools4Brokers who has 80+ broker clients with a market cap of above $100B combined (per their CEO)?

I’m really working to make Due Diligence on this project much easier for you and the GV team is giving me all of the ammo I need to do it via their public channels! This is almost too easy. Here are some expansions on the advantages included in the GV project. If you think I’m just a puppet to this project, go into Genesis Vision’s Telegram Channel and challenge them with your best questions — they’ll answer.

Below are a few other Genesis Vision social channels to join and follow for updates, to ask questions, or look for supporting information/documentation. Hope you enjoyed this, until next time!

- An Intro to Genesis Vision Ecosystem, Token and Solutions to Industry Problems

- Can Genesis Vision Be The Catalyzing Solution to ICO Regulation Amid Jamie Dimon’s Public Deception, China Ban & SEC Charges?

- 8 Advantages of Contributing to the Genesis Vision ICO

- Genesis Vision White Paper

- Genesis Vision Website

- @genesisvision on Steemit!

Below are some resources for beginning cryptocurrency enthusiasts:

- Cryptoversity by Chris Coney — The Online School That Pays You To Learn About Bitcoin, Crypto-currencies and Blockchains

- HitBTC Exchange — major exchange, access ICOs on the exchange

- CoinBase Wallet/Exchange to buy Bitcoin/Ethereum/Litecoin w/ Fiat — this link gives us each $10 when you purchase $100 :)

- CoinTracking — Your personal Profit / Loss Portfolio Monitor and Tax Tracker for all Digital Coins

- CoinMate.io — Exchange cryptocurrency for crytocurrency

- CEX.io— one of the better crypto-4-crypto exchanges

- NovaExchange — the top exchange for ANY cryptocurrency — find the smallest, less known on this exchange first.

- Coss.io Exchange — decentralized exchange building an All-in-one setup

- CoinPayments - Receive payment via 55+ different cryptocurrencies - the crypto-PayPal.

- Yobit Exchange - very similar to CoinExchange and NovaExchange, but much better arbitrage opportunities.

- QoinPro - Mission = simplifying getting started with cryptocurrency; educating and providing users with necessary resources to learn; listen to the community to build functional platform; & facilitate adoption of cryptocurrency, rewarding users for learning! FREE coins everyday. Pretty cool :)

@genesisvision - give this a resteem when you get a chance!