Bitbond

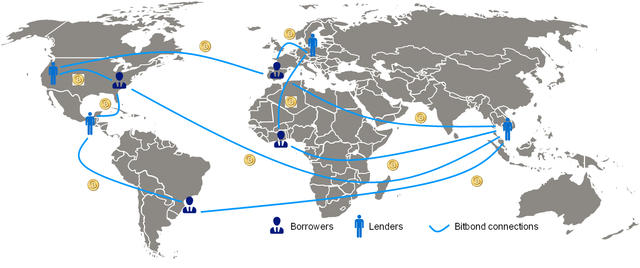

Nowadays I'm interested in crypto projects about loans. After all, we all like banks to be replaced by crypto companies and loans are the main products of banks. You may need a loan or you may be after earning interest for your money. Today's review is about such a project. Bitbond is a global business lending platform, was founded in 2013 and is based in Berlin, Germany. The first thing that makes them special is the fact that they got approval from BaFin and that makes them Germany’s first BaFin regulated blockchain company. Now may be a good time to learn what BaFin is:

"BaFin is one of the largest financial supervisory authorities in Europe. With its more than 2,600 employees, BaFin takes an industry-appropriate and risk-oriented approach to supervision on the basis of recognized European supervisory standards.

BaFin is a reliable partner in the area of policy formation, supporting the ongoing development of regulation. As an integrated financial supervisor for the banking, securities and insurance sectors, BaFin ensures the stability of the largest financial market in continental Europe. Frankfurt am Main is the heart of this market and is also home to the European Central Bank, the Single Supervisory Mechanism and the European Insurance and Occupational Pensions Authority."

Bitbond makes revenue by charging origination fees to borrowers and repayment fees to investors. The origination fees range from 2-3% of the loan amount. The repayment fee ranges from 0.5-1.5% of the total repayments. And over 3,000 loans have been funded on the platform.

Bitbond Finance leverages the Stellar blockchain to provide efficient and instant international transactions.

As a Token holder you will benefit from:

Instant transferability

The BB1 is distributed to the investors’ wallets when the STO

subscription period concludes and becomes immediately

transferable

Efficient transactions

Stellar is more efficient than other blockchains, drastically reducing the cost of global payment transactions.

Easy setup

When purchasing the BB1 Token, Token holders will automatically receive a Stellar Wallet. Holders can also use existing Stellar wallets.

I find it very interesting that Bitbond claims they will buy back the token at the original price of €1 after 10 years. That shows that they are confident that their token will reach maturity and they have their plans intact about it already. And of course, them running an STO instead of an ICO makes them more trustable in my book. Because an ICO is free of a strong regulation actually but an STO means that you are ready to prove your integrity to government institutions and you are willing to handle responsibilities if things go badly.

In my dream vision, there are no banks in the future. There are crypto-based companies like Bitbond. Do I need a loan? I want to earn interest for my money? I can use projects like Bitbond. And finally let me give you a secret: banks are so last century.

My Bitbond affiliate link = https://www.bitbondsto.com/?a=FRAUIZ

Bitbond Whitepaper = https://www.bitbondsto.com/files/bitbond-sto-prospectus.pdf

Bitbond Website = https://www.bitbondsto.com

Crypto Nobility is sponsored by https://www.coinbookmarkbank.com | All the useful cryptocurrency related links in one place.

My Bitcointalk profile = https://www.bitcointalk.org/index.php?action=profile;u=963827

My Bounty0x and Bitcointalk username = WeltSchmerz

My Youtube channel = https://www.youtube.com/channel/UCZX8LenEAibUlqNeQLf6nsg/videos

*Disclaimer: None of this information is intended to be financial advice. This article shows my personal opinion and I advise everyone to do their own research.