Value investing in ICO's

There are lot of risks on the ICO market ( See my last posting), but if you look carefully there also good opportunities.

What I look for in an ICO is information about the value that the token will bring to the token investor, and a statistics to measure performance and valuation going forward. I found what I was looking for with Covesting. While I am discussing valuation specifically in regards to Covesting in this posting, I use the same type of analysis for very ICO I invest in. please let me know about any other ICO you are considering, I am always eager to learn about good deals in the crypto space.

Before we start I just want to say that this is my own view into Covesting and you should do your own analysis before deciding to invest. Risk tolerance and estimates can vary significantly from person to person and what might seem like a good deal to me might not make sense for you. With that said, let's start!

- The company

- Why I am investing in it.

The company:

Covesting is a social network for investors and traders, which allows investors to automatically copy the trades made by successful cryptocurrency traders (up to 20) and benefit from their strategy. ( see video below) In addition to introducing copy trading to the cryto trading world, Covesting also provides liquidity aggregation for your trades ensuring you get a better rate on your trade than if you were to trade from an individual exchange, provides trading and educational resources via the crypto intelligence portal, and also is building a well designed trading terminal (for a test drive of their platfrom click on this link: https://mvp.covesting.io ). Not only that, but I believe that the platform have room for continuing expansion and to become a financial hub for the crypto world.

Why Am I investing on it:

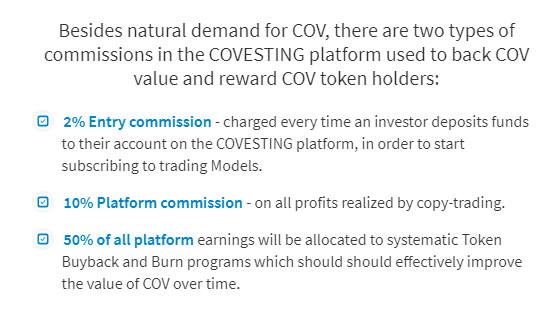

Covesting is one of the few companies that does provide a detailed explanation on how investors can monetize their token and the math just works. There is a clear way to calculate how revenue generated in the platform will benefit the token holders, and they are allocating a massive 50% of token earnings for token buybacks and burn programs that I believe will support and put upwards pressure on the token price.

Based on the maximum token issuance of 20,000,000 COV and average ICO price per COV of $.74 USD, the maxium market cap of COV at the ICO would be $14,800,000 USD. Looking at similar companies under the same calculation Trade.io for example would have a market cap of $320,000,000. Santiment market cap would be $244,177,410**, uttoken market cap would be $56,250,000.

To estimate users and community engagement I looked at the Telegram active uses for some of those companies: Covesting has 3,184 telegram users, Uttoken had 2,893 and Trade.io had 7,574. Trade.io had about 2x5 times the number of telegrams users as Covesting but 22 time the market cap. The reason I think this matters is that the success of all these trading platforms, which are hitting the market almost simultaneously, will depend on fast user growth positioning them as the leader in the space (if you don't think user growth matter more than just about anything else for a growing business, just trying sitting thru a quarterly earning call from Twitter or Facebook! :).

Now, all this is nice, but there are a number of factors that would justify some of the companies mentioned above having a much higher token valuation than Covesting. So the numbers discussed above were not determinant of the value of Covesting versus the other companies but just peaked my interest enough to look further into their ICO.

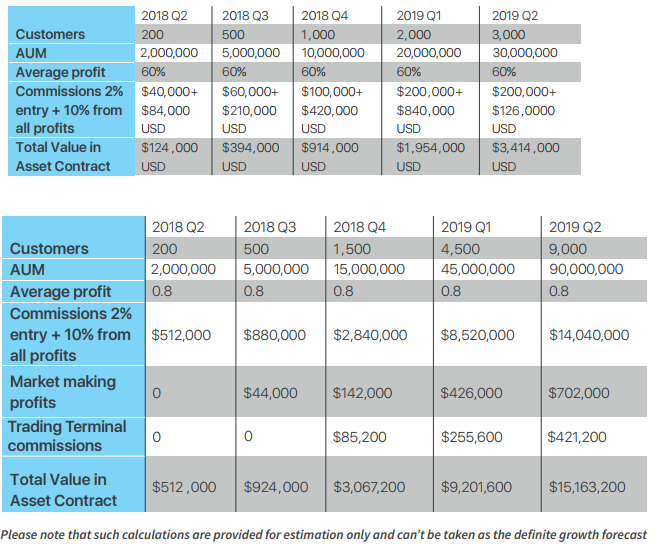

on their ICO page Covesting lists their expectation for user growth, Assets under management and revenues. they do the same thing on their white paper which include 2 different scenarios (see below):

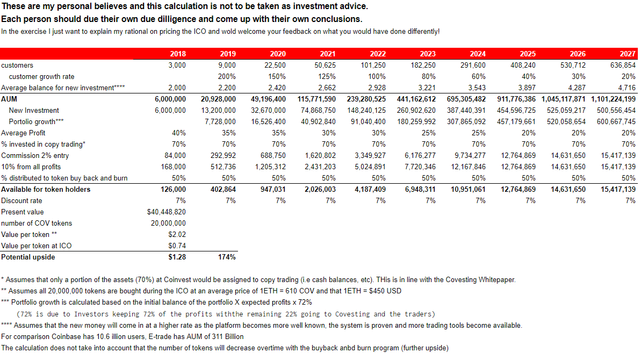

based on that data, I ran my own analysis adjusting some of their inputs and extrapolating a 10 year time frame and performing a discount cash flow analysis on the expected earnings of token holders.

User growth, for example, looks understated in their analysis. The already have over 3,000 telegram users today. I am assuming that most of these users would be also users in the platform, or would generate buzz to attract additional users to the platform, so even the scenario 2 which estimates 9,000 user by the end of Q2 2019 looks low. However, on my analysis I further reduced user growth expectation under scenario 2 and arrived at the 9,000 user count only at the end of the second year.

AUM or "Assets Under Management" assumes an average balance of $10,000 USD per user. I am sure they did plenty of research in coming up with those numbers, but since crypto investing is a new and volatile space, and many users are younger, for my analysis I was more conservative and assumed an initial balance per user of $2,000 USD, which as the platform proves it's value I would expect to increase over time.

Average profit in Covesting's scenario 1 is 60%, 80% in scenario 2. While this is probably an understatement if you joined the cryto trading world in January 2018 and are looking at the returns on Ethereum, Bitcoin, Ark and others, overtime I expect profits to decline and be more in line with market average returns. I assumed an lower profit margin which also decreases over time.

I did not include any profits from Market making and Trading terminal commissions in my calculation, but those would be another source of income to be available in the next 8 to 12 months according to the Covesting white paper.

Also I did not took into account that the numbers of token will decrease overtime via the buybacks, which would further increase the profitability.

Even with all these adjustment my calculation yielded a nice profit for this ICO (see below). Off course this all depends on how much is invested in acquiring new customers and developing the platform. I expect this space to be very competitive as is the case for trading platform for equities and not every company will be a winner.

But with that said I was willing to take a chance on the Covesting ICO. I will be tracking the ICO closely. If there is indication that they will sell all the 15,000,000 COV** before the end of the ICO period it will show that there is strong demand for the token and there is a higher probability that my expectations for price increase will materialize once they get listed on an exchange***. At that point I would be willing to make an additional investment in the ICO.

'* calculation is based on coinmarketcap.com current price of $2.93 time a total supply of 83,337,000 SAN

'** Total circulation will be 20,000,000 but only 15,000,000 will be sold thru the ICO. 5,000,000 will go towards the Covesting team, Pre-ICO contributors, advisors, etc.)

'*** Their white paper mentions Bittrex, Bitfinex, and HitBTC as potential listing exchanges. This would also be good news for the token in my view since these exchanges rank in the top ten in volume, and would give the token exposure to a broader trading group.

Let me know if you agree or disagree. If you are looking at other ICO's where you think there is a good opportunity, please let me know. I am always interested in a good deal! Also if you question about the calculations please let me know, I would love to discuss.

ICO's are high risk - high reward but to be honest the risk is not so great if you spend your time actually reading through and analysing it would be considered low risk .

thank you for sharing