SEC v. Kik: When the Levee breaks.

0

In 2007 reality struck hard at the owners of gambling websites. Until then, they listened to their lawyers that reasoned them into believing that they could still operate gambling websites, even if they are Israeli (or American) citizens, worldwide, as long as the server of the site is domiciled in a country that allows gambling and the company is licensed in that country. The owners believed that lawyers with a big fountain in the entrance to their office, luxurious marble flooring, paintings of the best artists and shiny wooden tables means that these people know what they are saying and that they could find a way to avoid the law. Then, like midsummer lightning, the Israeli police decided to arrest Michael Gary Carlton, the CEO of Victor Chandler, a gambling website, when he arrived to Israel to attend a parliamentary hearing about gambling. In the court's decision it was ruled that it is sufficient that the server allows Israelies to gamble in order that the crime itself be committed in Israel (P 1106/07 Police v. Carlton ). The gambling operators were shocked; they couldn't believe that the reality would be so true.

1

The same happened this week with the Kin token. On Tuesday,the Securities and Exchange Commission filed a lawsuit against Kik ( full complaint here ) for issuing the Kin token. Kin is a payment method inside the Kik ecosystem; and according to the SEC, it is a security for all purposes, as when it was issued Kik marketed it with an expectation of profit based on the joint efforts of others. These conditions, investment of money, based on the expectation of profit, which results from the common enterprise and efforts of others, are the conditions in the 1946 ruling of the US Supreme Court in Howey ( SEC v. Howey Co., 328 U.S. 293 (1946))

2

Kik, on the other hand, responded and said that the SEC's claims are overreaching and that it did not promise any profits, but said that when the network will grow, the value will increase (not profit) due to the usage. It also said that unlike the SEC's claims, there were no fictional applications developed, and that the Kin ecosystem is used worldwide and daily.

3

In order to understand the argument and decide whether Kin is a security or not, you need to understand what happened in the world of token distributions and how lawyers tried to stretch the Howey test to the furthest extent. The first thing that happened was the SAFT: Sale Agreement for Future Tokens; while the securities laws came to protect the average Joe, it is acknowledged that accredited investors, like people who are high net worth individuals, do not need the same protections as regular people. Therefore, they could purchase investment devices that are high-risk. So, the SAFT was meant to ensure that any person that buys the tokens in such accredited investor, and therefore there won't be any security law violation. However; no one was able to regulate what happened afterwards, meaning listing these tokens on exchanges and allowing them to be resold to the average Joes. This was the first problem with the SAFT.

4

While the SAFT was "placing the server in a regulated country", lawyers invented more excuses. The first was that in order for the token not to be a security, it would be named a "utility token"; meaning that unlike the regular tokens that allowed participating in profits, the utility tokens are meant to provide a way to pay for future services. Here, however, comes the problem; no one expect the price of a specific technological service to go up. If the token is meant to pay for hosting or processing power, and based on Moore's Law, these prices are supposed to go down. So why would the token's price increase? Well, here comes the problem that lawyers drafted: the scarcity; meaning that the fact that there are limited supplies of these tokens. And this is the problem: it is distributed stating that the supplies are limited and therefore higher demand would increase prices; this is sufficient to show that there is a publication for the expectation of profits.

5

So what happened? lawyers understood the problem and said "we'll set up a non-profit"; people would donate to this non-profit and receive tokens, and a separate legal entity, a development company, which will receive some portion of the tokens. Now, because this is a non-profit and it issues the tokens, there should be no fault on the development company behind the ecosystem and there would be no problem with the non-profit as it is set up in a more favorable jurisdiction. This, of course, is a problem because there still is an expectation of profit and still there are strong ties between the entities.

6

And who hasn't failed here? the people who built strong distributed communities that reward people based on their own endeavors. Meaning, that if it was a distributed project, with no one ruler, and the tokens are not sold but distributed to persons who actually contribute to the goal, then there is no expectation of profit based on the actions of others; If we see Ethereum as an example, then we see that the wish to build a distributed computing engine to divide rewards to people who help manage the engine is totally fine. People are rewarded for their own activities, and when the price of Ether goes up, it isn't because of just the limited supply, but according to the actual growth of the community.

7

So what happened here? The SEC says that there are two material issues. The first is that Kik promoted the token sale with an expectation of profit, saying that the tokens would be traded promptly in exchanges (meaning liquidity, which is a factor in the value of a token):

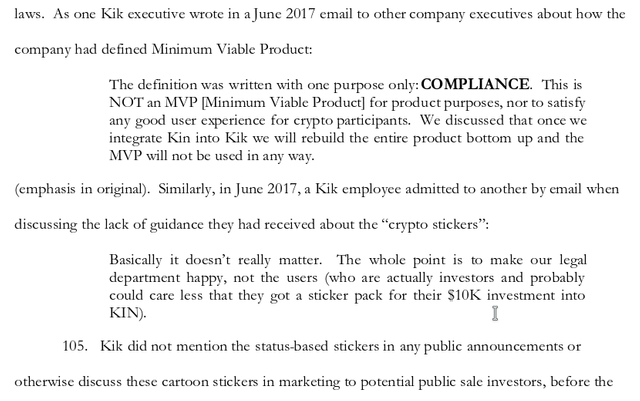

The other case is an email message that its origin is unknown; saying that Kik's executives said that the development of the Kin based applications is made for legal purposes only and that there is no actual use for the token.

Both of these are factual statements that must be resolved in the lawsuit.

8

However, the SEC chose a mighty foe; Kik is not a small company to settle, and this is not a clear cut case. Kik acted in accordance to legal counsel, it has the power to litigate this knowing that if the levee brakes, momma you got to move.

I hope Kik challenges the SEC on two fundamental issues: