SEC Launches "Fake" ICO Website

ICO's are so easy to do, even the SEC wants to do one!

The Securities and Exchange Commission just created a fake website in order to help investors identify what a fraudulent ICO might look like.

Yes, they really did this.

The SEC announced today that they have created an ICO called "HoweyCoin", likely named after the Howey Test which is used to define whether or not an investment is a security.

The link to the HoweyCoin website can be found here:

https://www.howeycoins.com/index.html

The HoweyCoin pitch:

The selling point for the HoweyCoin has to do with the travel business/industry.

The website claims that most travel business's nickel and dime their customers with unnecessary fees that add up to billions globally.

HoweyCoin and blockchain are going to change all of that!

"HoweyCoins utilize the latest crypto-technology to allow travelers to purchase all segments without these limitations, allowing HoweyCoin users to buy, sell, and trade in a frictionless environment - where they use HoweyCoins to purchase travel OR as a government-backed, freely tradable investment - or both!"

(Source: https://www.coindesk.com/the-sec-just-launched-a-fake-ico-website-to-educate-investors/)

The website even comes equipped with a techy-sounding white paper!

This all sounds like a great idea, but remember this product isn't real.

Instead, any users that try to sign up or invest in the ICO will be redirected to the SEC's educational tools section aimed at helping investors spot fraudulent ICOs.

More about the fake coin and the SEC's thought process behind building it can be found here:

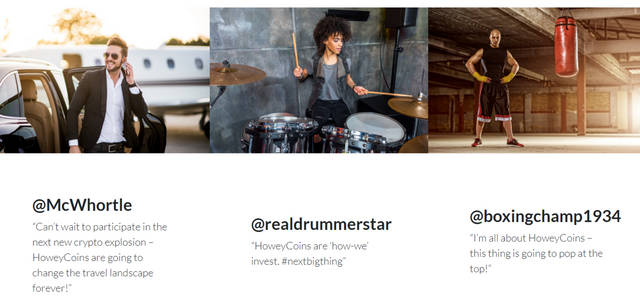

No token sale would be complete without Celebrity Endorsements!

(Source: https://www.howeycoins.com/index.html)

Owen Donley, of the SEC, said that the website incorporates many of the hallmarks seen in fraudulent token sales. Information he says is important in helping distinguish the frauds from the legitimate ones.

"Fraudsters can quickly build an attractive website and load it up with convoluted jargon to lure investors into phony deals, but fraudulent sites also often have red flags that can be dead giveaways if you know what to look for."

(Source: https://www.coindesk.com/the-sec-just-launched-a-fake-ico-website-to-educate-investors/)

Why would you not buy what realdrummerstar is selling?!

Stay informed my friends.

Image Source:

Follow me: @jrcornel

SEC sucks balls! They are so far behind the times in regulating their zone. Get it together SEC!

This is actually pretty hilarious and clever. Hard to argue with the huge volume of fake and Ponzi-scheme. Don't hate it but hope this also isn't a sign of a wide scale SEC crackdown on crypto. Hopefully they view this just as a means to increase credibility in the industry, not decrease it!

Wow that's hilarious, is that where all my tax dollars are going to?

Wow, great step to teach investors to keep themselves away from these fishing fake sites.

It's pretty funny that they went this far.

yeah, but I think it's a good step.

SEC is forgetting the fact that creating a fake ICO website does not cut the chase! Scam is everywhere, if they want to identify scam, they should start with the banks first.

It is a witch hunt!

I am not saying there are no scams, but community is a better evaluator than the SEC itself! That is my 2 cents.

Usually i don't agree with what SEC does but this time i support them. Fake ICO's are whats killing this industry.

good one post of cryptocurrency sir @jcornel,always follow your personality.keep up the good thinking

must be follow that,carry on sir.

Anyone who attempted to invest should be publicly named and shamed.

This website was cringy, even for Bitconnect standards.

I think this is great and should be the focus of the SEC in protecting investors from fraud. However, they are also confusing potential participants by talking about regulation of ICOs and fraud in the same discussions. Sone may view the discussions in being related to each other. Investor protection is not a bad thing but generalizing a concept is.

Agree 100%. They need to make it very clear what is ok and what isn't. Some of these projects are trying to toe the line but they aren't even sure what the line is...