Distributed Credit Chain review

I welcome all the readers of my blog, my name is Julia, and today I will tell you about another interesting ICO project, which was named Distributed Credit Chain.

The financial sphere has long ruled the world, big banks, managing huge flows of money, set their rules of the game in corporate, social and even political spheres. The 2008 crisis has shown that the collapse of just a few financial institutions can harm all the state on the planet, millions of people.

The greatest reliance on centralized financial institutions is observed in the credit area of financial activity, where a simple person becomes hostage to the banks ' decision to issue or surrender a loan, although often it is vital.

To solve problems of the financial sphere and the project Distributed Credit Chain was created.

What is Distributed Credit Chain?

It is an ecosystem based on the blockchain, developed for financial service providers as well as their clients. The main focus of the platform is focused on credit activity. The purpose of the platform is to reform this sphere, offering companies convenient tools for doing business and a convenient, simple opportunity to obtain credit.

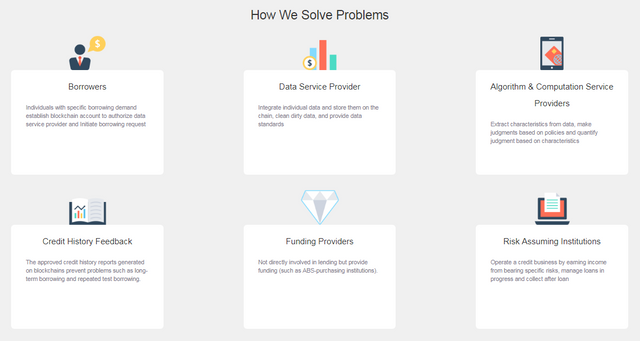

What problems does the platform solve?

- First, it is the high cost of the loan. Interest in it depends on the interest rate of the central bank, as well as the risks of the entire credit portfolio of the bank. What does that mean? The bank or any other credit institutions always take into account the risk of non-return, respectively, these risks are put in the interest rate, that is essentially the situation in which bona fide payers of the loan are obliged to pay a large Interest rate to cover losses on non-refundable credits.

- If we look at the sphere through the eyes of a credit institution, the main problem is the big time spent on checking the borrower. So far, there are no reliable models to identify the future of a bona fide or unfair payer.

The solution from the system

To overcome the current situation, the platform represents its decentralized infrastructure. All that is needed for the client is to create an account, to which it is necessary to submit the data for reception of credit, to create the application, and to receive the offer from credit organizations all over the world. The interest rate on such a loan will always be lower than the bank interest rate. The system fully guarantees the safety of your personal data, and you will not depend on centralized solutions of financial structures. I can especially note the transparency of the conditions of obtaining a loan, as they say, in this case, the small font will not be read.

Advantages of DСС

- For clients, the platform provides data security, protection against third-hand penetration, convenient, simple registration and simple operation of the system as a whole.

- The main advantage is decentralization, the system is striving to give power over their finances and cash flows to the people themselves, rather than to a large financial institution.

- The platform significantly reduces the amount of routine work for service providers, offering such functionality as the ability to store all the necessary data about borrowers in the network, with quick access to them, the possibility of qualitative analysis of the received Information.

Project Opportunities

Initially, the project is aimed at solving problems in the credit sphere and will allow taking almost any type of credit:

- consumer;

- target;

- credit for studying at the university;

- mortgage and so on.

However, this functionality of the platform is not limited, already with the launch will be available functionality on registration of loans, registration of claims on loans, as well as the issuance of the credit card with cryptocurrency. Over time, the possibilities of DCC will only grow.

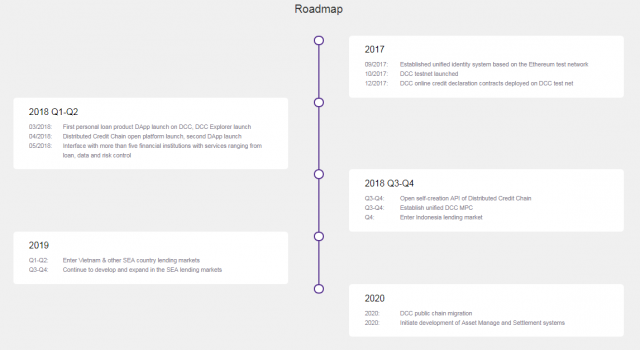

Roadmap of the project

At the moment the project is under development, the release of fully working versions of the application is scheduled for 2018. In 2019, large-scale expansion to the countries of South-East Asia is planned, and in 2020 — already worldwide.

Resume

At the moment in the world of finance and credit are quite acute problems, which were precisely marked by the leadership of the platform Distributed Credit Chain. In response to these challenges, a private platform has been proposed that can actually solve the tasks. In my opinion, the turning point in the development of DSS will be 2019, in which we can judge the future prospects of the company. However, I do not doubt the final success of this idea.

Congratulations @juliasto! You have completed the following achievement on Steemit and have been rewarded with new badge(s) :

Click on the badge to view your Board of Honor.

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @steemitboard:

SteemitBoard World Cup Contest - The results, the winners and the prizes