Token Utilization

- Opporty Priority Listing Services and Opporty Advertising Services

- Customer-Supplier transactions

Opporty Priority Listing Services and Opporty Advertising Services

Opporty has a complex listing system for business providers. Once the site has traffic, business providers may want to buy priority listings. We offer primary listing services with a manual verification procedure which grants priority to verified listings compared to those unverified.

Our other source of revenue is advertising. For example, Yelp reports (https://www.marketwatch.com/investing/stock/YELP/financials) $713.07M of sales revenue in 2016. The primary service Yelp sells is advertising for US businesses. Its revenue grew by about 30% compared to 2015, and by almost 90% compared to 2014.

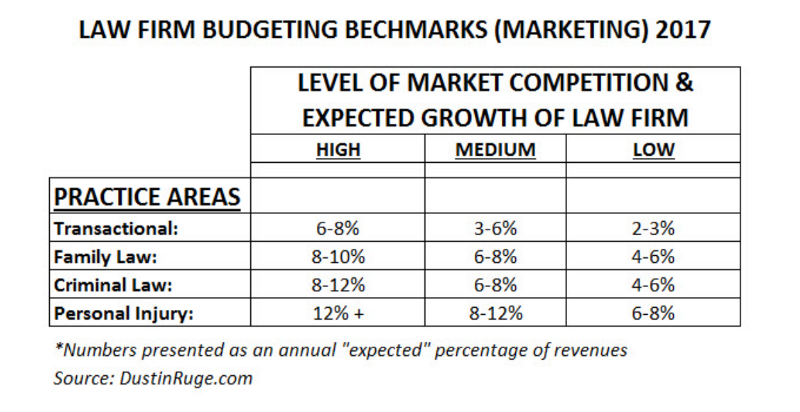

Other relevant information is provided by Dustin Ruge https://www.linkedin.com/in/dustinruge/ from FindLaw

https://www.linkedin.com/pulse/how-much-should-my-law-firm-spend-marketing-dustin-ruge/

US legal companies spend between two and 12% of their annual budgets on marketing and advertising.

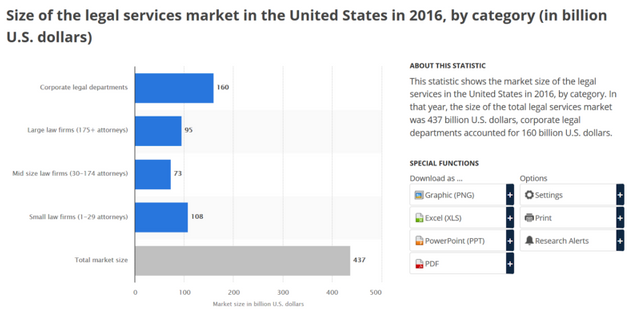

https://www.statista.com/statistics/318907/size-of-the-legal-market-by-category-us/

The annual US legal market is worth $437 Billion.

Small and midsized businesses make up $181 Billion USD of the market. Seven percent accounts for $12.67 Billion USD. That is $12.67 Billion USD spent on advertising. There is no exact data on the percentage spent on various online listings and catalogues. Different sources provide different information regarding the industry’s proportional usage. However, based on various sources, it could be assumed that between 10–25% is spent on a variety of listings and online marketplaces.

Avvo’s primary services are listings and advertising. In 2015 its services were valued at $650 Million USD. (https://www.bloomberg.com/news/articles/2015-07-28/legal-website-avvo-valued-at-650-million-in-funding-round)

Those services are overly commercialized, which we do not support. Our expectations are to generate between one and five Million USD per year in advertising revenue, which will grow in proportion to the growth of traffic.

The process of buying advertising services requires advertisers to purchase tokens, or to transfer money to us to buy tokens and spend them on their advertising campaigns. This source of funding will ensure stability and growth of token demand on the market.

However, this is not our main source of token demand.

Customer-Supplier Transactions

The demand for tokens is mainly created by their exchange for real life services. This procedure is protected by decentralized escrow.

For example, a user wants our lawyers to provide the standard services of registering a company for him.

The user has two possible choices:

- The user exchanges fiat to purchase tokens, and then orders the service through our platform.

- The user transfers fiat to us, we buy tokens at the exchange and then transfer them to the service provider.

For the provider’s convenience, we will use a “Provider Protection Policy”. For example, let’s say the service cost is $5000 USD. After the provider receives the money, due to short-term devaluation the amount of tokens he receives equals $4000 USD. In such a case, we will buy tokens from him using our profits. This option will increase the provider’s trust in our token. The more providers accept tokens, the more users will use them because of the additional layer of decentralized escrow protection.

This protection policy will increase the community’s trust in the OpportyToken, which will significantly decrease the chances of OpportyToken’s devaluation, regardless of its duration.