Money Token - Platform for Smart Loans Backed by Crypto-Assets

What Is MoneyToken?

MoneyToken is a bright example of the real use of blockchain technology, as well as offering a massive boost for crypto market liquidity for all market players, and especially for businesses

Since the emergence of cryptocurrencies, the behaviour of users, owners and miners has proved to be very different than what was expected. Rather than turning into true ‘virtual coinage systems’ used to buy goods and services on a day-to-day basis (from your morning latte to houses and cars), Bitcoin and other cryptocurrencies have turned into long-term investments; from something you keep in your wallet into something you store in your safe.

Nobody now would suggest buying pizza with Bitcoins as happened back on May 22nd, 2010 (Bitcoin Pizza Day) when a developer bought 2 Papa John’s pizzas with 10,000 units of BTC. "It wasn't like Bitcoins had any value back then, so the idea of trading them for a pizza was incredibly

cool," Hanyecz told The New York Times in 2013. "No one knew it was going to get so big."

Platforms that attempt to intermediate cryptocurrency-backed loans between individual lenders and borrowers usually fail to provide the service of proper risk management to their clients; price volatility of the collateral creates a burdensome risk to both the borrower and lender.

At the other end of the spectrum, most established lending channels are unwilling to accept volatile assets such as cryptocurrency as collateral at all. MoneyToken aims to resolve these issues, managing clients’ risks and creating a stable lending model using cryptocurrencies as a security deposit. Our model aims to facilitate access to credit while building a new credit market – loans backed by crypto collateral, based on the security and transparency of blockchain technology.

Who is the platform for ?

Miners:

- Avoid cash flow problems or invest in more equipment, without losing the macro cryptocurrency already mined.

Traders and investors:

- Maintain your investment portfolio of cryptocurrency and use leverage to make further investments or improve your ICO liquidity symbol.

ICO:

- Quick access to cash, without all red tape, for short-term businesses need a token symbol of money

Exchange:

- Meet the need for extra cash while hedging exchange risks and utilizing your crypto assets

Problem:

The problem has been obvious for some time - spending crypto assets today prevents cryptocurrency holders from gaining on any future growth in asset value; holders who buy low need to hold on to their investments in order to benefit from selling high.

This is where MoneyToken steps in. The MoneyToken platform allows you to borrow liquid funds instantly, based on the current value of your cryptocurrency asset holdings. You take out a loan, collateralized with more volatile assets such as Bitcoin or Ethereum - and in return you receive an agreed loan amount in a stable currency. And after repaying the loan you receive your whole collateral back; even if the collateral has increased in value multiple times.

This way, you're able to acquire liquid funds for immediate needs, and save your crypto position, all at the same time.

Vision:

At this stage of the market’s development, we see that cryptocurrency assets have gained the characteristics of various financial instruments. We can divide cryptocurrencies by their qualities and

algorithms; into investment assets and means of payment.

Investment assets are volatile and compelling for the long term, made to earn on the difference between rates of exchange or getting other types of earnings, such as from proof-of-stake algorithms, rate in interest and so on.

Payment cryptocurrencies are created to support the stability of the rate of exchange – they usually are embedded with a self-regulation mechanism, a unique algorithm to regulate the difficulty of mining or the release of new coins.

The problem is that, even if the new functional cryptocurrency has a capitalization of several million, it’s probably not recognized by the pre-existing fiat financial system as an asset. Even if on the governmental level the cryptocurrency has a certain status, the banking system and its loan services are closed for the cryptocurrency business or the holders of such an asset.

A revolutionary lending model

This lending ecosystem uses all the fluctuating crypto assets in the form of collateral. When crypto collateral is approved, a loan can be provided as a stable coin or currency. Here are the points that make this lending model revolutionary.

- Automatic loan confirmation can be done within a matter of minutes or even seconds.

- There’s no need for individual credit-scoring models for verifying assets.

- Customers can regulate all the loan conditions within the ecosystem’s pre-defined terms.

- High transparency is maintained during collateral evaluation.

Spending crypto assets won’t let an investor benefit from a future rise in their value; that’s why many investors buy less crypto and hold their order to reap benefits. Now, here’s where MoneyToken comes into play. This is a crypto platform allowing investors to borrow different liquid funds instantly—the best part is that the borrowing will be done on the basis of your cryptocurrency asset holdings’ existing value.

MoneyToken analysis

This platform lets you take a loan by using different volatile assets such as Ethereum and Bitcoin as collateral—in return, you’ll get a loan amount that’s available in a stable currency. Once the loan is repaid, you’ll get back the entire collateral even if it has increased in value.

With this platform, you’ll not only acquire liquid funds but also save the crypto position and stay right in the heart of the long-term investment game. Put simply, with MoneyToken, there isn’t any need to sell your owned BTC or ETH whenever you need stable currency or cash.

This blockchain-based (similar to ArmPack, THEKEY, BunnyToken, Upline, TrustaBit) credit ecosystem is ideal for all those miners who’re finding it difficult to raise funds to get new mining equipment; it’s meant for those traders and investors who want to make it big in the crypto-investment landscape; likewise, the network is ideal for ICOs looking to access quick cash for short-term needs.

Lastly, the platform can even be leveraged by crypto exchanges looking to bring down the hedging risks by securing extra cash.

MoneyToken innovation

MoneyToken is all about innovation.

Leveraging the power of smart contracts

This is a one-of-its-kind blockchain-based credit system where the value of any crypto asset can be used as collateral. However, the value and credit terms and conditions in this model are transparent and publically available at any moment—plus, they’ll be governed by smart contracts. Due to the presence of a blockchain and smart contracts, the lending model doesn’t need any intermediary apart from the link that ensures a transaction’s completion. As a result of the absence of intermediaries, all the financial institutes—banks and lenders—participating in the cryptocurrency economy can lower the loan-acquisition costs and improve the overall transparency of the process.

A revolutionary lending model

This lending ecosystem uses all the fluctuating crypto assets in the form of collateral. When crypto collateral is approved, a loan can be provided as a stable coin or currency. Here are the points that make this lending model revolutionary.

Automatic loan confirmation can be done within a matter of minutes or even seconds.

There’s no need for individual credit-scoring models for verifying assets.

Customers can regulate all the loan conditions within the ecosystem’s pre-defined terms.

High transparency is maintained during collateral evaluation.

MoneyToken token sale

MoneyToken’s native token is used to fuel the transactions or exchanges happening within the ecosystem.

Here are some token details associated with this ICO project.

ICO details :

-Ticker : IMT

-Price : USD0.005

-Maximum emission : 22.49 billion

-Private sale : February 7 to March 21 (Hard cap: USD 1,500,000)

-Presale : March 22 to April 12 (Soft cap: USD1.5 MM, Hard cap: USD 5,000,000

-Token Sale : May 2 to June 6 (Soft cap: USD3 MM, Hardcap: USD35,000,000 MM)

-Bonus : Available

Is MoneyToken Right For You?

If you frequently invest in cryptocurrencies or have a large number of crypto assets in your portfolio, MoneyToken may be right for you. The MoneyToken platform is one of the rare financial platforms that makes it easy to bring together cryptocurrencies with fiat money. One could argue that it’s a virtual necessity for any person who has seriously invested in cryptocurrencies.

MoneyToken Conclusion

The potential benefits of MoneyToken are plentiful. While MoneyToken is not technically a lender, it has created a platform for people who need fiat money but whose only collateral is in the form of cryptocurrencies. It’s a way to put cryptocurrency investments to good use while waiting for the price to increase and the investment to pay off. MoneyToken does not solve all of the problems that relate to merging cryptocurrencies with fiat money, but it’s a good step in the right direction.

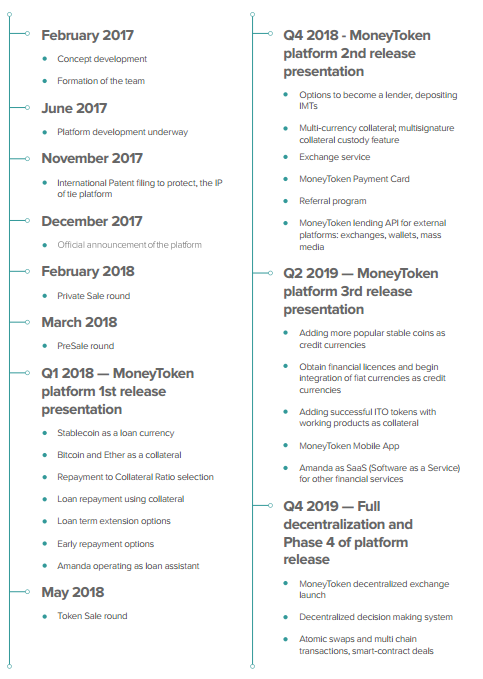

RoadMap

For Information:

Website: https://moneytoken.com/

Whitepaper: https://moneytoken.com/doc/MoneyTokenWP_ENG.pdf

Abstract: https://moneytoken.com/doc/Abstract.pdf

Telegram: https://t.me/moneytoken

Medium: https://medium.com/@moneytoken

Twitter: https://twitter.com/MoneyToken

YouTube: https://www.youtube.com/channel/UCz9r7r5BSoq4eE6guMa7P-w

Autor: https://bitcointalk.org/index.php?action=profile;u=1929991