Havven ICO profitable?

I like ICO, trying to help start up companies, and a chance to some nice rewards for myself. So I was investigating the Havven ICO. I see the need for the product in the market. A stable coin in this volatile market, great. So I started to think, what is in it for me? Here are my thoughts...

We earn from the transaction fees from the secondary stable coin Nomin. So what can I earn from a Nomin? For that to figure out it is importanted to know how often a Nomin will change hands in a year, its called the velocity. We have no clue what the velocity of the Nomin will be. But let me estimate it with the velocity in the fiat market. The velocity is about 5.5 quarterly (https://alfred.stlouisfed.org/series?seid=M1V). So in a year I would earn about 22 transaction fees.

Suppose the transaction fee is 1%. In that case I would earn $0.22 on a Nomin in a year. Cool, thats a nice interest..... BUT

The site also said: "The system only allows 20% of the value of havvens to be issued as nomins, this means there is a buffer of 80% against price changes". So I need $5 of Havven to issue a Nomin. Then my interest rate drops to 0.22/5 = 4.4%.

OK I thought, still no problem if my Havven rises a lot. But then another citation: "However, once nomin transaction volume is sufficiently high, we may instead consider internally estimating the value of a havven by the fees it is likely to accrue in the future." So that kinda puts a maximum on the price of the Havven. So how do we calculate that? Well there is a formula for that: payment per year /r where r is the interest rate in the market (http://financeformulas.net/Perpetuity.html). Suppose its 4%. We fill that in the formula: 0.22 / 0.04 = $5.5. But wait, that is the current value of the fees for 1 Nomin. I need to issue about 5 Havvens for that. So the value of the Havven in that case is $1.1.

I buy the Havven for $0.5, so that seems like x2.2, if we get 1% transaction fee (is that low?), the velocity is 22 and the interest rate in the market is about 4%.

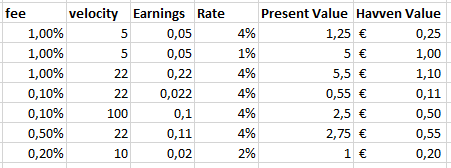

So for some different values I did the same calculation below:

My best guess in the beginning based on this story would be the last row. 0.2% transaction fee is what we pay on exchanges. Current interest rate in the market from 2%.

BUT BUT BUT I might be wrong offcourse! The hype and psychology may win from the math. An I might have screwed up somewhere. So this is in no way financial advise! What are your thoughts on this?

PS Excuse my bad English, its not my native language and I **** at languages.