ICON post ICO - Bancor formula explained and ICX price speculation

First of all, congratulations to ICON team with a hit success on their ICO! The ICO was scheduled in October, with pre-sales of 3 rounds in September. Each participants were capped to 30 ETH, 100 ETH and 1000 ETH in each round in sequence. 1st round of the pre-sale was capped to 75,000 ETH for the general public, and 75,000 ETH for strategic contributors. Total hardcap for the ICO pre-sale+crowdfunding combined was 150,000 ETH. The team managed to reach the total hardcap within 6.5 hours, both public and strategic investors fulfilled the cap! This is max 30 ETH from each individual, no whales involved! I am sure the pre-sale would've been done in matter of minutes if there weren't such cap. Once ICX hits exchanges, expect lots of FOMO buyers jumping in!

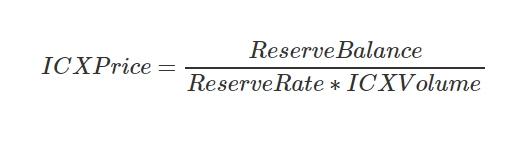

Bancor Formula Explained

Now there has been some major confusion regarding ICX future prices, people have been confused by ICON's mention of using bancor formula in their whitepaper. The use of the word 'pegged' was the worst vocabulary to explain what it is. For those who don't know what pegged means, it is simply to retain the exact ratio of the currency it is in relation to, ie. if 1 ETH is 2500 ICX, it will always be 1:2500, so the price of ICX is determined by ETH value, not by market demand. This is simply not the case and today I'm going to try and clarify that,

First and foremost, this has been put up since day 1 in ICON's FAQ section

What is the expected value of ICX tokens after the tokensale?

The value cannot be predicted in advance.

As with any other cryptocurrencies, the value of token is determined by the market valuation.

So before diving into details, ICX is NOT pegged to ETH like most people think it does.

Let's break the situation into two parts,

At current stage, there's no other currency but ETH in the reserve, it is natural that ICX price is in direct relation to ETH price (don't use pegged again please!). So in the pre-sale, 2500 ICX tokens = 1 ETH, your tokens are worth what ETH is worth today, before the tokens become tradable.

In the future when ICON releases its ICX DEX, ICX tokens will become tradable, and will be used as the intermediary transfer token among different cryptocurrencies. In this matter, bancor formula is in place FOR NOW, in order to determine the exchange rate. ICON DEX will incorporate other DEXs and as new currencies get added into the reserve, in the case of ETH, it'll only hold partial volume of total ICX.

Now let's take a closer look of what bancor formula looks like

This formula is not exactly rocket science!

If someone buys ICX, reserve balance increases and ICX volume decreases, resulting in an increase in ICX price. So the formula DOES take market supply/demand into account to determine the price.

Let's go even a step beyond, check another ICO that actually lives on bancor network as an example, Stox. Its ICO price was around $1.1 per STX token, with 29mn tokens in circulation and total supply of 59mn tokens. Bancor holds 4% of STX market cap in BNT at any given time.

Let's look at STX price today coinmarketcap, the token is driven by market supply and demand, currently around $0.5 USD per token, well below its ICO price. STX is based on bancor to benefit from sufficient liquidity, and avoid volatility risks, not to peg it as a stabilization mechanism.

ELI5: Insufficient liquidity is the risk of investors unable to acquire tokens when they want to speculate and of users unable to sell tokens when they want to cash out.

ELI5: Volatility risk is when token values fluctuate between the time an investor bought in and the time they want to cash out.

Price Speculation

******Disclaimer******

Price speculation is purely based on personal opinion, it is not based on facts. Do not take this as investment advise!

Given that people often refer ICON to South Korea being similar to what NEO is to China, both are the first public blockchain from the country with substantial support from investors nationwide. If we base on today's market cap of NEO, currently around $1 billion USD. ICON's raise of 150,000 ETH at the time of the pre-sale was around 42 million USD. In other words, 23.8x in price will pass NEO in market cap.

Pre-sale of the ICO was 1 ETH to 2500 ICX, around $0.1128 USD per ICX token. A 23.8x gain will calculate to ~$2.68 per token. This is the minimum goal I expect before even considering taking profit. But of course this is based on today's prices, by the time ICON catches up, the market cap of NEO can fluctuate quite significantly, use your own judgement! ICON's ultimate goal is to become the biggest blockchain in the world, so we're aiming to bypass Ethereum and maybe even Bitcoin, very far fetched goal but never say never ;)

People who participated in the pre-sale were limited to 30ETH each, from observation in various social channels, a ton of people were willing to put it more if they could. With that said, when ICX hits exchanges, I expect a major price rally, for those who missed on the pre-sale, and those who wanted more during the pre-sale.

We can safely bet that the first exchange to list will be coinone, one of the biggest crytocurrency exchanges in South Korea, a company that is under the same corporate umbrella, Dayli Financial Group as ICON.

I'm also expecting support from other South Korean exchanges, namely Bithumb, to list shortly after.

Foreign exchanges will also likely adopt the token, but since most exchanges forbid disclosure of listing tokens, I don't think we can ever find out who's next in line before it is actually listed.

TL;DR

ICX is not pegged to ETH

ICX will moon :D

For actual calculations and speculation on DEX opening price, please refer to this sheet

https://docs.google.com/spreadsheets/d/1F_TkmFHR1pcttGCLHGiG8EbnYlJpcmoDxYBPARD6I4c/edit#gid=2130567486

icon ico 투자자로써 엄청난 성장이 되길 기대합니다