My Entry on the huobi challenge, Margin trading on huobi

Margin Trading is a process of trading which allows users to increase their investment exposure a limited base principal to enjoy multiple returns.

Margin trading gives you the opportunity of adding leverage to a trade with money that was borrowed from your broker. This means you trade at a higher risk and also can make great return from it.

How to Margin Trade on Huobi Pro?

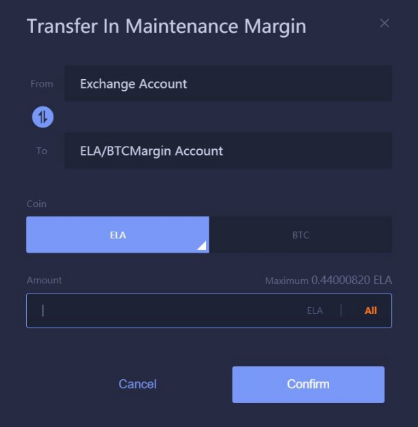

When you start trading on Huobi Pro you will need to transfer funds from your exchange account to your margin account. To do this, go to the margin trading tab after you logged in onto your Huobi account. Then go to the trading pair you want to trade. Go to “transfer in” and add the amount of tokens you want to margin trade.

You then click on the exchange button to transfer your margin funds back into your exchange account and then you can transfer both from your margin account to your exchange account.

You now go to your margin account balance and then click on the tab loan in the account, then below the tab balance s, top right corner on the website, and now accept the terms and condition. Then you will see your margin balance.

How does margin trading works

With margin trading ther e is an increase in the amount you trade with by leveraging on it. You can make the trade to exchange USDT to buy Bitcoin, because you believe the price goes up, you go long. Now you can choose to add leverage, the maximum you can add is 3x, so for instance, if you add 1x leverage, you take out a loan to insure that you can pay my leverage if the trade goes the wrong way.

The loan insures the currency exchange it can liquidate a trade account.

If you made a 100% profit before it was closed, with the 1x leverage it means you get another 100% profit. The loss is also doubled, if there is an 100% loss on the trade.

For example, if you have 300 USDT, you can loan from our platform to trade, and your gains can be magnified and you can get a 100% gain or loss

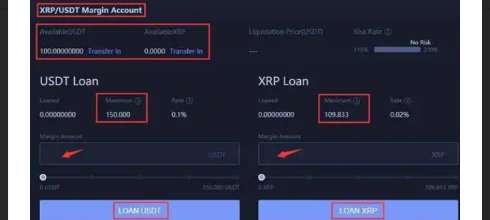

How can I apply for loans?

Funds are needed to be transferred into your Margin Account. Once funds are transferred, you can click “Loan” in the Margin Trading page and apply for loans straight up.

What is “Long”?

Using USDT/XPR pair as an example. You can borrow more USDT. Buy XRP at a low price and sell at a very high price to gain profits from price spread. Then repay the USDT back into our platform.What is “Short”?

Take XRP as an example. You can take loan as in more XRP. Sell XRP at a high price and buy at a low price to gain profits from the price spread. Then repay the XRP back into our platform.Under what circumstances will my account be forced into Liquidation

Isolated Margin: Whenever the risk rating of the respective margin trading position falls below 100%, the system will liquidate the position and the funds will be taken back.

Cross Margin: When the risk rating of the cross margin account falls down below 110%, the system will be forced to liquidate the position and the funds will be taken back.

How is Risk Rate calculated?

Total Asset (Tradable Balance plus Loaned Amount) / (Loaned Amount plus Interest Payable) times hundred percentageWhy can’t I transfer funds from Margin Account when I have funds?

Withdrawable Balance equals to Total Assets minus two times (Loaned Amount+ Interest Payable). You can refer to details on the page.

How much Interest should I pay for Margin Trading?

Interest can be charged according to the percentage of the loan amount. One hour/60 minutes is considered as a unit. Any time less than 60 minutes will be considered as one hour. You can refer to details of Interest Rate on the page.How much is the leverage?

There are different leverages on each trading pair. You can refer to details on the page.How can I check the risk rate on my account?

In other to check your risk rate, quickly navigate and click on the top menu 【Balances】 –> 【Margin Account】-> Toggle between the tabs Cross leverage/Isolated leverage to see their respective risk rates.How can I check my loan history?

Only Users can access historical loan application date/time, interest rate and interest records under 【Orders】,【Exchange & Margin Orders】and【Loan and repayment history】.How can I repay the loan?

Whenever you want to repay your loan Click on the ‘Repay dialog box on the Margin Trading page or via 【Balances】 –> 【Margin Account】-> Toggle between the tabs Cross leverage/Isolated leverage

Thanks for letting me be a part of this.

Dont forget to comment and upvote.

Thank you for taking part in the Spotlight on Huobi Challenge.

Keep following @steemitblog for the latest updates.

The Steemit Team