India’s $32 billion bank rescue plan looks great—but the fine print is missing

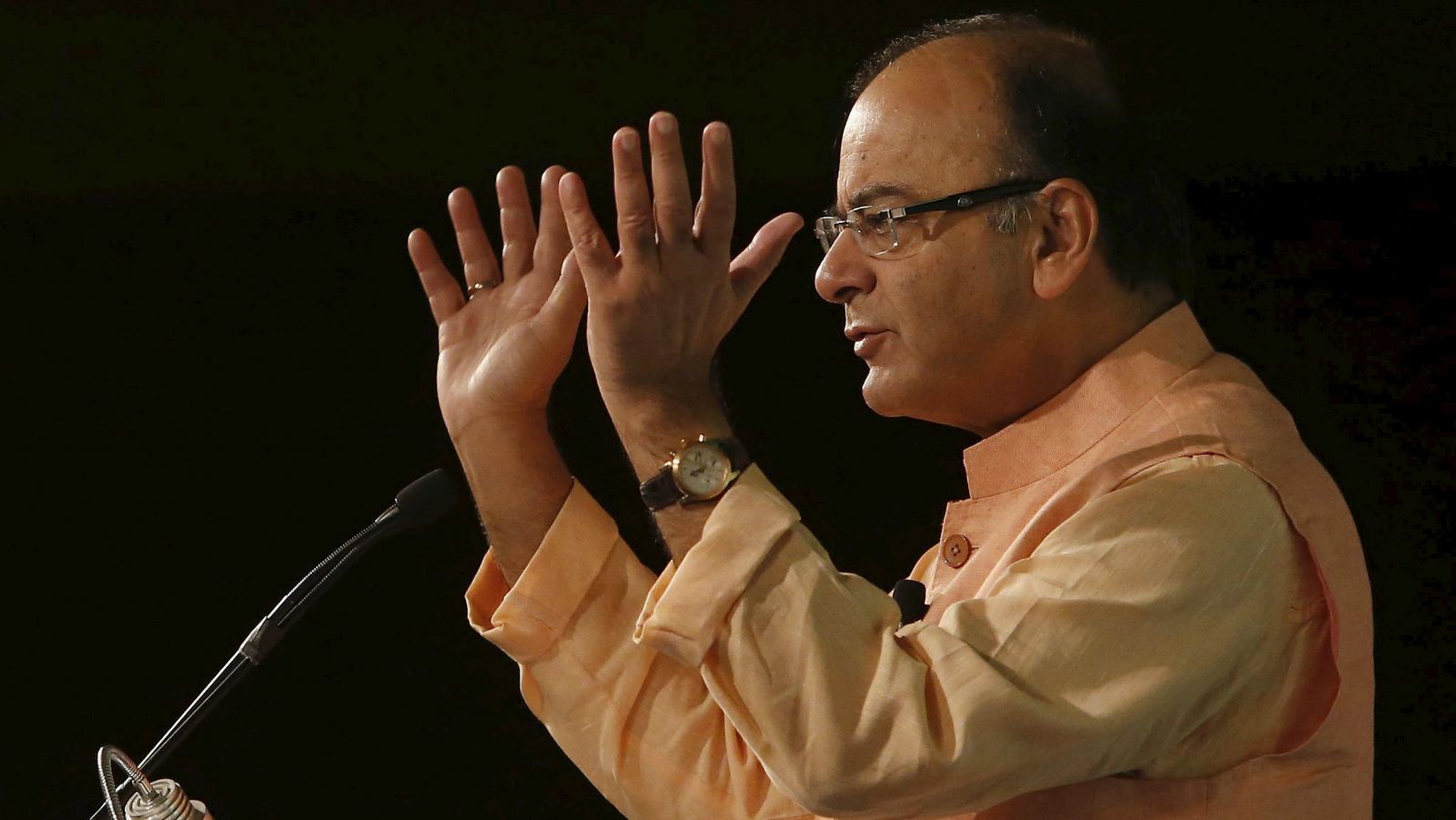

jaitley.jpg

The Narendra Modi government has unveiled a grand plan to lead India’s banking sector out of its acute toxic-loan mess.

Public sector banks, which command a lion’s share of the loans and deposits in the Indian banking system, will receive Rs2.11 lakh crore ($32.43 billion) over the next two years to improve their capital position. Out of this, Rs1.35 lakh crore will be provided through recapitalisation bonds—government instruments subscribed to by banks. The remaining Rs76,000 crore will either be provided by the government, or the banks will tap the financial markets.

The move could provide respite to a sector whose total gross non-performing assets (NPAs) in March 2017 stood at about Rs7.29 lakh crore, equivalent to 5% of the country’s GDP. NPAs are loans on which borrowers have stopped repaying either the principal or the interest. These toxic loans have put banks’ balance sheets under pressure as they need to make higher provisions to cover for possible defaults. In all, public sector lenders needed between Rs1.4 lakh crore and Rs1.7 lakh crore by March 31, 2019, to meet regulatory requirements for their capital positions, according to a report by rating agency CRISIL.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://qz.com/1110438/the-modi-governments-32-billion-recapitalisation-plan-for-public-sector-banks-is-missing-the-fine-print/

i upvoted you plz do the same

https://steemit.com/teachers/@sentechnical/teacher-reminder-students-didn-t-choose-their-parents