Don’t Wait Too Long To Buy Long Term Care Insurance

Many Americans have the tendency to wait for too long to purchase long term care insurance. They choose to sweep it under the rug first and put off purchasing coverage until later down the road. Waiting too long to buy insurance for long term care can actually do you more harm than good.

How?

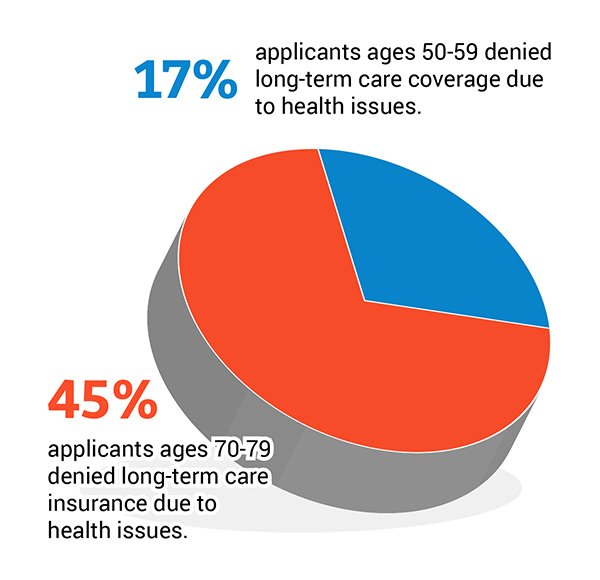

It gets harder to qualify for long term care insurance the older you get. Insurance providers reject individuals who are too old and have pre-existing conditions.

In addition to this, premiums increase as you get older. You can buy a long term care policy for $1,593.90 at the age of 55, which can go up to $2,296.32 when you buy the policy at age 65.

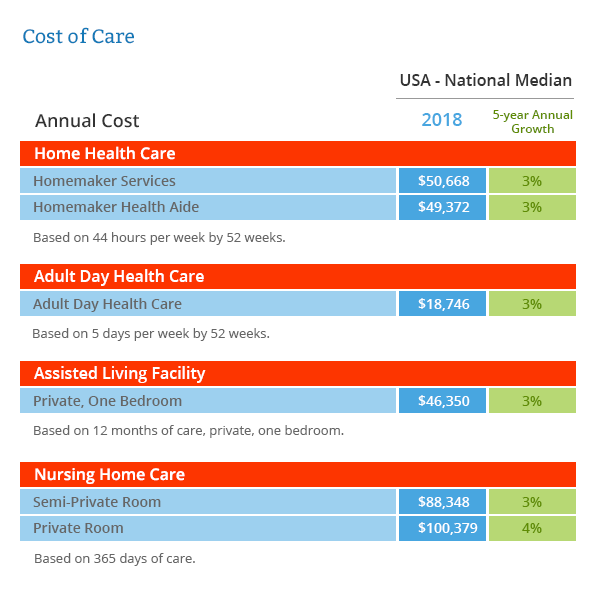

It pays to realize the importance of having a long term care insurance policy and to get one early. According to the latest cost of long term care, the average cost of a private room in a nursing home is $100,379 annually. In a span of 5 years, it will increase to $116,362 annually.

Your health changes as you age. The older you get, the harder it is for you to health qualify for long term care insurance. Insurers actually offer health discounts to applicants who have good health. But how early should you buy coverage? Should you get it while in your 30s, 40s, 50s, 60s or 70s?

According to experts, the best age to buy long term care insurance is in your 50s. By this time, you are only a few years away from retirement, which makes it the best time to make financial decisions such as boosting your retirement income and buying insurance policies like long term care insurance.

When Is It Too Late to Buy Long Term Care Insurance?

Most insurers reject applicants of 70-year old individuals. You can still try to apply for coverage but since long term care insurance companies have strict underwriting, chances are you will get denied of coverage.

Avoid Financial Woes in 2019

You can start your year right by exploring your long term care options this 2019. Now is the best time to put your finances in order and to plan for your future long term care needs. To help you get started, answer this short long term care quiz to find out how much you know about long term care and to help you jumpstart your long term care plan.

If you’re considering comparing ALTCP long term care insurance, we can send you no-obligation quotes from top insurers. Feel free to compare policies with no pressure to purchase coverage.

Hello @samstein! This is a friendly reminder that you have 3000 Partiko Points unclaimed in your Partiko account!

Partiko is a fast and beautiful mobile app for Steem, and it’s the most popular Steem mobile app out there! Download Partiko using the link below and login using SteemConnect to claim your 3000 Partiko points! You can easily convert them into Steem token!

https://partiko.app/referral/partiko