Save Your Money- Get it out of the Bank

This post's goal is to help you earn more money on your savings.

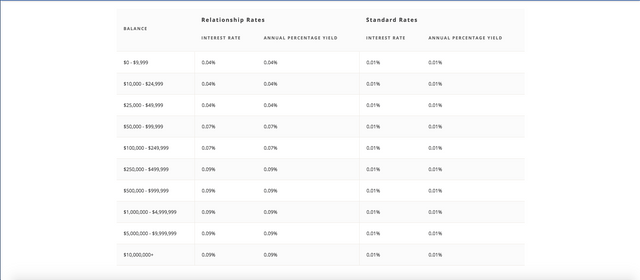

If you have online banking, check your interest rate. Many banks will have a link for their current interest rates. For example check Chase Bank Chase Interest Rates

By going to that link you will see they virtually pay 0% interest.

I recommend taking out money in your savings account of money you can afford. Leave money in for paying the bills, emergency money and fun money. The rest start the process of moving cash out.

You may want to look into investing with Prosper Not an affiliate link.

They allow you to loan money to anyone in America who needs a small loan of $30,000 or less. People will pay 6% or higher in interest or about 600 times what Chase pays.

Most people purchase Notes. A note is a $25 investment. This can count towards $30,000 loan. For a $30,000 loan that can be 1,200 separate individuals funding the loan. 1,200X25= $30,000

The worse someone's credit score, the higher the interest fee is. Some people will default on their loans. This is why people diversify between AA, A, B, C, D, E, HR (High Risk).

Prosper recommends Diversifying investments. AA 5% A 11% B 21% C 31% D 20% E 10% HR 2% =100%

Loans are between 3-5 years. Every month, you earn monthly payments. Once enough money has been payed back, you can invest that $25 into a new loan. For example, say you buy $500 in notes and the first month you get payed $16 . The next month you may make $15.90 as they are slowly paying off their debt. 16+15.90=31.9-25=6.90

You can invest that $25 and be left with $6.90 left towards your goal of $25 to invest again. You earn money by adding interest onto interest as much as possible. A good chunk of that $25 is interest money.

Have you ever heard of the rule of 72? This works for compound interest. You divide 72 by an interest rate and that will tell you how long it takes to double your money. For example $10,000 will become $20,000 at 10% interest in 7.2 years. 72/10 =7.2

If a bank is paying 1% then it takes 72 years instead of 7.2 years. If a bank is paying 0.1% then it takes 720 years.

I recommend looking into prosper, I'm just starting with them. Even if you can only afford $25 a week, in a year that is a total of $1,300. Don't forget you have been making interest so that $1,300 is much more than that.

Interest rates vary and the amount of people defaulting can vary but a 9-12% return of interest per year is common to receive.