9 key indicators that drive exchange rates in forex market..

9 key indicators that drive exchange rates

Here are the most important factors and economic indicators influencing the exchange rates:

Interest rates

Inflation

Deflation

GDP growth rate

Employment statistics

Trade balance reports

Political events

Military conflicts

Quantitative easing

You must remember that these factors are relative and should be compared between the two countries of a currency pair. For example, if Japan’s Gross Domestic Product (GDP) is skyrocketing, it doesn’t automatically mean that Japanese yen will be more valuable than U.S. dollar. Japan’s GDP growth must be higher than that of the US in order for this factor to drive yen’s value up in USD/JPY pair.

The great thing about forex is that all of this information is transparent and instantly available to everyone, not just for the insiders (as it often is with stocks). Furthermore, there are factors like interest rates and target inflation that are planned well in advance, and reported instantly through news outlets like Bloomberg, Reuters and economic calendars.

In forex, headline economic data really does move markets, and currency traders can take advantage of this fact.

- Interest rates

Interest rates are one of the most important indicators for forex traders who use fundamental analysis. If money makes the world go round, interest rates make the money go round. For example, the higher interest rates are in the U.S. relative to other countries, the more attractive it is to deposit money in the U.S. The return from savings is better, and so the demand for U.S. dollar increases.

Therefore, a country with the highest interest rates attracts more foreign investments, and their currency rate drives up in the long term.

How do interest rates work? If the economy is in a downturn and companies are nervous about the future and are reducing investments, a central bank can lower the overnight rate that it charges smaller banks for borrowing money. This charge is called “interest rate”. If the central bank reduces the base interest rate, this will usually cause commercial banks to reduce their own interest rates as well. Lower interest rates make it cheaper to borrow. This tends to stimulate investment and spending, which then leads to economic growth.

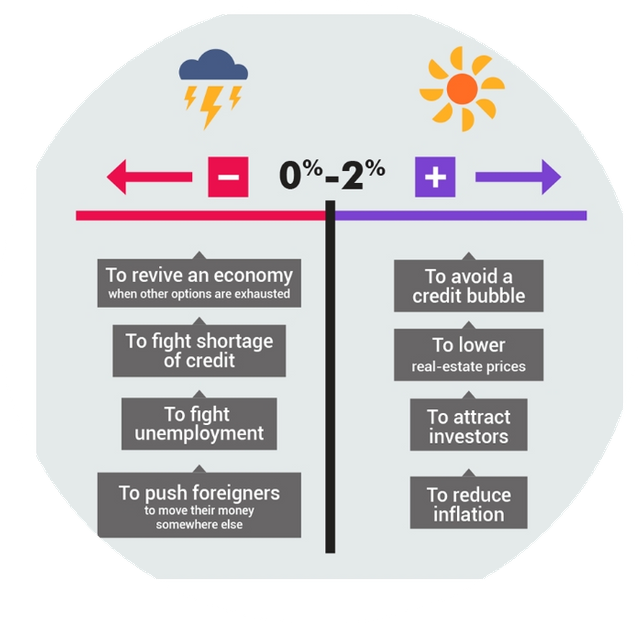

In the illustration below, you can see the situations when the central banks either cut or raise the interest rates:

Cutting interest rates

What happens when interest rates are being cut?

Cheaper borrowing.

If loans are cheaper, businesses and consumers will spend more, thus “warming” the economy.

Reduced incentive to keep money in banks.

Lower interest rates means smaller return from depositing money, so consumers and businesses will be motivated to spend the money rather than just save it.

Lower mortgage payments.

When banks have access to cheaper money, they will also lower the costs for mortgages.

Real estate prices rise.

When more people can afford to buy a house, the prices will go up due to the increased demand. This again will create more wealth and more wealth/ money in circulation is also good for a weak economy.

Decreasing currency rate.

If, for example, Sweden cuts its interest rates, it will be relatively less attractive to save money in Sweden because you could get a better return on your deposits elsewhere. Therefore, there will be less demand for Swedish krona resulting in a fall in its value.

Investors move their money elsewhere.

Investors are looking for the highest returns so they move their money to countries with rising interest rates.

Country’s exporters become more competitive.

Let’s take the Swiss watchmaker “Swatch”, for example. If the Swiss franc appreciates against the euro, a wholesale watch buyer from France would need more euros to pay for the Swatch watches, which are sold in Swiss francs. Therefore, the higher the value of the franc, the less competitive the local Swiss businesses become.

Going below zero

Would you want to be charged for lending your money to banks?

Absurd as it sounds, several of Europe’s central banks have cut their rates below zero in 2015.

Denmark -0.75,

Sweden -0.25,

Switzerland -0.75

The European Central Bank (ECB) announced in June 2014 that it would impose a negative interest rate on deposits in an effort to encourage banks to use those funds for lending. As a result, global banks also began charging large clients for their euro deposits in order to offset the fees they are paying for keeping their money in the European Central Bank.

There are two reasons why most of those large clients accept this negative return.

Keeping big money in small banks is risky.

Moving that money across borders and exchanging it to other currencies can be hard, as not all of them are great in foreign exchange.

Also, holding cash stuffed in mattresses or old shoes is risky.

Greek savers learned this the hard way during the Greek crisis in 2014. Worried that their banks might go bankrupt, they withdrew their savings and immediately, home robberies skyrocketed across the country.

Economists argued that negative interest rates would not happen, but they did. Setting negative interest rates was the last major move before the ECB committed to quantitative easing in order to revive its economy. Negative interest rates are a sign of desperation, signaling that all other traditional means of boosting an economy have failed. Negative interest rates have never been used in an area as big as Europe.

Countries like Switzerland and Denmark cut their interest rates for slightly different reasons. Both countries had their currencies pegged to euro so they pushed their rates into negative territory in order to protect the peg; otherwise, the Swiss franc and the Danish krone would appreciate against the euro, thus breaking the peg and causing chaos.

If you want to resteem or wanna upvote your post and want to promote your post, you can send 0.5 SBD to @Vives and give that post link in memo, then it will be get upvote from our groups and 100% payment back if you won't get back. Vives gives you more back than you want. we have 20k followers in our group and many delegates. so don't worry to upvote your post.

Our website is coming soon www.steemvives.com

Stay tuned for next article, we will be supportive to our regular followers and I hope that you will be help us to continue helping that you steemians wanted..

Our website is here and Click this to show SteemVive inc

Twitter account is @steemvive

Linkedin account is Steemvive

Thanks for your support and follow me as I also help you. Good Day...

Welcome to Steem Community @steemvive! As a gentle reminder, please keep your master password safe. The best practise is to use your private posting key to login to Steemit when posting; and the private active key for wallet related transactions.

In the New Steemians project, we help new members of steem by education and resteeeming their articles. Get your articles resteemed too for maximum exposure. You can learn more about it here: https://steemit.com/introduceyourself/@gaman/new-steemians-project-launch

Source

#introduceyourself/#introducemyself

The “introduceyourself/introducemyself” tag is for creating one introductory post that tells us about you. Users are encouraged to use this tag exclusively for that, and not to reuse it.

More information:

The Game of Tags

Welcome to Steem, @steemvive!

I am a bot coded by the SteemPlus team to help you make the best of your experience on the Steem Blockchain!

SteemPlus is a Chrome, Opera and Firefox extension that adds tons of features on Steemit.

It helps you see the real value of your account, who mentionned you, the value of the votes received, a filtered and sorted feed and much more! All of this in a fast and secure way.

To see why 3155 Steemians use SteemPlus, install our extension, read the documentation or the latest release : SteemPlus 2.20: Utopian + SteemPlus Partnership = Bigger upvotes.

Thanks for your comment will stay with us I'll be with you