Introducing The Case for Collateral Free Pseudo-Anonymous Lending

Collateral Free Pseudo-Anonymous Lending

....The next step in cryptoeconomics

Cryptoeconomics is the application and study of economic systems, incentives and mechanisms (ESIMS) within distributed ledger implementations such as blockchain technology.

-Jomari Peterson (Founder of the Digital Reserve)

Cryptoeconomics is a fundamental aspect of achieving systems that doesn’t rely on a 3rd party for its value. It is our believe that economic and behavioural analysis within the cryptocurrency setting is the key to new forms of financial systems. The ability to devise new currency systems and the underlying necessity for incentive based design was evidenced in Nick Szabo’s discussion of Bit Gold in December of 2008. He demonstrated the value of incentives that weren’t solely philosophical, but based on profit maximization within the context of the system. This is the line of thinking which led to the success of Bitcoin’s elective economy and cryptoeconomics.

The blockchain market is aggressively working to create democratized solutions to a diverse set of issues. However, despite the growth of possibilities, a difficult problem has maintained its hold on the system: anonymous or pseudo-anonymous lending for those without financial collateral.

Blind Man Honesty Test: Adrian Gee

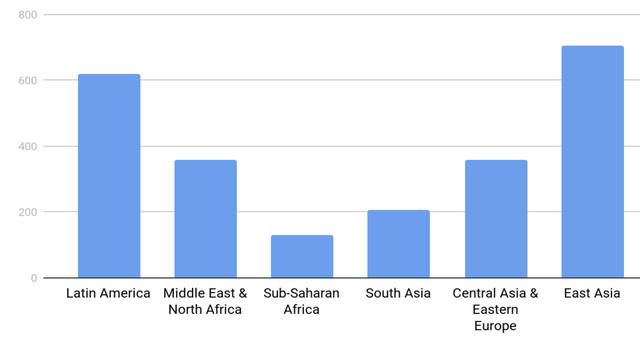

In considering the breadth of potential lending transactions, The Digital Reserve believes that pseudo-anonymous borrowing is necessary and possible given the proper crytoeconomic ESIMS. In the democratization of solutions, the lack of pursuit in this area is a major oversight because there are 2.5 billion people living without banking infrastructure and 1.5 Billion people without identification documents.

Financing Gap in Billions: Data Aggregated by Jomari Peterson

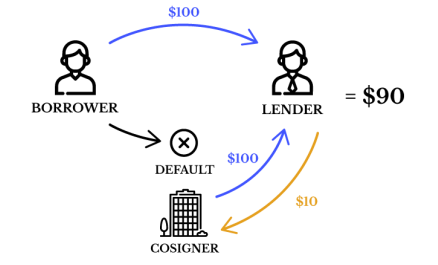

There is also the potential of individual cosigning of debt. This can be done in a pseudo-anonymous application, but the incentive for the cosigner is to discover as much additional information about the borrow as possible to mitigate risk. Cosigners also limits the capital pool by positioning assets in a way that limits scalability. This is because existing capital assets are being used to secure capital.

While this does mitigate risk, cosigners perform additional risk management which shrinks the potential credit pool through increased selectivity. It is also reliant on an active 3rd party player. This is not to take away from the ability of these other solutions, but there is a space for a scalable system that focuses on maximizing financing through pseudo-anonymous lending without locking additional assets.

A guiding document for development of this blog is the work of Peter P. Swire on the Uses and Limits of Financial Cryptography in 1997.

In his work, an early assumption on anonymous borrowing is the pseudo-anonymous loans are not significantly different than anonymous loans. In his early view, anonymous borrowing and pseudo-anonymous borrowing are both identities that are unable to provide the assurances necessary for the bank to take the risk. There are few components to directly consider.

A Lack of Collateral leads to a Risk Premium

The 1st issue identified in anonymous lending is the absence of collateral. As identified by solution like SALT, which uses Ether, ERC20 token and bitcoin based loans, collateral is possible. However, if the debt or loan is greater than the collateral, the assumption by the writer, is that there will be a premium on the interest because of the unmitigated risk. Otherwise, lenders will keep the lending 1:1 and this is just another form of debit.

Therefore, the first design requirement for pseudo-anonymous loans was a method for covering defaults that does not necessarily require collateral from the borrower to mitigate the risk premium.

One early consideration was making the identification collateral for the loan. Thus default would result in the revealing of identity and allow pursuit of collection. This would raise the cost of the defaulting. However, this would necessity the inclusion of an identifying oracle. This oracle would provide authentication and verification of identity to create a borrowing account that is only revealed under set conditions. Another consideration is to create an system of reserves to cover or cosign a portion of the loans. This system of reserves should need to be at the protocol level and created as a function of transactions or fees for the system. These represent potential solutions for defaults to mitigate premiums.

Risk Management & Reputation

Another issue is the decision making process for offering and providing pseudonymous loans. This decision making process typically relies on sourcing relevant information which is typically in the form of a credit rating.

Therefore, this introduces a requirement for some credit ranking or rating system to assist with decision-making. This would essentially given every pseudo-anonymous account the ability to build a history and reputation to further strengthen their access to credit.

While Peter Swire admits that a pseudo-anonymous rating system can be accomplished and statistically profile created over time to mitigate risk, he identifies three design issues to overcome:

- Adverse Selection

- End-Game Issues

- Market Fit

Adverse Selection

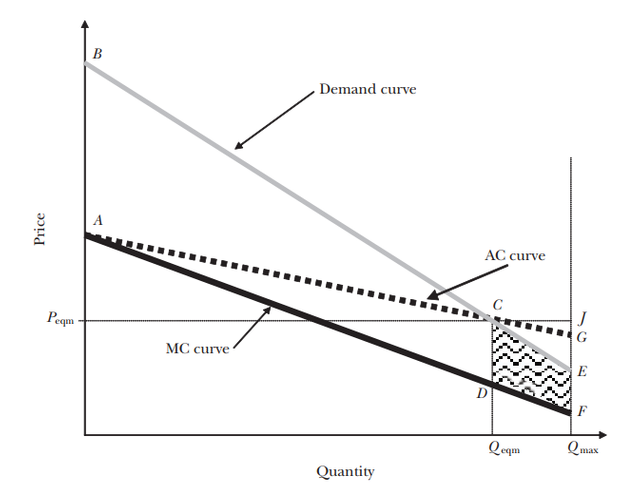

The adverse selection problem is most often referenced in the the context of insurance. The graph shows a Demand curve for a service, the Marginal Cost (MC) for a service and the Average Cost (AC). When the Average cost is greater than the demand, that is when adverse selection comes into play.In the Patient Care and Affordable Health Care Act, https://www.congress.gov/bill/111th-congress/house-bill/3590, or “ObamaCare” the selection problem is an implicit driver. Prior to the Affordable Care Act, the cost rates the insured faced varied based upon pre-existing conditions. However, you can imagine if this was removed as an attribute for cost decisions, the rate of insurance consumption would rise most dramatically for those with health issues. You should be able to imagine what this would cause the rate of claims to increase. Thus, either they would need to raise the price for everyone or increase the participants in the pool. If more people don’t participate and the price rises, this would cause everyone that is healthier to have issues and shift to companies with lower rates. Overtime, this would drive away all the good drivers and result in the insurance company being insolvent. Thus, in this scenario customers will result in adverse or disadvantageous selection.

Therefore, the design requirement for pseudo-anonymous loans is to create a systems of incentives to minimize the potential to default or provide a service that attracts more positive users. Potential incentives or system additions are varied. I advocate for the two-pronged approach. Microfinance has demonstrated that the impact of education is tremendous in increasing debt repayment. Therefore, introducing educational requirements like a quiz or lesson can potentially facilitate lower payment rates. The Digital Reserve introduces both relevant education materials and a more hands on approach through a borrower led repayment auction system. This will allow borrowers to set their own rates, while also competing against other borrowers in the market. This will empower and educate them. In addition, providing perks for debt repayments can have benefits. These perks can range from raffle tickets in a lottery or increases of the debt limit. These also have the potential to turn historical negative deviance into positive users.

End-Game Issues

This particular issues, is one that assumes that sufficient responses were created to screen out or mitigate 1st order issues and maintain solvency, but long term subversion still exists. One solution advocated is initially providing small credit limits that essentially weed out deviant initial participants and lead to the building of good credit over time. However, an issue may still exist. Peter Swire admits here that it is theoretically possible to create a pseudo-anonymous system along these principles. The bad credit risks will default on smaller limits and the protocol can focus on building those with good credit risks. However, the pitfall is around the gradual or sudden manifestation of credit defaults. This can lead to unacceptable credit losses and render the system potentially insolvent. Therefore, according to Peter Swire, lending only maintains profitability when average profits gained prior to default is greater than the default rate.

The primary issue to consider is the ability of the system to sustain a systemic or sudden defaults. This issue can arise due to exterior economic issues or coordinated malicious borrowers. Imagine that the borrowers maintain and demonstrate creditworthiness over time and raises their credit limit to $5,000 dollars or X. In this case, X is greater enough for the borrowers to feel the utility or benefit of walking away is greater than maintaining their credit. In this case, if the lender only benefited $4,000 dollars or Y, then the net loss is Y-X, which is -$1,000. If you have a series of these malicious actors, you have systemic loss that can harm the lender. A well-financed organization or entity can purposefully play this endgame.

Swire suggests there are 2 conditions where this scheme fails. The 1st is if the lender can screen hostile account holders and the 2nd is if it costs the borrower more to build up a credit rating than they can gain from end-game spending of the credit limit. However, I believe there is a 3rd scenario. This scenario is where the value from the interest gained prior to default produces new loan opportunities that have a greater worth than the loss. We will call this reinvested interest R.

Equation for Solvency: R + Y — X > 0

Therefore, assuming screening is not possible, the design requirement in The Digital Reserve's whitepaper is that pseudo-anonymous collateral free loans require the careful assessment of the credit limits and the net value created prior to credit limit increases. Also, a system for identifying systematic issues would help to alleviate the issue. This is where the inclusion and development of machine learning protocols can play an important part within a decentralized implementation. The revelation of identity would also be a solution because of the associated additional cost. Another approach is also to focus on shorter term loans and smaller amounts. This would mitigate larger losses and facilitate better asset management.

Existing Market Practices

The final argument by Peter Swire is that given the markets incentive for borrowers to carry more unpaid debt to increase interest profits, the interest of the lender is for borrowers to maximize debt. In addition, for pseudonymous borrowers, lenders will only be able to see the information provided by the borrower. Therefore, lenders mitigate their risk by having access to more data on their borrowers.

This last issue is really about values and system design. Therefore, the design consideration for Existing Market Practices is to not rely on existing market practice. One easy step is to combine various lines of incentives to make lending more beneficial. There are a combination of incentives ranging from “personalized thank you letters” to the ability to participate in more stable financial products. Another component is to take a macro system perspective of borrowers to determine risk systematically. This mitigates the individual risk and focuses on net benefits. The macro system components in the Digital Reserve is through the unification of the security and consensus protocol with the lending protocol.

Conclusion

In a marketplace with Trillions of dollars in unmet financing needs, a scalable and sustainable solution is needed. There is immense untapped productivity that can be leveraged through the proper alignment of incentives and opportunity. Providing credit accessibility will translate to increased economic productivity. For many money is a powerful incentive, but empowering people has the ability to create more wealth than hoarding ever will. In addition, this can facilitate new financial products and opportunities. In short, this can be a very attractive option for the financing needs of people around the world.

The above analysis and requirement introduce the first level of design considerations that are part of a compelling case for the ability to implement pseudo-anonymous lending as part of a platform for sustainable financial inclusion products and services.

If you want to know more and get involved, please join the Digital Reserve Network mailing list, check out the whitepaper and give a shout on Twitter. We are looking for continued input because this is meant to be designed together

|

|

You got a 12.50% upvote from @sleeplesswhale courtesy of @minnowpond!

Thank you so much for using our service! You were protected from up to 20% losses!

Help us grow by delegating to us! 100sp, 500SP, 1000SP, ANY SPYou just received 9.99% upvote from @onlyprofitbot courtesy of @minnowpond!

You got a 7.45% upvote from @minnowvotes courtesy of @minnowpond!

You got a 6.53% upvote from @dailyupvotes courtesy of @minnowpond!

This post has received a 21.40% upvote from @msp-bidbot thanks to: @minnowpond. Delegate SP to this public bot and get paid daily: 50SP, 100SP, 250SP, 500SP, 1000SP, 5000SP Don't delegate so much that you have less than 50SP left on your account.

You got a 2.09% upvote from @oceanwhale With 35+ Bonus Upvotes courtesy of @minnowpond! Delegate us Steem Power & get 100%daily rewards Payout! 20 SP, 50, 75, 100, 150, 200, 300, 500,1000 or Fill in any amount of SP Earn 1.25 SBD Per 1000 SP | Discord server

This post has received a 6.77% upvote from @lovejuice thanks to @minnowpond. They love you, so does Aggroed. Please be sure to vote for Witnesses at https://steemit.com/~witnesses.

You got a 9.96% upvote from @joeparys! Thank you for your support of our services. To continue your support, please follow and delegate Steem power to @joeparys for daily steem and steem dollar payouts!

Congratulations @digitalreserve! You have completed the following achievement on Steemit and have been rewarded with new badge(s) :

Click on the badge to view your Board of Honor.

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Do not miss the last post from @steemitboard:

SteemitBoard World Cup Contest - Semi Finals - Day 1

Participate in the SteemitBoard World Cup Contest!

Collect World Cup badges and win free SBD

Support the Gold Sponsors of the contest: @good-karma and @lukestokes