well known investor in indonesia " lo kheng ho "

hallo dear readers this time I want to introduce to you all a famous investor in this country that is Indonesia if time ago we discuss about world investor this time we will know the famous figure in investment field in my country that is lo kheng ho. yes it is true that viewers he comes from indonesian descent Chinese in the majority of the population is Muslim but the power of China is very influential in this country especially in the field of economy, politics and others. it is already recognized that the Chinese population affect some of the world's population they are very influential in any field can not be denied that in asia china is very indentik with the development of the world both in the state of developed countries and developing countries they average rank of the throne beyond any race.

well the stemians all I do not extend from this prolog again directly I go to the discussion that we want to peel in detail know this figure is very influential in this country that is "lo kheng hong" affects the world of investors to date and mengai many stock shares which is stuck in this country.

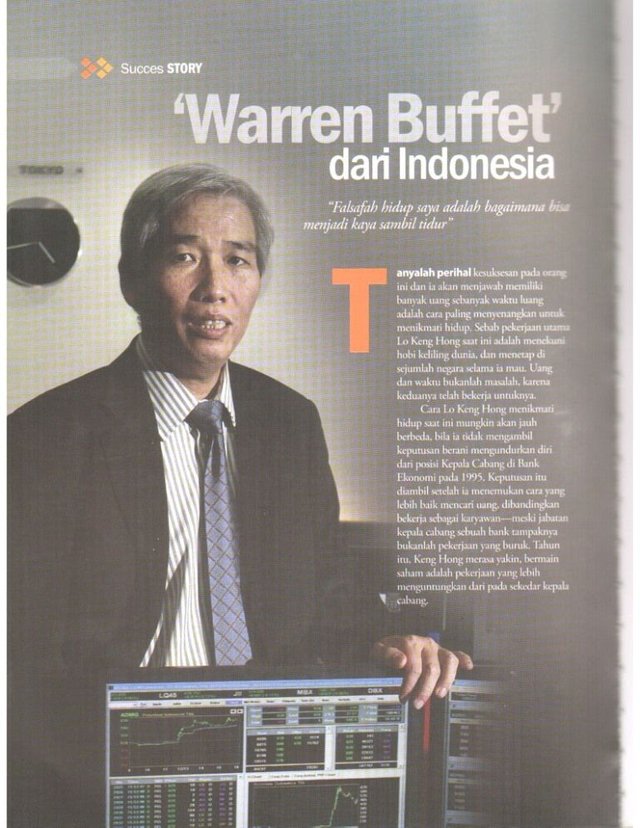

Lo Kheng Hong (born in Jakarta, Indonesia, February 20, 1959, age 58 years) is an individual investor value of Indonesia. Lo Kheng Hong as a stock investor touted as Warren Buffett of Indonesia. He argues that being a stock investor can make him rich, even if he is asleep, because he has a public company whose stock price is always rising and making big profits. In 2012 it has assets of shares worth Rp 2.5 trillion.

- childhood

Lo Keng Hong as a child feels a hard life. His home in Jakarta is narrow, only four meters wide

- daily routine

Almost everyday from morning, noon, afternoon until evening he sits in the garden near the house containing frangipani and shady mango trees doing the 3 things he calls RTI, namely reading, thinking, and investing. He reads 4 daily newspapers, corporate financial statements and capital market statistics. He uses a small amount of money from investment in Indonesia Stock Exchange to travel the world on 5 continents. At least twice a year he travels abroad. He says as a free man, has no boss, no office, no customers, and no employees.

- principle of investment

- Get rich while sleeping with stock investing

- Always try to save money. the money he got he bought shares. Maybe someone else if money can be consumed, or put on deposit. Most people's money is consumed, for example bought a car. Meanwhile, he is the most anti-buying car, because its value is down. Until 2014 he still uses a car that was 10 years old. The first stock he bought was PT. Solar Multi Finance elephant during the IPO

- Learn the stock investment from Warren Buffett. Self-taught by reading Warren Buffett's books on investing a collection of 40 Warren Buffett books

- Never buy gold. He believes gold is not productive. If saving 1 kg of gold, then 10 years remain 1 kg

- Do not buy dollars. He believes that the person who deposits the dollar generally expects a bad thing to happen, economic crisis, unstable country, in order for the rupiah to weaken and he gains

- Do not put large amounts of money in bank accounts. Just enough. He believes to save money in the bank is a loss, because the interest is small

- the latest news to date

is revealed from PTRO's shareholder list today, Thursday (5/10).

Male ownership commonly known as Warren Buffett from Indonesia is in PTRO as of September 30, 2017 was recorded at 11.69%, equivalent to 117.9 million shares.

This amount was reduced compared to the previous month by 118.4 million shares, or equivalent to 11.74% ownership in PTRO shares.

In the first trading session today, PTRO's share price rose 1.8% to 09.48 WIB to Rp1,135 per share.

In the last 1 month, PTRO shares had touched the highest price at the level of Rp1.345 per share. Not yet known at what price Lo Kheng Hong off shares PTRO.

According to news circulating among the stock market participants, he entered PTRO shares in 2013 and continues to increase its stake in the subsidiary of PT Indika Energy Tbk. the.

well readers of this beloved for this time we enough up here first our current discussion of all the attention and votenya I thank you.

Good post rakan terus berkarya.. Bantu avote rakan

Bektuwo lirik ataa tetangga wkwk

Good post rakan

Great investor.