Post Fork Update: The Bitcoin Cash Network and Markets

It’s been four days since the infamous August 1st blockchain split on the Bitcoin network which gave birth to a new token called Bitcoin Cash (BCH). The new BCH chain is currently pretty far behind the legacy BTC chain, and its associated token’s value has plummeted another 30 percent on exchanges.

Bitcoin Cash Network Update

A lot has changed over the past 24-hours regarding the new BCH network and its price action on exchanges. Currently, the BCH blockchain has processed 65 blocks since it came into existence on August 1. The BCH mining difficulty started off to be the same as BTC’s difficulty but has dropped significantly over the past 48-hours. However, the legacy BTC chain is 406 blocks ahead of BCH furthering its lead as the longest proof-of-work chain.

There are only three pools dedicating resources to mining the BCH chain which still includes Viabtc, pool.Bitcoin.com, and an ‘unknown miner.’ The strange mining pool’s hashrate may be made up of various miners pointing their miners at the BCH network. Five hours ago BCH block 478617 had an interesting message within the block’s coinbase data which said, “M6Yq$/Fuck BitcoinCash – bcc.suprnova.cc/.” Some think it may be a miner that doesn’t like the BCH protocol but have questioned why this pool dedicated energy to this message as it is not very profitable to mine BCH at it’s current price. According to data from Coin Dance, it is currently 2.63x more profitable to mine on the legacy BTC chain.

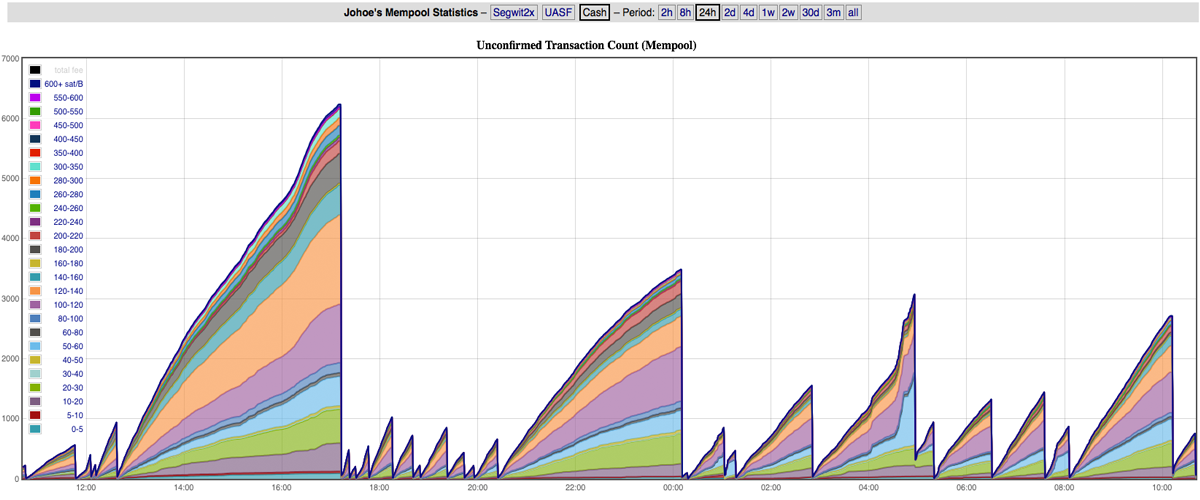

The BCH network’s mempool has been very interesting as well to watch. On August 2nd during the early evening hours (EDT) the BCH network’s mempool jumped in size in a matter of minutes. Many people attributed this to exchanges like Bittrex allowing deposits and the hardware wallet company Trezor released its BCH splitting tool after taking the tool’s server down multiple times since August 1. One block last night (478599) had a transaction that showed someone sent 84,000 BCH to an alternate address. BCH blocks have been confirming transactions and have been varying in size as the chain moves forward. There have been approximately six ‘big blocks’ (over 1MB) found so far, and two of them have been over 4MB.

Jochen Hoenicke’s Bitcoin Cash Mempool (Unconfirmed Transactions) Data Set.

Bitcoin Cash’s Market Value Goes South as the Flood Gates Open

Both BTC and BCH markets have changed significantly over the past 12-hours. Bitcoin markets are up roughly 3-5 percent at the time of writing at $2875 per BTC. Bitcoin Cash markets are down at the moment as one BCH is roughly $250-280 at press time depending on the exchange. There’s a lot more BCH action happening on exchanges likely due to many people who are now able to move their tokens safely. Charts show a bearish BCH price decline may continue and the Relative Strength Index (RSI) is heading south showing a strong seller’s market.

Post Fork Update: The Bitcoin Cash Network and Markets

BTC markets are up while BCH markets have dipped in value considerably.

Last night a few more exchanges announced future support for the BCH chain. As news.Bitcoin.com reported earlier the bitcoin company, Coinbase announced it would distribute BCH to customers in January of 2018. Following this announcement, the large cryptocurrency exchange Poloniex detailed it would also be distributing BCH to clients who left BTC on the platform prior to the last common block found. Poloniex says that they will give their customers BCH before or on August 14 but is still undecided on listing the BCH market.

Kraken’s Bitcoin Cash markets as of August 4, 2017, at 11:30 am EDT.

Cryptocurrency Proponents Continue to Fight Over the ‘Real Bitcoin’

Of course, the split hasn’t stopped the fighting between the two factions of bitcoin supporters, which in some ways are represented on the two most popular cryptocurrency subreddits r/bitcoin and r/btc. One side is waiting for BCH to fail miserably with many proponents exclaiming they are going to “dump” their Bitcoin Cash hard on the market. The other side shows signs of optimism towards the new chain and seem very willing to take all the cheap coins coming their way. Further, there’s a heated discussion concerning the branding of Bitcoin Cash as some are calling the digital currency “Bcash.” Most Bitcoin Cash supporters seem to hate the name Bcash and believe it’s a ploy to degrade the project’s branding.

It’s quite obvious by observing both arguments that each side believes their network is the “real bitcoin.”

IMO there will be a huge reversal once the difficulty of BCH resets and BTC has segwit engages. It will be quite the show.