Investment Language 101 Series: TERM OF THE DAY: -- What Is: ' Bond ' | A FUN Episode! Edutainment | E.118 | Trading Candle Cheat Sheet Incl. Each Episode.

A series designed to help all the new people flooding into & entering Crypto/Investments daily who get thrown into the rabbit hole so to speak and everything is new to them.

Bitshares 101 Focus/Resources Section for New Crypto Folks now included near the end of each post - starting just prior to Christmas 2017. BTS is a Decentralized Exchange and much more. Very undervalued!

It is a TLDR / Short Form Series, covering ONLY one thing each episode in blue collar, easy to understand language to give a SHORT OVERVIEW of the term or lesson of the day.

It is specifically designed this way to keep it short and simple.

People can then search out extra info if they wish.

I've never seen a regular series or resource running on Steemit to continually address this basic need so I decided to do it.

TERM OF THE DAY:

What is....

' Bond ' ?

--

A bond is a fixed income investment in which an investor loans money to an entity (typically corporate or governmental) which borrows the funds for a defined period of time at a variable or fixed interest rate.

Bonds are used by companies, municipalities, states and sovereign governments to raise money and finance a variety of projects and activities. Owners of bonds are debtholders, or creditors, of the issuer.

--

Breaking Down...

' Bond ' :

--

Bonds are commonly referred to as fixed-income securities and are one of the three main generic asset classes, along with stocks (equities) and cash equivalents. Many corporate and government bonds are publicly traded on exchanges, while others are traded only over-the-counter (OTC).

-- How Bonds Work:

When companies or other entities need to raise money to finance new projects, maintain ongoing operations, or refinance existing debts, they may issue bonds directly to investors instead of obtaining loans from a bank. The indebted entity (issuer) issues a bond that contractually states the interest rate that will be paid and the time at which the loaned funds (bond principal) must be returned (maturity date). The interest rate, called the coupon rate or payment, is the return that bondholders earn for loaning their funds to the issuer.

The issuance price of a bond is typically set at par, usually $100 or $1,000 face value per individual bond. The actual market price of a bond depends on a number of factors including the credit quality of the issuer, the length of time until expiration, and the coupon rate compared to the general interest rate environment at the time.

-- Example:

Because fixed-rate coupon bonds will pay the same percentage of its face value over time, the market price of the bond will fluctuate as that coupon becomes desirable or undesirable given prevailing interest rates at a given moment in time. For example if a bond is issued when prevailing interest rates are 5% at $1,000 par value with a 5% annual coupon, the bondholder will be credited $50 in interest income annually. The bondholder would be indifferent to purchasing the bond or saving the same money at the prevailing interest rate.

However, if interest rates in the economy drop to 4%, the bond will continue paying 5% coupon rates, making it a more attractive option. Investors will purchase these bonds, bidding the price up to a premium until the effective rate of the bond equals 4%. On the other hand, if interest rates rise to 6%, the 5% coupon is no longer attractive and the bond price will decrease, selling at a discount until it's effective rate is 6%.

Because of this mechanism, bond prices move inversely with interest rates.

-- Characteristics of Bonds:

Most bonds share some common basic characteristics including:

Face value...

-- is the money amount the bond will be worth at its maturity, and is also the reference amount the bond issuer uses when calculating interest payments. For example, say an investor purchases a bond at a premium $1,090 and another purchases the same bond at a discount $980. When the bond matures, both investors will receive the $1,000 face value of the bond.

Coupon rate...

-- is the rate of interest the bond issuer will pay on the face value of the bond, expressed as a percentage. For example, a 5% coupon rate means that bondholders will receive 5% x $1000 face value = $50 every year.

Coupon dates are the dates on which the bond issuer will make interest payments. Typical intervals are annual or semi-annual coupon payments.

Maturity date...

-- is the date on which the bond will mature and the bond issuer will pay the bond holder the face value of the bond.

Issue price is the price at which the bond issuer originally sells the bonds.

-- Two features of a bond – credit quality and duration – are the principal determinants of a bond's interest rate.

If the issuer has a poor credit rating, the risk of default is greater and these bonds will tend to trade a discount. In addition, bonds with a high default risk, such as junk bonds, have higher interest rates than stable bonds, such as government bonds.

Credit ratings are calculated and issued by credit rating agencies. Bond maturities can range from a day or less to more than 30 years. The longer the bond maturity, or duration, the greater the chances of adverse effects. Longer-dated bonds also tend to have lower liquidity. Because of these attributes, bonds with a longer time to maturity typically command a higher interest rate.

When considering the riskiness of bond portfolios, investors typically consider the duration (price sensitivity to changes in interest rates) and convexity (curvature of duration).

-- Bond Issuers:

There are three main categories of bonds:

-- Corporate bonds are issued by companies.

-- Municipal bonds are issued by states and municipalities. Municipal bonds can offer tax-free coupon income for residents of those municipalities.

-- U.S. Treasury bonds (more than 10 years to maturity), notes (1-10 years maturity) and bills (less than one year to maturity) are collectively referred to as simply "Treasuries."

-- Varieties of Bonds:

Zero-coupon bonds do not pay out regular coupon payments, and instead are issued at a discount and their market price eventually converges to face value upon maturity. The discount a zero-coupon bond sells for will be equivalent to the yield of a similar coupon bond.

Convertible bonds are debt instruments with an embedded call option that allows bondholders to convert their debt into stock (equity) at some point if the share price rises to a sufficiently high level to make such a conversion attractive.

Some corporate bonds are callable, meaning that the issuer can call back the bonds from debtholders if interest rates drop sufficiently. These bonds typically trade at a premium to non-callable debt due to the risk of being called away and also due to their relative scarcity in the bond market.

Other bonds are putable, meaning that creditors can put the bond back to the issuer if interest rates rise sufficiently.

The majority of corporate bonds in today's market are so-called bullet bonds, with no embedded options and a face value that is paid immediately on the maturity date.

Resharing this one..... This is a KEY everyday thing to understand in the markets. So many new people coming daily and posts often also miss people in other timezones..... different languages....... 3 things I try and remember, to help people and be aware of, thanks.

Your Friend in Liberty, Barry.

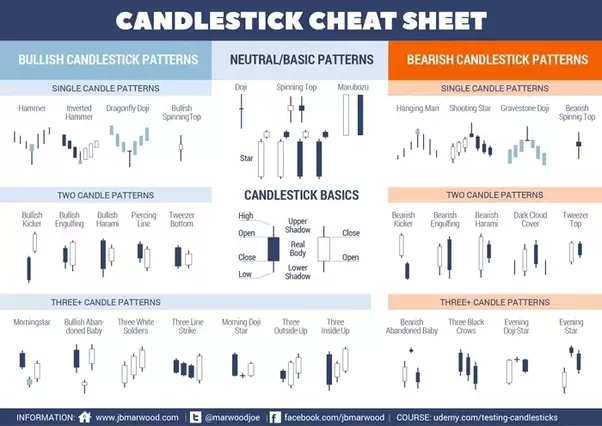

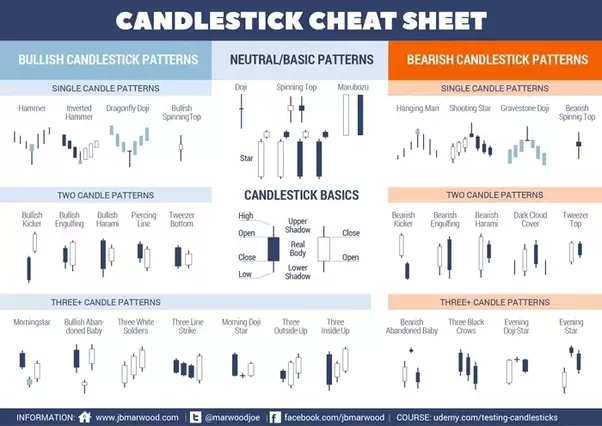

Trading Candle Cheat Sheet:

--

Further Reading/Source/Resources

Friend of the People -- Enemy of the State.

--

Bitshares 101 Focus/Resources Section:

for New Crypto Folks.

https://bitshares.org/

--

-- Bitshares is a Trading platform, and a LOT more.... designed by blockchain wizard here Dan Larimer - @dan / @dantheman.

I've blogged on him, and BTS many many times.

It's a place you can use that is decentralized, with an active community, to use trading lessons like this, that we are learning together.

Just a few of my past $BTS blogs....

to help you apply lessons today!

--

Thanks for reading, have a nice day.

PixaBay has tons of free pictures for us all to use!!!

Super Easy/Fast Picture Edits / Resizing at: http://www.picresize.com/ and also https://www298.lunapic.com/editor/

If you liked this blog post - please Resteem it and share good content with others!

--

Some of my recent blogs:

--

Most Images: Gif's - via Giphy.com , Funny or Die.com / Pixabay. Today:

If you feel my posts are undervalued or you want to donate to tip me - I would appreciate it very much.

--

LiteCoin (LTC) - LKdsnvSXk9JW99EiNicFMGKc1FXiBo9tUE

EOS (EOS) - 0xD37bEFf5bf07E3aa432de00cE0AaA8df603A4fB0

Ethereum (ETH) - 0x3Ad69Ff057C9533ca667B2d7E3E557F5eeFd4477

Ethereum Classic (ETC) - 0x5ab2b08d4ce8d454eb9d1ecc65c6d8b0c5f9784c

Bitcoin (BTC) - 18J6RRuzX4V7b2CDbx7tWZYNBLkkGWsvWX

DASH - XgZvsvSZgPkNbmGbRhc3S1Pt2JAc7QHwiS

PIVX - DA3azxQqJiX9t7EviuacpamfNhMi2zGAUh

Stratis (STRAT) - SNsJp6v1jXvKWy4XcXSXfNQ9zhSJJppJgv

ZCash (ZEC) - t1aCPEYELkGaf3GtgGTiCEDo7XfPm4QEwmL

Please note -- I will have limited internet access for awhile -- so PLEASE do not be upset that I cannot reply right away, or to everyone. I am dealing with some changes, and will have limited time online and will be happy if I get a few blog posts up a week.

This has really upset some people but I do not force my opinions on others, or need to communicate every detail of my life or issues, most people do not care anyways. I invested around 10 hours or more a day on Steemit most of my first 13 mths here, trying to build community, put out content and engage people, help and donate to people, and I just do not have that time in my life right now, and that includes for replies and voting/curation.

I have done my best, sorry if you do not understand like some are clearly having a problem with. It's a blogging platform, and I will do my best at everything, and to keep blogging.

Carry On.

A series designed to help all the new people flooding into & entering Crypto/Investments daily who get thrown into the rabbit hole so to speak and everything is new to them.

Bitshares 101 Focus/Resources Section for New Crypto Folks now included near the end of each post - starting just prior to Christmas 2017. BTS is a Decentralized Exchange and much more. Very undervalued!

It is a TLDR / Short Form Series, covering ONLY one thing each episode in blue collar, easy to understand language to give a SHORT OVERVIEW of the term or lesson of the day.

It is specifically designed this way to keep it short and simple.

People can then search out extra info if they wish.

I've never seen a regular series or resource running on Steemit to continually address this basic need so I decided to do it.

TERM OF THE DAY:

What is....

' Bond ' ?

--

A bond is a fixed income investment in which an investor loans money to an entity (typically corporate or governmental) which borrows the funds for a defined period of time at a variable or fixed interest rate.

Bonds are used by companies, municipalities, states and sovereign governments to raise money and finance a variety of projects and activities. Owners of bonds are debtholders, or creditors, of the issuer.

--

Breaking Down...

' Bond ' :

--

Bonds are commonly referred to as fixed-income securities and are one of the three main generic asset classes, along with stocks (equities) and cash equivalents. Many corporate and government bonds are publicly traded on exchanges, while others are traded only over-the-counter (OTC).

-- How Bonds Work:

When companies or other entities need to raise money to finance new projects, maintain ongoing operations, or refinance existing debts, they may issue bonds directly to investors instead of obtaining loans from a bank. The indebted entity (issuer) issues a bond that contractually states the interest rate that will be paid and the time at which the loaned funds (bond principal) must be returned (maturity date). The interest rate, called the coupon rate or payment, is the return that bondholders earn for loaning their funds to the issuer.

The issuance price of a bond is typically set at par, usually $100 or $1,000 face value per individual bond. The actual market price of a bond depends on a number of factors including the credit quality of the issuer, the length of time until expiration, and the coupon rate compared to the general interest rate environment at the time.

-- Example:

Because fixed-rate coupon bonds will pay the same percentage of its face value over time, the market price of the bond will fluctuate as that coupon becomes desirable or undesirable given prevailing interest rates at a given moment in time. For example if a bond is issued when prevailing interest rates are 5% at $1,000 par value with a 5% annual coupon, the bondholder will be credited $50 in interest income annually. The bondholder would be indifferent to purchasing the bond or saving the same money at the prevailing interest rate.

However, if interest rates in the economy drop to 4%, the bond will continue paying 5% coupon rates, making it a more attractive option. Investors will purchase these bonds, bidding the price up to a premium until the effective rate of the bond equals 4%. On the other hand, if interest rates rise to 6%, the 5% coupon is no longer attractive and the bond price will decrease, selling at a discount until it's effective rate is 6%.

Because of this mechanism, bond prices move inversely with interest rates.

-- Characteristics of Bonds:

Most bonds share some common basic characteristics including:

Face value...

-- is the money amount the bond will be worth at its maturity, and is also the reference amount the bond issuer uses when calculating interest payments. For example, say an investor purchases a bond at a premium $1,090 and another purchases the same bond at a discount $980. When the bond matures, both investors will receive the $1,000 face value of the bond.

Coupon rate...

-- is the rate of interest the bond issuer will pay on the face value of the bond, expressed as a percentage. For example, a 5% coupon rate means that bondholders will receive 5% x $1000 face value = $50 every year.

Coupon dates are the dates on which the bond issuer will make interest payments. Typical intervals are annual or semi-annual coupon payments.

Maturity date...

-- is the date on which the bond will mature and the bond issuer will pay the bond holder the face value of the bond.

Issue price is the price at which the bond issuer originally sells the bonds.

-- Two features of a bond – credit quality and duration – are the principal determinants of a bond's interest rate.

If the issuer has a poor credit rating, the risk of default is greater and these bonds will tend to trade a discount. In addition, bonds with a high default risk, such as junk bonds, have higher interest rates than stable bonds, such as government bonds.

Credit ratings are calculated and issued by credit rating agencies. Bond maturities can range from a day or less to more than 30 years. The longer the bond maturity, or duration, the greater the chances of adverse effects. Longer-dated bonds also tend to have lower liquidity. Because of these attributes, bonds with a longer time to maturity typically command a higher interest rate.

When considering the riskiness of bond portfolios, investors typically consider the duration (price sensitivity to changes in interest rates) and convexity (curvature of duration).

-- Bond Issuers:

There are three main categories of bonds:

-- Corporate bonds are issued by companies.

-- Municipal bonds are issued by states and municipalities. Municipal bonds can offer tax-free coupon income for residents of those municipalities.

-- U.S. Treasury bonds (more than 10 years to maturity), notes (1-10 years maturity) and bills (less than one year to maturity) are collectively referred to as simply "Treasuries."

-- Varieties of Bonds:

Zero-coupon bonds do not pay out regular coupon payments, and instead are issued at a discount and their market price eventually converges to face value upon maturity. The discount a zero-coupon bond sells for will be equivalent to the yield of a similar coupon bond.

Convertible bonds are debt instruments with an embedded call option that allows bondholders to convert their debt into stock (equity) at some point if the share price rises to a sufficiently high level to make such a conversion attractive.

Some corporate bonds are callable, meaning that the issuer can call back the bonds from debtholders if interest rates drop sufficiently. These bonds typically trade at a premium to non-callable debt due to the risk of being called away and also due to their relative scarcity in the bond market.

Other bonds are putable, meaning that creditors can put the bond back to the issuer if interest rates rise sufficiently.

The majority of corporate bonds in today's market are so-called bullet bonds, with no embedded options and a face value that is paid immediately on the maturity date.

Resharing this one..... This is a KEY everyday thing to understand in the markets. So many new people coming daily and posts often also miss people in other timezones..... different languages....... 3 things I try and remember, to help people and be aware of, thanks.

Your Friend in Liberty, Barry.

Trading Candle Cheat Sheet:

--

Further Reading/Source/Resources

Friend of the People -- Enemy of the State.

--

Bitshares 101 Focus/Resources Section:

for New Crypto Folks.

https://bitshares.org/

--

-- Bitshares is a Trading platform, and a LOT more.... designed by blockchain wizard here Dan Larimer - @dan / @dantheman.

I've blogged on him, and BTS many many times.

It's a place you can use that is decentralized, with an active community, to use trading lessons like this, that we are learning together.

Just a few of my past $BTS blogs....

to help you apply lessons today!

--

Thanks for reading, have a nice day.

PixaBay has tons of free pictures for us all to use!!!

Super Easy/Fast Picture Edits / Resizing at: http://www.picresize.com/ and also https://www298.lunapic.com/editor/

If you liked this blog post - please Resteem it and share good content with others!

--

Some of my recent blogs:

--

Most Images: Gif's - via Giphy.com , Funny or Die.com / Pixabay. Today:

If you feel my posts are undervalued or you want to donate to tip me - I would appreciate it very much.

--

LiteCoin (LTC) - LKdsnvSXk9JW99EiNicFMGKc1FXiBo9tUE

EOS (EOS) - 0xD37bEFf5bf07E3aa432de00cE0AaA8df603A4fB0

Ethereum (ETH) - 0x3Ad69Ff057C9533ca667B2d7E3E557F5eeFd4477

Ethereum Classic (ETC) - 0x5ab2b08d4ce8d454eb9d1ecc65c6d8b0c5f9784c

Bitcoin (BTC) - 18J6RRuzX4V7b2CDbx7tWZYNBLkkGWsvWX

DASH - XgZvsvSZgPkNbmGbRhc3S1Pt2JAc7QHwiS

PIVX - DA3azxQqJiX9t7EviuacpamfNhMi2zGAUh

Stratis (STRAT) - SNsJp6v1jXvKWy4XcXSXfNQ9zhSJJppJgv

ZCash (ZEC) - t1aCPEYELkGaf3GtgGTiCEDo7XfPm4QEwmL

Please note -- I will have limited internet access for awhile -- so PLEASE do not be upset that I cannot reply right away, or to everyone. I am dealing with some changes, and will have limited time online and will be happy if I get a few blog posts up a week.

This has really upset some people but I do not force my opinions on others, or need to communicate every detail of my life or issues, most people do not care anyways. I invested around 10 hours or more a day on Steemit most of my first 13 mths here, trying to build community, put out content and engage people, help and donate to people, and I just do not have that time in my life right now, and that includes for replies and voting/curation.

I have done my best, sorry if you do not understand like some are clearly having a problem with. It's a blogging platform, and I will do my best at everything, and to keep blogging.

Carry On.

--

LiteCoin (LTC) - LKdsnvSXk9JW99EiNicFMGKc1FXiBo9tUE

EOS (EOS) - 0xD37bEFf5bf07E3aa432de00cE0AaA8df603A4fB0

Ethereum (ETH) - 0x3Ad69Ff057C9533ca667B2d7E3E557F5eeFd4477

Ethereum Classic (ETC) - 0x5ab2b08d4ce8d454eb9d1ecc65c6d8b0c5f9784c

Bitcoin (BTC) - 18J6RRuzX4V7b2CDbx7tWZYNBLkkGWsvWX

DASH - XgZvsvSZgPkNbmGbRhc3S1Pt2JAc7QHwiS

PIVX - DA3azxQqJiX9t7EviuacpamfNhMi2zGAUh

Stratis (STRAT) - SNsJp6v1jXvKWy4XcXSXfNQ9zhSJJppJgv

ZCash (ZEC) - t1aCPEYELkGaf3GtgGTiCEDo7XfPm4QEwmL

Please note -- I will have limited internet access for awhile -- so PLEASE do not be upset that I cannot reply right away, or to everyone. I am dealing with some changes, and will have limited time online and will be happy if I get a few blog posts up a week.

This has really upset some people but I do not force my opinions on others, or need to communicate every detail of my life or issues, most people do not care anyways. I invested around 10 hours or more a day on Steemit most of my first 13 mths here, trying to build community, put out content and engage people, help and donate to people, and I just do not have that time in my life right now, and that includes for replies and voting/curation.

I have done my best, sorry if you do not understand like some are clearly having a problem with. It's a blogging platform, and I will do my best at everything, and to keep blogging.

Carry On.

i think you create a great post.......i learn some new from your post....... i impressed to see your post......i hope everybody like your post...thanks for shear it..

Good post and thanks for the insight into bonds. I know about them tangentially but this gives me much more insight. It looks like the bond market is about to blow up in the US and take the world with it. Any thoughts?

Good post. Thanks to sharing and information. My name is muhammad rizal. I'm a new member of steemit. Nice to meet you.

Please followback and upvote my post https://steemit.com/introduce/@rizal98/introducing-my-self-a9b64da9379b5