TIB: Today I Bought (and Sold) - An Investors Journal #244 - Brazil, Emerging Markets Small Caps, Midstream Oil

Brazil takes a pounding. Interest rates get the jitters. I join the herd to short Brazil but go contrarian on emerging markets mid caps. Some tidying up in midstream oil and Australia.

Portfolio News

Emerging Markets Selloff Currency woes came back to the forefront of markets attention. The woes come from a number of places. Brazil's central bank took action to protect the Brazilian Real from a free fall driven by uncertainty from the truck drivers strike and the upcoming presidential elections.

The market view is that the leading candidates in the election run will not take the actions necessary to reform the fiscal economy

https://www.ft.com/content/11645f36-69e2-11e8-8cf3-0c230fa67aec

Of course, we could all focus on what is really important. This is what comes up when one types Brazil in a Google search box. Football World Cup is one week away.

Turkey also raised its rates to protect the Turkish Lira on the back of double digit inflation and an upcoming election.

Meanwile expectations that the Federal Reserve is on track to raise US rates 3 more times in 2018 came back to the front. I even heard one talking head suggesting there could be 4 in 2019 too. I suspect he is out on a limb. What that will do though is increase the borrowing cost of emerging market economies who have dollar denominated debt.

Emerging markets were rattled Thursday as a range of fears rippled through financial markets — ranging from U.S. trade wars to Federal Reserve interest-rate hikes.

No surprise that emerging markets were the worst performers in my portfolios.

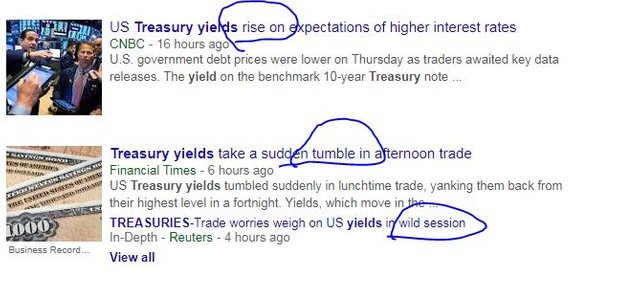

Interest Rate Jitters Treasury yields had an interesting day. The headlines tell the story of yields racing to a two week high and then falling off hard in the afternoon session as the market fear drove the buyers back into the "safe arms" of risk free US Treasuries.

This article tells me that markets are confused about the way they are feeling - emerging market debt, Brazil, Italy, central bank liquidity, aggressive central bankers, slow inflation vs strong jobs, ECB tapering. Take your pick and ride out the volatility.

The short term interest rate markets show this quite starkly - a 4 hour chart on Eurodollar - spike up and back down in one 4 hour session. I fully expect this to go back to do what it was doing - going down (i.e., rates going up)

Bought

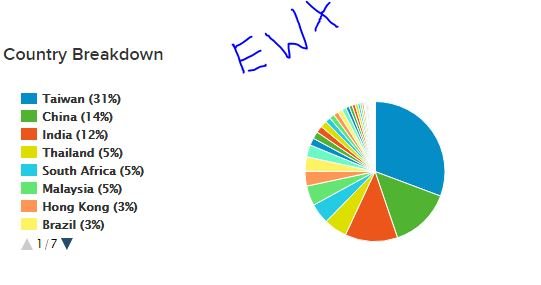

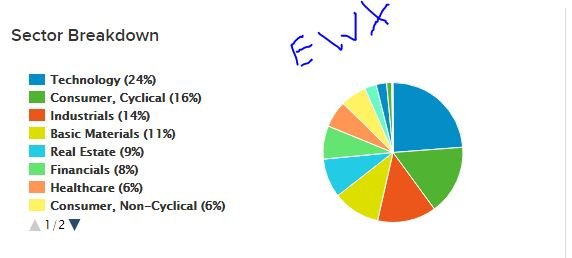

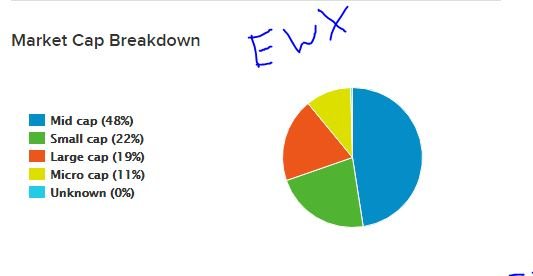

SPDR S&P Emerging Markets Small Cap ETF (EWX): It seems a strange thing to be buying an Emerging Markets ETF in the midst of an Emerging Markets selloff. I have long been invested in emerging markets, principally in SE Asia, on the back of solid economic growth. This trade idea was triggered by one of the talking heads (from UBS Wealth Management) talking about Asia mid cap stocks as a way to harness that growth without being overly exposed to the overall macroeconomic factors. I went searching to find an ETF that does that and came across this ETF focused on emerging markets small caps. It is not quite the same thing as it does carry more risk than medium caps.

My sense is that markets will eventually come back to valuing economic growth than they do relative currency values. What struck me about this ETF is its holdings are diverse with 975 stocks and the largest holding of 0.78%. It is focused in Asia (71%) across several countries. Importantly the investment in risky countries like Brazil and South Africa and Argentina is low.

The mix of sectors also fits well. It is dominated by sectors that benefit from growth or drive growth, like technology, industrial, and consumer. More importantly it has low exposure to financials which are affected by interest rates and currency fluctuations.

Last point is the name of the ETF is a misnomer. It is 67% mid to large cap rather than small cap.

Investsmart Australian Equity Income Fund (INIF.AX): Australian Equity. I switched some of the proceeds of the sale of Bega Cheese (BGA.AX) into this equity income fund. This fund aims to deliver a mix of capital growth (say 10%) and dividend yield (say 4%) without over-investing in Australian banks which account for about 30% of the ASX200 index.

Sold

Antero Resources Corp (AR): US Midstream Oil. I started the process of focusing my midstream oil investments in the NYSE Pickens Oil Response ETF (BOON). In TIB234, I wrote about this ETF - "Here was a way to invest across the width of the opportunity in a sector and reduce individual stock risk." My plan will be to add to my holding of this ETF, and progressively sell off the individual stocks. The sale of Antero Resources for a 5% profit since May 2018 was the first such step. I did put in a bid for more BOON but it was not hit overnight as oil prices spiked.

Shorts

iShares MSCI Brazil Capped ETF (EWZ): I wrote in TIB233 and TIB235 about going short Brazil ahead of the upcoming elections. I have been reviewing buying put options on this ETF. Implied volatility had increased (40%) and I needed a 20% move down in the price to make 100% profit. The talking heads were talking about the currency moves in Turkey and Brazil which indicated that a collapse in the valuations in Brazil was imminent. I shorted the stock as the market opened. Too bad I did not do this a few days earlier but I did grab a 5% drop in price. I do have to pay stock borrowing costs - I will be reviewing this closely and take the profits before the costs get too steep.

Shorting this ETF which invests in Brazilian stocks implies shorting the Brazilian Real as well as the stocks are denominated in Real.

Cryptocurency

Bitcoin (BTCUSD): Price range for the day was $132 (1.7% of the high). It is more than a year since we have seen as quiet a Bitcoin day. Price is pushing hard up against the resistance line I have had drawn on the chart for some time now. When it breaks it will break hard like a coiled spring.

Momentum indicators are mixed. MACD is still below zero but it is rising (middle window). Stochastic (bottom window) is reaching into overbought which suggests we could see a pull back to the bottom of the range before the breakout (or just make another cycle down and up).

CryptoBots

Outsourced Bot No closed trades on this account (212 closed trades). Problem children was increased with BTS joining the list (>10% down) - (15 coins) - ETH, ZEC (-42%), DASH (-45%), BTS, ICX, ADA, PPT (-45%), DGD, GAS (-48%), STRAT, NEO (-48%), ETC (-44%), QTUM, BTG (-48%), XMR.

Having joind the -40% club yesterday, PPT was racing to the bottom (now -45%). The worst threesome of GAS, BTG, and NEO all dropped a point to -48%.

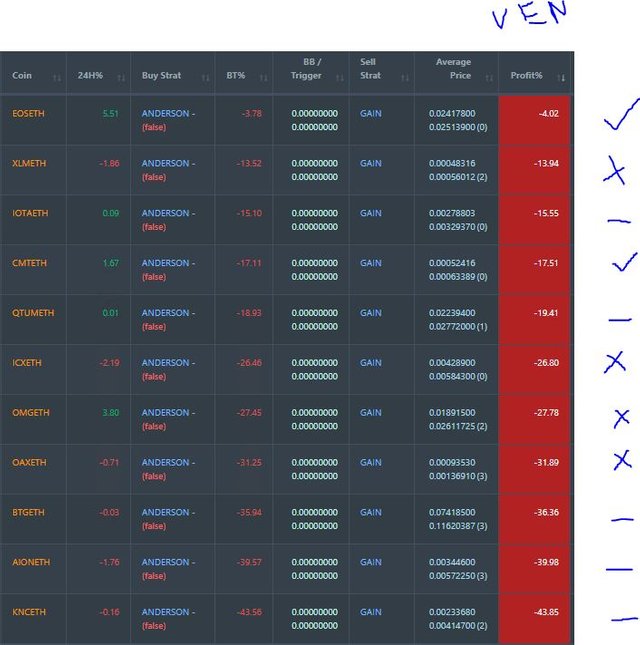

Profit Trailer Bot No closed trades. Dollar Cost Average (DCA) list dropped to 11 coins with 2 coins improving, 5 flat and the other 4 worse. VEN pops on and off the list which has a -2% cutoff.

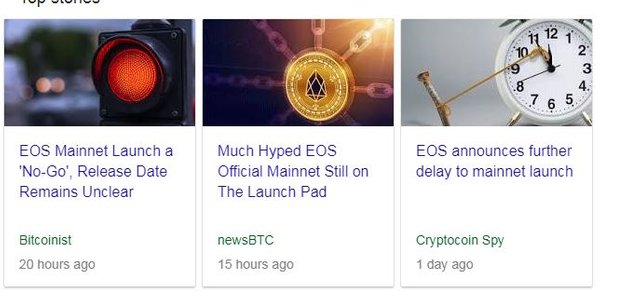

EOS was the biggest mover of the day ahead of its mainnet launch. The chart tells a story of a price rise with low volume - the time to hold onto the coin ahead of the launch has come. [Note: 4 hour chart from Binance. Binance will support the launch]

The launch date has been postponed with the next vote due within 24 hours (June 8).

http://bitcoinist.com/eos-mainnet-launch-no-go-release-date-remains-unclear/

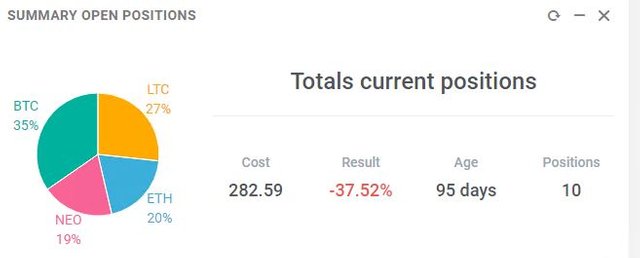

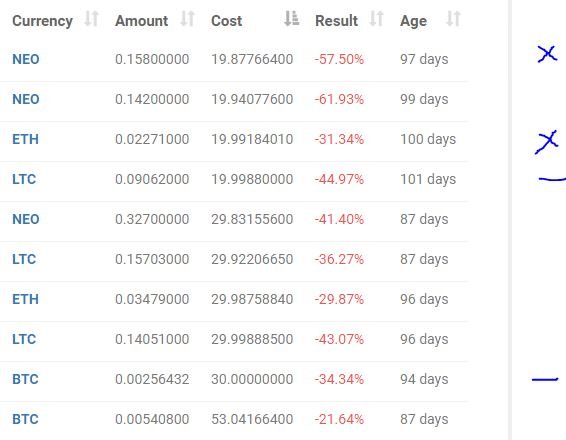

New Trading Bot Positions dropped 1 point to -37.5% (was -36.7%).

LTC and BTC traded flat with ETH and NEO dropping a point each

Currency Trades

Forex Robot did not close any trades and is trading at a negative equity level of 1.1% (lower than prior day's positive 2.1%). I have not checked the VPS is working

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Brazil flag from https://pixabay.com/en/flag-brazil-3d-brazil-flag-1815945/

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Crypto Trading: get 6 months free trades with Bitmex for leveraged crypto trading. http://mymark.mx/Bitmex

Bitcoin: Get started with mining Bitcoin for as little as $25 http://mymark.mx/Galaxy

June 7, 2018

Upvoted ($0.17) and resteemed by @investorsclub

Join the Investors Club if you are interested in investing.

You have a minor misspelling in the following sentence:

It should be aggressive instead of agressive.Fixed

Welcome .The perfect Thursday to invest.

in the problem of buying and selling we must be very thorough and smart, because a little of our mistakes can be much loss. hopefully master @carrinm already very understand this problem

One of the skills of investing it capital management. One of the ways to do this is to make investments in small parcels so that a mistake only makes a small loss. The next tool is to use correlations and invest in things that are not dependent on each other. Easy example. A person supplying food in your village is less dependent on interest rates in Europe than a German bank or a factory with big borrowings. Combining these two ideas is the art of diversification.

that's a great way. can be sampled. you seem very experienced in trading. if there is free time you visit my blog.

honestly, i do not understand about this. However, slowly I started to learn about this program thanks to the posts you always share, I am very grateful for this.

Incredible ,, in this case requires skil, investment and skills that have been taught. You are one of them. Applause.

Oya, allow me to share this, let others see this, because it is worth learning.