TIB: Today I Bought (and Sold) - An Investors Journal #252 - US Regional Banks, Corn, Russia

Canada legalises Marijuana. Markets step back from tariffs precipice. Buying more Russia and Corn and banking profit from US banking. And Bitcoin survives another exchange hack. Maybe it is a sign for good things to come.

Portfolio News

Marijuana Canada's Senate passed the legislation for legalisation of recreational marijuana use.

Canada had legalised the medicinal use of marijuana in the early 2000's. This step makes a leap forward with the industry in Canada estimated to pass $7 billion in 2019 of which legal sales could be as much as half. It will take time for provincial governments to implement the regulations needed but these are expected to be done with 8 to 10 weeks.

Canadian businesses have become by far the largest cannabis businesses in the world. The lenient federal approach to marijuana law in Canada means the United States is falling behind. The U.S. is "literally giving the next billion-dollar industry — the next internet boom — to the Canadians,"

Kris Krane, president of 4Front Ventures, a U.S.-based marijuana investment firm.

I have long been invested in marijuana ventures. My approach has been to seek out listed entities that are operating in countries in which marijuana usage for medicinal and now recreational purposes is legal or about to be legal and focused more on medicinal marijuana than recreational use. One of those investments landed me in Canada through MMJ Phytotech (MMJ.AX) which owns 60% of Harvest One. No surprise to find the biggest growth overnight in my portfolios was in MMJ which jumped nearly 10%. You read it here first in TIB162

http://www.wbur.org/hereandnow/2018/06/20/canada-marijuana-industry-legalization

Market Jitters - Tariff Tantrum What a difference a day makes says one of the talking heads this morning.

Markets stepped back to assess the reality of the tariff response and took another step to rotate away from stocks that would be affected onto stocks that would be less affected. The losers are big industrials and the winners are technology stocks (again) and small cap stocks (again). Many emerging markets recovered too as the wiser heads pointed to strong economic growth and solid balance sheets. Under the radar were a few strong moves in a few pharmaceutical stocks.

The European Union did announce more specifics on their retaliation with tariffs imposed on bourbon, jeans and motorcycles - starting Friday.

In addition they highlighted the potential for further tariffs accounting for about €3.6 billion of trade over the next 3 years. These are seemingly aimed very specifically at Trump heartland supporter states.

The tariffs introduce a whole new set of industry and business problems.

There is price gouging and price speculation. There is stockpiling. There is the process of making application for exemptions from US users and from foreign suppliers. There is a rising bottleneck in the Commerce Department and a lack of skills to make balanced decisions.

In a chaotic and frankly incompetent manner, you’re picking winners and losers on a very technical basis… without a great deal of training

Sen. Claire McCaskill, Democrat Missouri in Senate hearing fronted by Wilbur Ross, Commerce Secretary.

This is emerging from the steel and aluminium tariffs. Just imagine what this will look like when the tariff slate has to be implemented across the board. Further down the list of headlines is one about the media billionaire Koch Brothers starting a campaign to lobby Congress to curb President Trump's Authority on Tariffs. This is a big deal.

The Koch-backed ad campaign and letter are the first major phase of the network’s multi-year, multi-million dollar campaign to promote free trade and oppose tariffs. Tariffs are taxes that make Americans poorer. They raise our cost of living and force higher expenses on our businesses

James Davis, Executive Vice President of Freedom Partners

Note: TIME’s parent company, was acquired by Meredith Corp. in a deal partially financed by Koch Equity Development, a subsidiary of Koch Industries Inc

http://time.com/5316633/koch-brothers-donald-trump-tariffs/

World Cup Russia headlines were all about football.

No surprise really as Russia qualified for the next stage after Uruguay beat Saudi Arabia. It was not all sweetness and light as Russian division of Burger King were forced to pull this offer

a lifetime supply of free Whopper burgers to women who get "the best football genes" and "ensure the success of the Russian team for generations to come."

https://www.rferl.org/a/burger-king-russia-apologizes-ad-urging-world-cup-pregnancies/29307762.html

Only in Russia. Meanwhile on the fields the diving continued - especially from Ronaldo.

Bought

ETFS Corn ETC (CORN.L): Corn Futures. Corn futures prices have been on the slide since I first purchased this ETF. My guess is it has to do with potential trade retaliation. My thesis is for a longer term timeframe demand for corn from China which should survive any tariff changes. Price was making a reversal on a 4 hour chart - so I added another small parcel. Disappointing to see price close the day lower again. See TIB245 for the rationale - maybe I should have heeded my advice about prudent investing - wait to see a solid reversal before entering the trade.

The chart is not pretty with price breaking below all time lows. I would hate to be a farmer.

VanEck Vectors Russia Small-Cap ETF (RSXJ): Russia Small Caps Index. Russia too has been sliding. I added another small parcel to one of my portfolios to average down my entry price.

Sold

Zions Bancorporation (ZION): US Regional Bank. Price has been holding above the strike price for some time on one of the call options I have been holding - $55.90 closing price vs strike price of $40. I sold January 2019 strike 40 call option for 193% profit since April 2017.

I then decided to use a quarter of the profits to add a January 2020 55/65 bull call spread for net premium of $4.11 (7.4% of strike). [Means: Bought strike 55 call options and sold strike 65 call options with the same expiry]. This offers maximum profit potential of 143% if price passes the sold call strike on or before expiry. How does that look on the charts which shows the bought call (55) as a blue ray and the sold call (65) as a red ray and expiry the vertical dotted green line?

The sold call line (red ray) is less than halfway to the pre-GFC 2007 highs. If we get one rate hike more than current expectations this trade will make it. All it needs is another move like the one it made from the mid-2017 consolidation to flow from the mid-2018 consolidation. I just watched Jay Powell, Governor of Federal Reserve, presentation at Central Bankers meeting in Sintra, Portugal where he talked a lot about a strong US economy. The market is pricing in two rate hikes in the next 12 months but the dot plot and this rhetoric says 4.

https://www.msn.com/en-ca/money/video/feds-powell-says-case-remains-strong-for-gradual-rate-hikes/vi-AAyUtuR for the Jerome Powell speech

Original trade was discussed in TIB64.

Income Trades

No bids hit overnight.

Cryptocurency

Bitcoin (BTCUSD): Price range for the day was $251 (3.7% of the high). Price action produced a long tailed bar with price dropping when the news of the hack of Korea's Bithunmb exchange broke but recovering when Bithumb agreed to cover losses. This is the first time we have seen a recovery in one session after an exchange hack.

What is different this time? One talking head, Brian Kelly, pointed out the obvious things - quick response from exchange and commitment to refund losses. The more interesting point is Seller Exhaustion.

The weak hands have been shaken out of the market. Looking back at the daily volatility for the last week confirms that in my mind. Video is worth watching.

Ethereum (ETHUSD): Price range for the day was $27 (5.0% of the high). Price action closed above the parallel channel but not with a higher high - i.e., it made an inside bar [Means: Price was fully contained by the high and low of the previous day]

CryptoBots

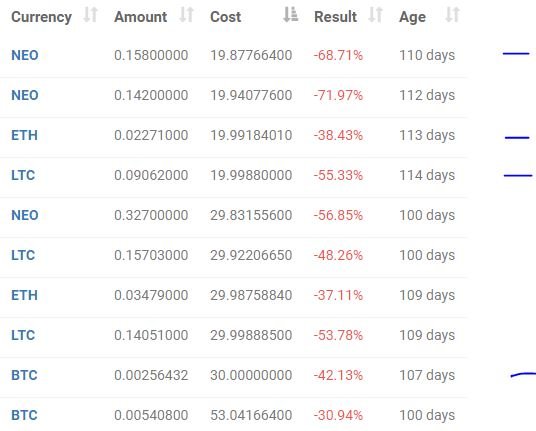

Outsourced Bot No closed trades on this account (212 closed trades). Problem children list was unchanged (>10% down) - (18 coins) - ETH, ZEC (-45%), DASH (-47%), BTS, LTC, ICX, ADA, PPT (-55%), DGD (-46%), GAS (-59%), SNT, STRAT (-49%), NEO (-56%), ETC, QTUM, BTG (-57%), XMR, OMG.

ADA and QTUM are getting close to -40%. Worst coin remains GAS at -59%

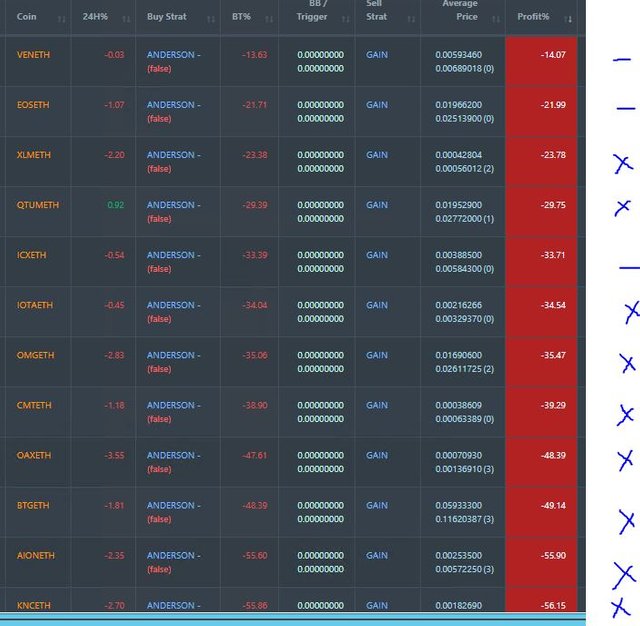

Profit Trailer Bot No closed trades. Dollar Cost Average (DCA) list was unchanged at 12 coins with 3 coins trading flat and 9 worse. Two coins are creeping past -55% down (AION, KNC)

New Trading Bot Positions unchanged at -47.6% (was -47.6%).

All 4 coins traded flat

Currency Trades

Forex Robot did not close any trades and is trading at a negative equity level of 1.7% (lower than prior day's 1.8%).

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search and Time. Bitcoin image comes from CNBC.com. All other images are created using my various trading and charting platforms. They are all my own work

Marijuana image is creative commons https://pixabay.com/en/marijuana-drugs-cannabis-drug-hemp-2766343/

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Bitcoin: Get started with mining Bitcoin for as little as $25 http://mymark.mx/Galaxy

June 20, 2018

Bithumb was quite quick to cover up the losses their team certainly did a good work

Indeed. It is time for exchanges to stop under-estimating how much effort is aimed at hacking them. This is a big deal that banks have solved years and years ago.

Binance in this case is taking this thing on a very serious not having hacker bounty and adding many layers of security i hope other exchanges learn from it

Upvoted ($0.12) and resteemed by @investorsclub

Join the Investors Club if you are interested in investing.

Edit: Added link to Jerome Powell speech in Sintra, Portugal

no other word for you @carrinm, keep the spirit and success always, i always support you.

Thanks

Thank back @carrinm

The big problem has been solved by the Bank, how will it be in the future whether the same thing will happen again?

The exchanges have not invested properly in security. In time the small ones will die and we will only have big ones that can afford proper security. The coin holders will lose. The best way to protect your coin is to hold it offline and use several exchanges when you are trading.

I use multiple exchanges for my trading and holding activity.

Are the losses with the profits aligned here or vice versa?

This is a big problem, is it possible that investors continue to invest if there is an arbitrary hacker?

The market is reaching the point where the scared money is staying away. All that will be left is serious investors.

wow very excellent post Thanks for sharing i will done upvote..

Changed timing for upvote action @smartmarket - bought earlier when my own vote flow was not established.

Before:

After:

Did not deliver a return for the 2SBD ($1:03 per SBD)

Edit: 1.712 SBD refunded