TIB: Today I Bought (and Sold) - An Investors Journal #399 - South Africa, Home Builders. Video Gaming, Ethereum

Markets keep moving ahead with positive vibes from bank earnings. Trade action is averaging down in video gaming and going short on South Africa and profit taking in home building. Weekly update on naked puts included.

Portfolio News

Market Rally

US markets continue to rally on the back of new earnings season data and merger news

Bank earnings come out stronger than expected especially from JP Morgan (JPM). Wells Fargo (WFC) earnings were in line but price is pushed lower by 2.62% to $46.49 - I am short WFC with a 47.5/42.5 bear put spread.

Disney announces prices for its Disney+ streaming service below Netflix subscription price = makes for a surging stock up 11.54% - good for my portfolios. This starts to show the value of the 21st Century Fox acquisition

Merger Moves

Chevron (CVX) makes a bid for Anadarko Petroleum (APC) at $65, a 38% premium to Thursday's close. the offer is part cash, part stock deal.

This brings my holding in APC into positive territory. The deal propels Chevron into the top 4 oil and gas majors. What the deal does do is reduce the Colorado regulation specific risk from Anadarko. Normally I exit when there are acquisitions like this as full value is generally reached. In this case, I will review whether I would want to invest in Chevron, which is one of the world's best managed oil businesses.

“Medicare-for-all” Plan

Senator Bernie Sanders unveils “Medicare-for-all” Plan.

The plan would create a single-payer health care system to replace the current job-based and individual private health insurance system. The big losers are health insurers with United Health Group Inc (UNH) down to a one-year low losing 5.18% on Friday.

https://stocknews.com/news/unh-why-is-unitedhealth-unh-experiencing-its-biggest-2-day-drop-in/

Bought

Electronic Arts (EA): Video Gaming. Electronic Arts has been quietly recovering after the horror collapse with December earnings and forward guidance. Averaged down my entry price in one portfolio and added it to another.

Price has broken the downtrend and is re-testing a support level (dotted green line)

Sold

SPDR S&P Homebuilders ETF (XHB): US Homebuilders. When I rolled strike June expiry 38 calls to strike 41 I failed to apply the trade to all the contracts in one portfolio. Closed out 38 strike calls for 126% profit in 3 weeks. Closing price $40.59 - a little way to go to get to in-the-money on the 41 calls..

Shorts

iShares MSCI South Africa ETF (EZA): South Africa Index. Was looking to replace my expiring spread and with closing price of $56.96, bought October 2019 56/51 bear put ratio spread. Net premium for the base spread was $2.065 offering a basic profit potential of 142%. Net premium for the ratio spread was negative $0.10 (i.e., a cash neutral trade). A quick look at the chart which shows the bought put (56) as a red ray and the sold put (51) as a blue ray with the expiry date the dotted green line on the right margin.

This spread covers the top and the bottom of the current trading range. All the trade needs is for the downward momentum to continue on the red arrow price scenario

Now I have been thinking about this over the weekend - problem with a ratio spread is that the further out-the-money legs move more than the closer in legs (because they have higher delta). This means that it is possible that a trade does not end profitably when price lands up between the two legs closer to expiry. There is also a naked put situation if price drops calamitously below $51. Maybe it would have been better to make it a calendar spread with the further out leg given less time to expiry - then time decay can work in my favour.

I think I will buy back one of the sold legs - especially as price did move up in Friday trade (my trade went on in early trade)

Expiring Options

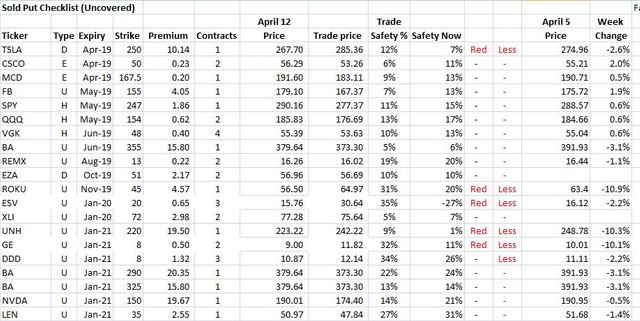

Naked Puts Table below contains status update on naked put trades sorted in expiry order. Key columns to watch are Safety % and Safety Now.

Two new trades have been added on EZA and XLI (trades with no values in April 5 Price column). New column added to show whether protection is more or less than last week.

What stands out

- New Red trade in UnitedHealth Group (UNH) reacting to the "Medicare for all" plan.

- Ensco (ESV) data has been adjusted to reflect the 1 for 4 split. Oil drillers have been improving as a sector and Ensco completed the Rowan merger last week - this should be safe enough with 9 months to go.

- Tesla (TSLA) price is holding above 250 strike despite the Model 3 news. This trade is covered as I am long 250 puts with June expiry.

- April expiries on TSLA, MCD and CSCO look safe.

- ROKU move probably reflects the Disney+ (DIS) launch. With November expiry, there should be enough time

- Strong fall in General Electric (GE). Expiry should be far enough out to give restructuring plan time to work.

Cryptocurency

Bitcoin (BTCUSD): Price range for the weekend was $273 (5.5% of the low). Price made a low test bar right on the support level at $4995 on Friday and moved ahead with an engulfing bar on Sunday. The reversal right on support makes for a good foundation to move ahead to test the last high at $5466.

Ethereum (ETHUSD): Price range for the weekend was $9 (5.6% of the low). Price tested down to the short term support line (blue ray now extended) and aslo makes an engulfing bar to push higher.

I added in one more long contract on my IG markets account on this reversal.

Price target is recent highs around $185.

CryptoBots

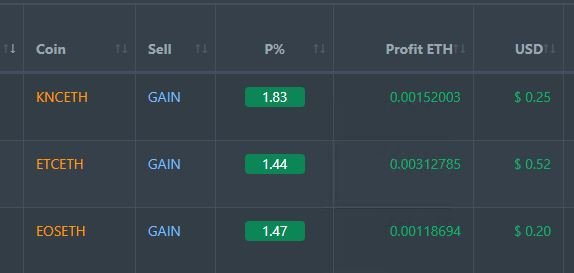

Profit Trailer Bot Three closed trades (1.58% profit) bringing the position on the account to 8.10% profit (was 8.00%) (not accounting for open trades).

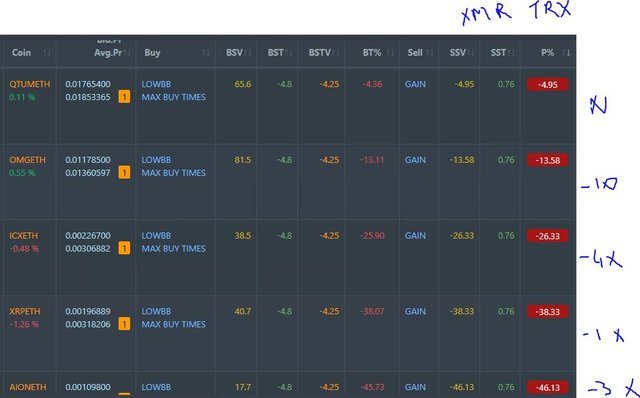

Dollar Cost Average (DCA) list drops to 5 coins with XMR and TRX shifted to PT Defender. QTUM is new on the list. The continued slide of OMG highlights the strategy I am working toward once I clear this list - stop loss around 7.5 or 8%

Pending list increases to 11 coins with 2 new, 2 coins improving, 0 coins trading flat and 7 worse.

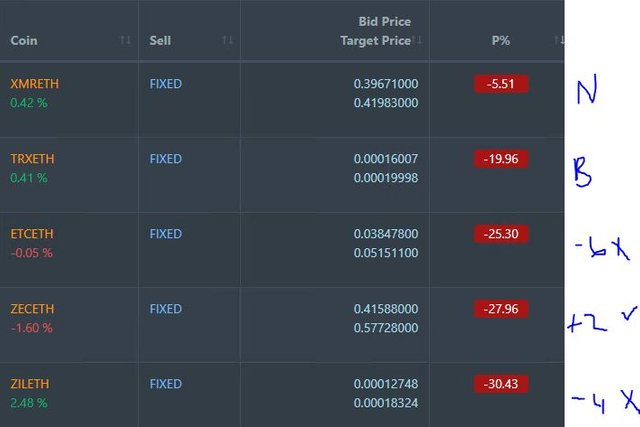

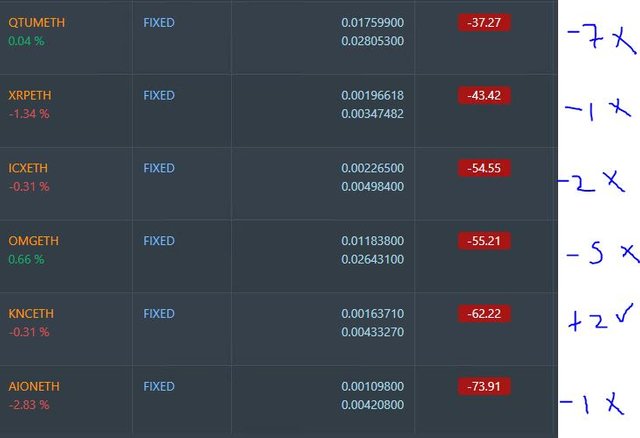

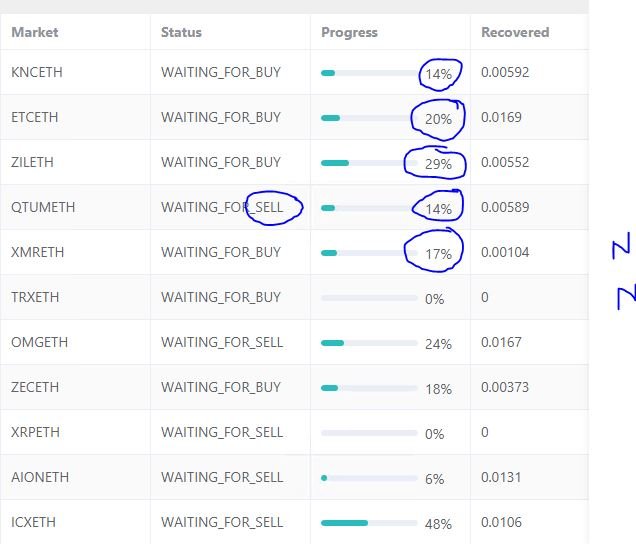

PT Defender now defending 11 coins with TRX added back and XMR added. Defence trades won on KNC, ETC, ZIL, QTUM, XMR.

New Trading Bot Trading out using Crypto Prophecy. Trade closed on ENG (1.84% profit). Trades open on SC, VET, XLM.

Currency Trades

Australian Dollars (EURAUD): Needed to raise Australian Dollars to pay upcoming bills. Chose to sell Euros. Euro has weakened 2% versus Australian Dollar over last 12 months - feeling is there could be more to come.

Outsourced MAM account Actions to Wealth closed out 7 trades on AUDNZD, AUDCAD, XAUUSD for 0.29% losses for the day. No open trades over the weekend.

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Bitcoin: Get started with mining Bitcoin for as little as $25 http://mymark.mx/Galaxy

Crypto Prophecy provides a useful tool to identify oversold and overbought coins - https://mymark.mx/CryptoProphecy

Trading: Binance offers a wide range of coins to trade, tight spreads and low fees if you use BNB to pay https://mymark.mx/Binance

Tracking: Keeping track of your crypto trades is a whole lot easier with CoinTracking.info. Get 10% off all your account upgrades https://mymark.mx/CoinTracking

April 12, 2019

I was surprised to see United Healthcare at 52 week lows given the noise regarding potential changes like this one you mention. It will be difficult to get that through even if they take the White House which I am still unsure of at this point. Valuations look attractive although uncertainty will remain for some time.

Posted using Partiko iOS

Markets seem to price for worst case. This is a good example. The pressure has been building for a while ever since the Green New Plan reached the airwaves.

scash!tip 100

⚡$$$ Tipped @carrinm

⚡100.000 SWIFT! If you don't know how I work, click here! Currently the price ofSwiftCashin the market is$0.003 USDperSWIFT. Current value of the tip is$0.300 USD. To find out more aboutSwiftCash, please read our whitepaper!