[HIT 003] Position Types-Short Put Vertical

Hi Steemian Traders,

We're going to start a series on what Position Types I use. After, we through verticals, I'll put up a grid to help short-cut what how I select which ones. I wouldn't have posted so close together but am getting some questions and want to make sure this is making the best sense I can. Please ask more questions where it isn't making sense and I'll try to clarify.

NOTE0: This isn't investment advice. We can loose a lot trading Options.

NOTE1: These are my understanding of the definitions

NOTE2: I'm trading in an IRA. It requires defined risk trades. Also, these can be a bit safer for a less experienced and/or less active trader.

Short Put Vertical

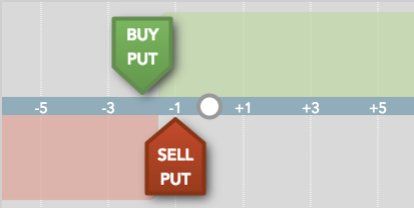

As this is a defined risk trade we can only loose a known amount. Putting this position on we get a credit(cr) of let's say $0.25. Given the image let's say the current trading price is at $10 a share instead of $0. With that we could say the short put's strike is at $9 and the long put's strike is at $8.

MaxLoss = (ShortStrike - LongStrike) + NetCredit

Max Loss is (9 - 8) + 0.25 or $0.75. That really means $75 per set since a contract is for 100 shares.

Max Profit is simply $0.25 or $25 for that same 100x shares per set.

As long as the underlying price stays well above the Short Strike price of $9 at expiration we could make that whole $25.

Improving the Odds and Trading Often

Next, if we want to trade faster, we can adjust this trade by only looking to make half (50%) of the max profit instead of all of it. Additionally, the odds are a bit higher of getting to the 50% profit instead of 100%. What this means is that we can turn around and put another trade on with that same capital for another 50%.

Theta = Time Decay

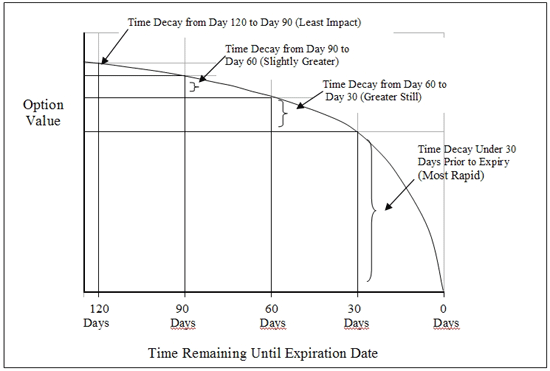

If you think of options as insurance policies, then you can imagine the premium for the policy goes away with time. The amount of the premium value, known as time value or extrinsic value. Theta is the amount that goes away for that day if the price didn't move. So we can make or pay money for an option just for the time we hold it.

Theta decays most in the last 45 days of a contract. This is why lots of short trading is started around 1 month or a bit more from expiration.

I tend to go out further than 45 days for the defined risk trades as it seems I have to manage by rolling much less. If I were in undefined risk trades of just selling the short put without having the "protective" long put, 45 days would be much more my target.

NOTE: Check on tastytrade.com search for DTE and/or Theta and you'll see lots of videos covering this from many angles.

Follow-up

I wouldn't have posted so close together but am getting some questions and want to make sure this is making the best sense I can. Please ask more questions where it isn't making sense and I'll try to clarify. A good discussion will help us all.

This could also be called a Short Put Spread.