How to think about crypto markets - Are you qualified to make the decisions you make?

How did you justify your cryptocurrency decisions over the past year? It's probably a good time to think about how you make decisions.

This post talks about randomness in markets, and the techniques for dealing with that randomness, as well as the important consideration of correlation between the prices of different assets while making decisions.

Random Walks and Randomness in markets

Perhaps the most striking thing that happened to me to change my understanding of financial markets was thinking about random walks. When I was looking at the R statistics language, one of the exercises was to simulate a random walk and plot the result. To do this you pick say 100 numbers at random from some distribution and then plot the total after adding each number.

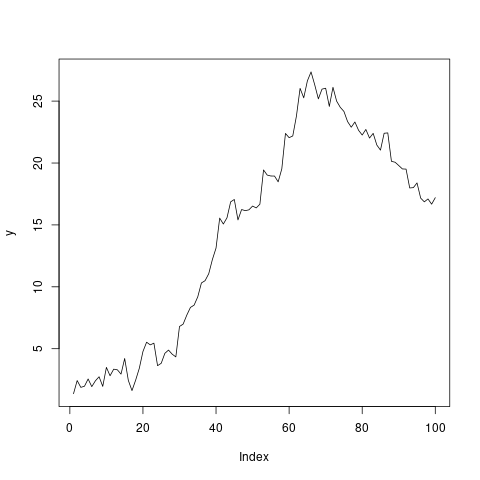

If you take anything away from this post it should be this: It is impossible to distinguish a plot of the price of a currency from the plot of a random walk and from a mathematical point of view, if two things are indistinguishable then they may as well be the same. This plot has been produced just by picking numbers from a standard normal distribution and then adding them up, but if you look at from technical analysis point of view, maybe you'd think that judging by this chart its a good idea to buy some of this currency. Maybe you can even see some Elliot waves This raises two questions: Thinking of markets as random walks, how on earth do people actually make money by looking at charts? and is it possible to study the randomness of the different cryptocurrencies to make forecasts?

The answer to the first question is that people generally don't. With cryptocurrencies in 2017,iIt's generally accepted that lots of people made money because of a huge speculative interest. As long as the decision was to end up with a holding of cryptocurrency, the value would increase since lots of people were finding out about cryptocurrencies. If one was making money with a dodgy decision making process then one wouldn't feel the need to question those decisions, and instead believe that they were making money because of their currency portfolio decisions. With normal stock broker accounts people generally lose money to such an extent that the brokers don't even bother properly buying the stocks that their customers decide to buy and in many cases set their investments to do the opposite of what their customers do.

The answer to the second question is yes, but it is very complicated. The best way to model the currency price movements is as a random walk, but the random variable at each time step (as in the random number that determines what to add to the total) depends on what has happened to the price in the past. Time series analysis is the study of such processes. Note that this is very different to the chart reading that can be found on YouTube and steemit as predictions can be made with quantitative confidence intervals and expected price increases. Neural networks and other machine learning techniques (see my other posts) also offer ways of predicting how currencies will evolve through time by learning the expected change in price given the previous price changes. It is important to remember that all these techniques use the fact that fundamentally the markets are random and the best you can do is predict the expected price movements and assess how likely these price movements are going to be.

Correlations in the prices of different assets

Predictions of the future prices of cryptocurrencies (and of other markets) are made all the more complicated when one considers correlations between the different currencies. For example, if bitcoin increases in price, then it it likely that many other cryptocurrencies will also increase in price either at the same time or with some positive or negative delay on the bitcoin price. This is definitely something to consider when selecting cryptocurrencies to form a portfolio with since if, for example, two currencies share the same gains then is there any point in selecting one over the other? If two currencies are negatively correlated (ie one goes up in price when the other goes down in price) then how do you decide how much of each to buy, given a prediction and confidence of that prediction? This is an area of mathematics / economics called portfolio theory, and it is quite a large field. If you make your decisions based of predictions from separate sources then your decisions are likely not to be optimal from a risk minimising point of view because each prediction is likely to be heavily correlated. To make decisions about a portfolio to make money you need to be able to consider the correlations between different currencies and be able to judge how likely it is that your predictions will be realised.

Where to go from here

To make money, generally you need to act rationally. If you don't have any grounds for owning the cryptocurrencies that you do, then perhaps it is best to either invest in some sort of fund run by people who can prove to you that they know what is going on, or spend a lot of time researching the things mentioned above - ways of making predictions and portfolio theory. It is also possible to change your strategy from investing based on the prices of currencies to the projects themselves, but it is incredibly hard for your decisions not to be influenced by the current price of the currency. In any case, making sure all future financial decisions are completely justified, and not based on the output of a random number generator is an excellent way to increase the likelihood of your investments doing well.

I plan to write more about the process of making sensible decisions, so if you are interested then be sure to follow me. If you have any questions then don't hesitate to post them in the replies.

Congratulations @homes! You received a personal award!

Click here to view your Board

Congratulations @homes!

You raised your level and are now a Minnow!

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Congratulations @homes! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!