My Different Ways Of Investing Long Term

Contributing is a gadget for building wealth, be that as it may it isn't only for the well off. Anyone can start an Investing framework, and distinctive vehicles make it straightforward regardless little totals and add to a portfolio at times. Frankly, isolates Investing from wagering that it requires speculation it isn't a get-rich-expedient arrangement.

Contributing is moreover about benefitting. Spending is basic and gives minute fulfillment paying little respect to whether the try too hard is on another outfit, an escape to some exceptional spot or dinner in some help restaurant. These are eminent and make life all the more enchanting. However, Investing requires arranging our budgetary prospects over our present yearnings.

.png)

Contributing is a way to deal with put aside money while you are possessed with life and have that money work for you so you can totally get the advantages of your work later on. Contributing is a route to a more cheerful culmination.

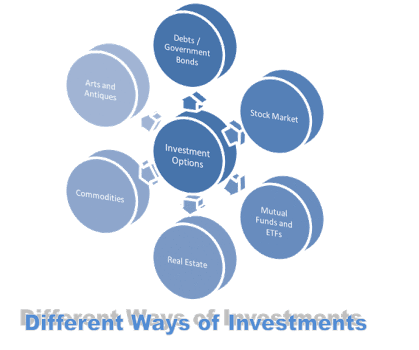

There are an extensive variety of ways you can approach Investing, including setting money into stocks, securities, shared resources, ETFs, arrive (and other choice wander vehicles), or despite starting your own business.

Each wander vehicle has its positives and negatives, which we'll look at in a later portion of this instructional exercise. Perceiving how assorted sorts of theory vehicles work is essential to your success. For example, what does a mutual store place assets into? Who is managing the store? What are the charges and expenses? Are there any costs or disciplines for getting to your money? These are for the most part request that should be answered before making a wander. While it is legitimate there are no accreditations of benefitting, some work on your part can grow your odds of being a productive examiner. Examination, ask about and even basically scrutinizing up on Investing would all be able to offer help.

Since you have a general idea of what Investing is and why you should do it, it's an incredible chance to get some answers concerning how Investing allows you to abuse one of the wonders of math: collecting reserves.

There are many sorts of theories and Investing styles to peruse. Regular resources, ETFs, particular stocks and securities, close end shared resources, arrive, diverse alternative theories and owning all or some bit of a business are just two or three delineations.

Stocks

Acquiring offers of stock addresses ownership in the association and the opportunity to appreciate the association's flourishing through augmentations in the stock's cost notwithstanding and benefits that the association may articulate. Investors have a claim on the association's advantages.

Holders of standard stock have voting rights at investors' social occasions and the benefit to get benefits if they are articulated. Holders of favored stock don't have voting rights, however do get slant in regards to the portion of any benefits over ordinary investors. They in like manner have a higher claim on association assets than holders of essential stock.

Bonds

Securities are commitment instruments whereby a theorist effectively is propelling money to an association or office (the underwriter) as an end-result of irregular premium portions notwithstanding the landing of the security's face total when the security creates. Securities are issued by associations, the administration notwithstanding many states, regions and authoritative associations.

A common corporate security may have a face estimation of $1,000 and pay interest semi-consistently. Excitement on these securities are totally assessable, yet eagerness on metropolitan bonds is exculpated from government charges and may be barred from state charges for tenants of the issuing state. Energy on Treasuries are saddled at the administration level in a manner of speaking.

Securities can be purchased as new offerings or on the assistant market, much the same as stocks. A security's regard can rise and fall in light of different factors, the most basic being the direction of advance expenses. Security costs move conversely with the course of credit costs.

.jpg)

Regular resources

A typical store is a pooled wander vehicle administered by a theory executive that empowers budgetary experts to have their money place assets into stocks, securities or other wander vehicles as communicated in the save's arrangement.

Normal resources are regarded toward the complete of trading day and any trades to buy or offer offers are executed after the market close as well.

Normal resources can idly track stock or security grandstand documents, for instance, the S&P 500, the Barclay's Aggregate Bond Index and various others. Other basic resources are viably regulated where the director adequately picks the stocks, securities or distinctive hypotheses held by the store. Viably supervised shared resources are generally more costly to guarantee. A save's concealed costs serve to decrease the net hypothesis returns to the regular store investors.

Shared resources can make dispersals as benefits, interest and capital increments. These allotments will be assessable if held in a non-retirement account. Offering a common store can realize a get or disaster on the wander, comparatively as with singular stocks or bonds.

Basic resources empower little examiners to in a glimmer buy upgraded introduction to different wander property inside the hold's hypothesis objective. For instance, an outside stock shared may hold 50 or possibly 100 particular remote stocks in the portfolio. A fundamental wander as low as $1,000 (or less now and again) may empower a money related authority to guarantee all the concealed property of the hold. Normal resources are a mind boggling way for money related authorities enormous and little to achieve a level of minute widening.

ETFs

TFs or exchange traded resources take after basic backings in many respects, yet are traded on the stock exchange in the midst of the trading day just like offers of stock. Not in the slightest degree like shared resources which are regarded toward the complete of each trading day, ETFs are regarded dependably while the business areas are open.

Various ETFs track inert market documents like the S&P 500, the Barclay's Aggregate Bond Index, and the Russell 2000 rundown of minimal best stocks and various others.

Starting late, successfully supervised ETFs have showed up, as have affirmed smart beta ETFs which make records in light of "components, for instance, quality, low precariousness and vitality.

Elective endeavors

Past stocks, securities, shared resources and ETFs, there are various diverse ways to deal with contribute. We will discuss several these here.

Land endeavors can be made by buying a business or private property particularly. Land hypothesis places stock in (REITs) pool theorist's money and purchase properties. REITS are traded like stocks. There are normal resources and ETFs that place assets into REITs as well.

Adaptable ventures and private esteem also fall into the class of alternative hypotheses, notwithstanding the way that they are quite recently open to the people who meet the compensation and aggregate resources necessities of being an affirm examiner. Theoretical stock speculations may contribute wherever and may hold up better than standard wander vehicles in turbulent markets.

.jpg)

Private esteem empowers associations to raise capital without opening up to the world. There are furthermore private land bolsters that offer offers to monetary masters in a pool of properties. Consistently alternatives have constraints to the extent how much of the time money related experts can approach their money.

*photo taken by google search

This post was resteemed by @steemitrobot!

Good Luck!

The @steemitrobot users are a small but growing community.

Check out the other resteemed posts in steemitrobot's feed.

Some of them are truly great. Please upvote this comment for helping me grow.

I upvoted and comment for you. Please upvote and comment for helping me grow @mdfoysal

goodluck with your journey on investing

Sir pa cite na lang yung mga resources mo online baka kasi makita ka ni chetaah at ma ban ka.

Parang google translated ang post, baka ma flag ka ni cheetah bot kung hindi original ang post. o.o