On Investment Risk & Investor Psychology

In bear markets or bull markets, investors tend to do the exact opposite of what they SHOULD do. Unfortunately, humans have been conditioned since neolithic times to run away as fast as we can from risk, screaming at the type of our lungs, "Do not go there! There is a BEAR over there! And he's baring his big ugly teeth! Everybody RUN!"

Thus, when markets get hairy, retail investors tend to always overshoot the mark and overcompensate for their losses. In other words, in risky markets, we are more likely to do what we know we should not. We buy high and sell low. It makes us feel better. After all, there is a Big Bad Bear RIGHT OVER THERE. 👆🏼

This phenomenon is the classic "moment of despair" that I referred to in my article last week, "On Capitulation and Bitcoin's Bloody Black Friday Weekend." If we see any more downside from here in the crypto markets (and chances are high that we will), it will be most definitely related to this investor psychology.

In order to be better investors, we have to intimately understand our own personal relationship to risk as well as our own primordial urges as a species. The fight-or-flight response conditions the way everyone responds to stress. There's no way around it. So we just have to understand it. When we perceive stress, our body's sympathetic nervous system initiates a series of automated physiological responses: dilated pupils, elevated heart rate, pale skin, and body trembling.

The release of a whole flood of hormones mostly causes these physical reactions. The main hormone that is secreted into the bloodstream is adrenaline, which basically makes a person act like they have drunk a whole case of Red Bull. The more stress you perceive, the more adrenaline your body makes. Why?

The adrenaline helps you fill your lungs with air and pumps blood to all the extremities of your body so you can run away from THAT BEAR. 👆🏼

So it makes sense that in a bear market, most investors are running away as fast as they can. But what happens in a BULL market? In that situation, which cryptocurrencies experienced all throughout the latter half of 2017, retail investors don't even think about risk. It kinda looks like this:

Do you see that little tiny four-letter word below the bull? That's risk. And in a bull market of screaming gains where even the newest noob is pocketing 400% returns, that's what risk is. A four letter word that you dare not mention.

That's the unfortunate part. In financial markets, risk is actually the highest when prices are relatively high and no one is talking about risk. Everyone around us is doing it. It's as if they are all saying, "Come on in! The water is fine!"

We as investors have to condition ourselves to do the exact opposite of what our hormones want us to do. We know what we have to do. The greatest investors of all time have told us over and over again exactly what to do.

First, there was Lord Rothschild:

Then it was Rockefeller:

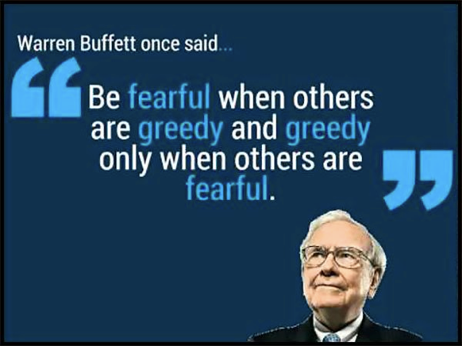

And finally, we have Buffett:

These are the best investors in the history of mankind. They all echo this same sentiment. Do the opposite of your fight-or-flight reaction. Yet, time after time, in bull markets, retail investors never take their gains, almost always top up their investments at the height of the bull market, hold on to their losses for far too long, and eventually sell at the worst possible time at the very nadir of the market.

How can we avoid the fight-or-flight trap?

Investors must familiarize themselves with their own most intimate, visceral emotions. Study and reflection may help you to dive deep into that abyss. When you do, you turn the bear from that toothy, violent fella above into a cute cuddly teddy that you can deal with.

Remember that it's better to

Run toward the Bear and flee from the Bull.

That's the essence of contrarian investing.

I love contrarian investing, but sometimes you must go with the trend until the end when it bends. Lol

Check out my recent article "Why Most People Don't Own Assets."

https://steemit.com/money/@cryptomeeks/why-most-people-don-t-own-assets

Good luck getting off at the right time! It’s a crapshoot.

Posted using Partiko iOS

haha nice analogy and i did miss the 4 letter word at first glance, the bull grab the center of attention =)

PS :

Autopost post from instagram to steemit EASILY, new dapp share2steem | Get daily upvotes from s2s and 287 users who activate unique double curation! | Let’s onboard 1% of insta users, and show them the possibilities with steem !

https://steemit.com/gobindagonj/@anon9/loving-our-high-school#comments

If you want to take traditional markets as an example of what your saying, then it would be wrong. This is due to the fact that on traditional markets, there is definitely not enough "blood on the streets" yet, which - to recognize the right timing of - is also part of being a good speculative market investor.

An example - if you look at how far the dow went in 2008, none of us thought it could reach those lows, halfing itself from 14k to 7k, and people were buying into it at 12k,10k,8k, seeing the bloodbath. This went on for almost a year and a half of downfall from October 2007-June 2009, so where would you have guessed the reversal? So yes, buy when theres blood in the streets (but HOLD FOR YEARS) waiting it out. Theres way more time to think about any reversals towards a bullish market anytime soon, at least in traditional markets, which makes it a bit early to echo historical traditional investor quotes. This could be just a drop of blood in what will be a full bucket.

The great thing about crypto is that it doesnt work like traditional markets, which is why I would stay away from using traditional market processes as an example or investors such as Rothschild and Rockefeller, which in anycase controlled enourmous market share in their time (Buffet as well today) and thus had advantage over very unique insider market intelligence, which makes it easier... Along with their subordinate employees/investors making more then a million a year, scrambling through wallstreet for "special information" at every old job post of theirs in every investment bank previous to big investor their working for.

Anyhow, this is not meant to be disrespectful of your post in anyway, and I thank you for writing it, as it truly makes me think of todays economic whirlwind, and how it'll be going.

I like that

Si quieres que siga tu contenido, ¡sígueme!

If you want me to follow your content, follow me!

Awesome graphic! Couldn’t agree more!

Posted using Partiko iOS

I am waiting for the stock market to crash which I believe it will do in Jan or Feb and then I will invest more. Just like I have invest in steem while it has been this low and other cryptos.

Posted using Partiko Android

Great ideas, but this is only true for real investments. Bitcoin is not an investment, it's pure speculation. And that's fine, If you understand it. But assets like crypto have no floor, only momentum.

Yeah, you make a good point. I always say that we are going to experience these kind of whipsaw price movements until some finprof somewhere can figure out a decent valuation model we can all agree on!

Posted using Partiko iOS

Congratulations @shanghaipreneur! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click here to view your Board of Honor

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Super well said! Good to see you on the trending page!

Posted using Partiko Android

Are my comments nesting properly on this post? I feel like I maybe found a partiko bug

Posted using Partiko iOS

Sure! Send me a screenshot in we chat!

Posted using Partiko Android