Bank of America Stock 14.85% Lower than their November 2015 Peak

Bank of America (NASDAQ: BAC) is the second largest banking and financial services corporation in the U.S. by assets. BofA, as it is commonly referred to, is based in Charlotte, North Carolina and operates in over 35 nations throughout the Americas, Asia Pacific, Europe, the Middle East and Africa. The company has continued to lag the entire financial sector while investors have felt the pain of its under-performance for the bigger portion of this year.

Bank of America investors seem to be fed up with years of poor returns

The Wall Street Journal just reported that some BofA investors, fed up with years of poor returns, had approached activist investors including ValueAct Capital Management LP to see if they would be interested in buying BofA shares. This comes after ValueAct disclosed on Monday that it had purchased Morgan Stanley stock, going against the norm that activists do not invest in the banking sector because of excessive regulations.

A number of the activists are seeing BofA as a potential investment.

But CEO Laurence Fink of BlackRock, which is one of the biggest shareholders of the Bank of America, recently warned U.S. firms to not give in to 'short-termists', meaning the activists, and rather to inform their shareholders about their longer-term strategies.

The CEO and Chairman of the Bank of America Mr Brian Moynihan last month announced plans for big cost-cutting. Mr. Moynihan acknowledged that they are working to ensure that shareholders get better returns.

Bank of America Stock 14.85% lower than their November 2015 peak

The Bank of America (NASDAQ: BAC) is trading at about $15, having shown gradual improvements since early July when it traded at $13. The shares had traded at $18 in November last year before it plunged. According to analyst Giovanni DiMauro of Seeking Alpha, BofA stock price is below book value and are a good buy now. Giovanni sees the stock improve by up to 30% by end of year catalyzed by likely increase in interest rates and recovery in the oil sector.

Bank shares had been battered in January and February in the bear market that persisted in the U.S. financial stocks. Big banks that fared badly and hit a 52-week low include JPMorgan Chase, Citigroup and Bank of America. The plunge in bank shares had stemmed from the turmoil in the commodities market, renewed banking distress in Europe and the China economic downturn.

Growth in the bank's earnings expected to improve in 2017

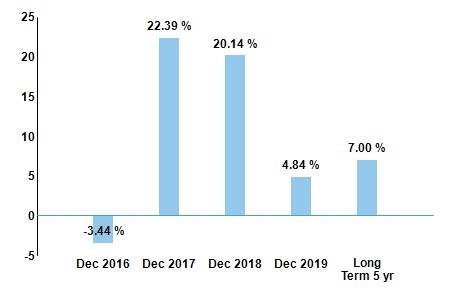

Wall Street analysts have projected earnings growth for BofA to equal -3.44% this year (against the industry average of 0.8%), and improve to 22.39% next year.

You can trade this company on 1broker.uk with Bitcoin - check it out!