My Peer to Peer Lending Strategy.

Have you heard of spit-roasting? No? Google it.

That's got nothing to do with my investment strategy, and everything to do with how adventurous you are.

In a similar way, your rate of return in peer lending, has to do with how much risk you are willing to take.

Loans are rated on the basis of a persons credit rating, and your return is based on your percentage of investment in high or low risk loans.

High risk loans have a high rate of default on average, and low risk loans have a low rate.

I use a different system however.

In my opinion, is the loan applicant a knob-end?

For example, I declined to invest in supposedly low risk loan, for a jet-ski with the comment "for a jet-ski and holidy (sp) that my family deserve".

Declined: Only assholes rides jet-skis, he didn't capitalize the first letter, and no full stop. No, you don't deserve a jetski you knob, you have to earn one and the fact you have a family is a liability.

You've bought a service and a liability, completely destroying my investment and any chance of recovering my investment should your dumb ass lose your job.

Other investments I don't make include, anyone under 25 buying a car and anyone consolidating debt. Oh you were stupid enough to get multiple loans? There's the door.

I invest mainly in people who are between 45-60, who've been working at the same job for 5 years, with no comment, or a well written comment, with grammar.

Sounds simplistic, but gfy. It's better than your strategy, and your mom's strategy. No, your spoon collection isn't worth anything mum, you have dementia and you're just attracted to anything shiny.

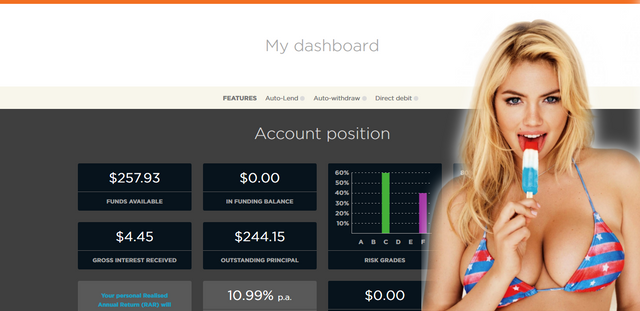

11% P.A. ain't bad.

Peer to Peer Lending with a deposit guarantee scheme sounds like perfect deal.