My four rules for the stock market!

I know it is not easy to summarize everything you need to know about investing in a single post but i will try to be as brief as possible. I have several rules i follow and they are really quite simple.

The first rule is:

Before you do anything haste, research the market even if you know what you wanna do. You might be tempted to overlook some well established companies. Companies are required to report their financials every quarter and they cannot lie about it to the SEC but they can hide very bad news from the public during earnings' conference. The diligent people spare time to read the Q-10 report. If you cannot understand the reports, then you just have to research what the Gurus say about the company. You first have to commit. There are a lot of resources out there, some are good and some are bullshit. You only have to sort through the mud to find your jewel.

Here are some tips of how to do good analysis of a company without having any accounting background.

- Familiarize yourself with the financial ratios of the company There are a lot of financial ratios but really few will tell you what you wanna know. I particularly like to check the EPS and the PEG ratios. There are a lot of other metrics that can come in hand but mastering one/two is the way to go.

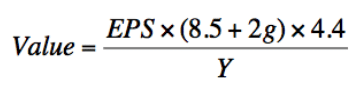

- Determine if the company is undervalued or overvalued It is really hard to do this analysis accurately. It is always within a reasonable range. The best way to approach this is to use the Ben Graham Formula.

- Research the company's future growth Companies nowadays set limits for themselves for their next earning season. You can also look up analyst prediction of expected annual growth.

- Look at the past performance of the company Determine if the company is loss making or if it had made a sensible return on its equity, capital and assets.

- Check the health of the business Check if the company is able to meet its short term commitments with its holdings of cash and other short term assets. You need to also look up its level of debt compared to the net worth.

- Check the company's management team Asses whether you can rely on the CEO of the company to produce the growth you are expecting. Check the tenure of the board of directors, if the average tenure is less than 7years that should indicate to you a new board. However, if the average tenure of the board of directors is more than 7 years that should indicate seasoned and experienced board in the matters of the company. You also need to check if there was any recent insider activity. If so many insiders are selling the company stock, that should raise a big alarm.

)

)Value: The intrinsic value

EPS: The trailing 12-month EPS (Earnings per Share).

8.5: The constant represents the PE ratio of the company with 0% growth as proposed by Graham.

g: the company’s long-term (5-10 years) earnings growth rate.

4.4:The minimum required rate of return. The risk-free rate was 4.4% in around 1962.

Y: The current 20-year AAA corporate bond rate (~3.63%NOW)

The second rule is

The market is a tool to transfer money from the impatient to the patience - Warren buffet

I stand by that statement. Always the market trend is upwards unless there is a correction or unfortunately a crash.

In both cases (market correction or crash) can be avoided with well laid out plan which is my next point.

The third rule is

I will just go a head and share this link with you.

The fourth rule

It is very prudent to have a target and a limit otherwise you will always miss out because of greed and emotions. If a company gains market over a short term it is always not a good idea to sell but if a company takes for example more than 12 weeks to gain 20%, you should take the profit.

If stock is crashing and you already lost more than you are comfortable with, get out of the trade. 90% percent of newbie traders wipe out their accounts because they cannot get out of a losing trade. If you minimize your losses and maximize your winnings, you will always come a head.

I guess you lose some and win some

Long as the outcome is income

-Drake

Some questions you should ask yourself are:

- How long am I going to hold this?

- How much profit is enough?

- How much loss am I comfortable with ?

If you enjoyed reading this, follow me and hit the money button.

Knowing when to get out is the hardest part for me. I’ve watched gains slowing get eaten away it is the worst. My new rule is up 50% sell 25%.

Everyone has that problem because it is very hard to time the market. The only way to win in the long run is to take greed and emotions out of the equation.

That’s why I have a few rules that have been forged in my failures and successes. Another rule I live by is averaging into a position. I’ve been burned by buying an entire position at once.

Congratulations @crazysnake! You received a personal award!

Click here to view your Board

Congratulations @crazysnake! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!