The #1 reason why investing on Lending Club is not what you may expect! (and 2 other alternate options)

If you've been looking into investing some money on the Lending Club platform, read on, and you may very well save 2 years...

If you've not hear about Lending Club, they are a peer-to-peer hard lending platform that allows both borrowers to get quick access to loans (debt consolidation, big purchase, home renovations, etc.) and private investors (like me) to fund these loans and receive interests. They supposedly vet the borrowers, check credit history and make sure only the best borrowers are allowed to get loans (or at least the rates charged reflect the risk).

Simple enough.

Well, not so simple...

If you go to their website and browse to their investor performance page, you can see the provided annualized adjusted investors return curve. This is basically the investor expected return based on the number of loans, the loans mix, a platform average, defaults, charge-offs, etc.

When I pick the 24 months mark on the curve (the age of my account) and a diversification of 100 notes, it tells me that I would likely be earning between 4.2% (10th percentile) and 7.5% (90th percentile) with a median of 5.9%. Seems like pretty good odds.

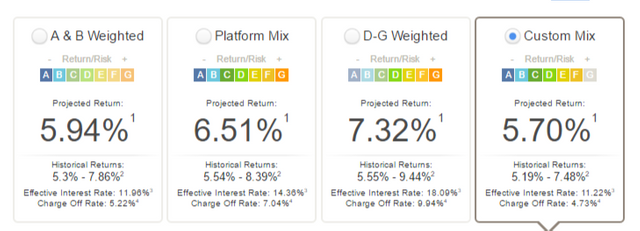

Here is another view, inside my account, of the expected return for my chosen loans basket.

Sounds good to me. Great way to diversify.

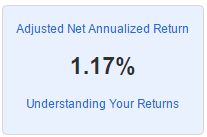

Well, after over 24 months invested on the platform, after going through 173 loans using their automated diversification and a custom mix (removing the worst loans, expecting 5.70%), my actual adjusted annualized return is.....

Yep.

1.17%.

It sucks.

That puts me well below the 10th percentile (I wish I could find out on the curve where I am).

Maybe I did not hold long enough. (although 2 years is a pretty decent test run)

Maybe I did not have enough loans. (although 173 loans seems like a large enough number)

Maybe I'm one of the unlucky being given bad loaners (got lots of charged off loans, people who stop paying).

I don't like much to play with luck when it comes to investing.

So my advice to you is that if you're looking into Lending Club, you can always test it but make sure that you only put an amount you're ready to possibly have sit there for several years not returning what you expect.

At this point, and for the time being, I'm saying goodbye to Lending Club (letting the currently invested loans complete) and I am looking elsewhere for a better return.

Where?

At the time of this writing, my two favorite alternative (income generating) investment places are Fundrise (eREITs for everyone, starts at $1,000) and Groundfloor (Real Estate Loans for everyone, starts at $10 ).

If I see you good feedback and some interests in these alternate investment opportunities, I'll write up some more about my results, returns and overall strategies on these platforms and others.

I've got a Lending Club account I started April 2016 to play with. I'm invested in 13 notes (I've basically added or beefed up to $25 to semi-regularly invest in new notes) over the past 16 months. Current ROI is 13.61%, and that's partly because one of my notes had his credit rate go up, so he or she got new loans to pay off older higher interest loans, so good for him/her! The trick is who you choose to invest in. You have to realize two things: 1) these are subprime loans, and 2) every note is a diversification of your investment. Just as a rough guide to how I approach speculating in these subprime loans, I'm looking to reduce my risk and balance my return. I pick people trying to pick themselves up from a bad credit situation, but who are otherwise stable. This translates to picking B and C level notes for people refinancing credit cards or consolidating debt. They've had jobs and have been paying bills without issues for several years.