1 YEAR IN ....

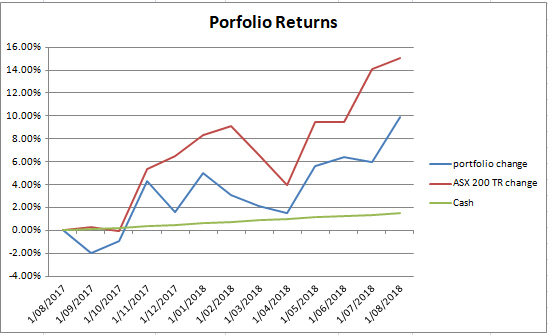

The title is a little decieiving. I have actually been investing for over three and a half years. I have only started tracking performance like a fund would in the last year.

Overall I would say the past year has been moderately successful. Whilst I have underperformed the market I think I have positioned myself well for outperformance in a flat or bear market. The majority of my portfolio (80%) is currently in Listed Investment Companies (LICs), ETFs and cash. I have found that buying certain LICS at discounts has been a worthwile strategy. Whilst some LICs are trade at discounts for good reasons like poor management, lack of direction and poor investment performance, some are simply out of favour or due to a patch of below average performance. Respectable long term performance, reasonanble fees, a discount to NTA and good management are all amongst the first things I look for when buying LICs.

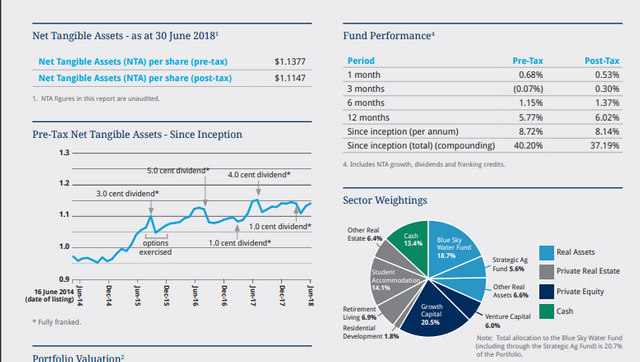

A recent purchase I have made in this space is BAF. Blue Sky has been destroyed by Glacius and whilst I have not made an informed opinion on BLA, I think BAF was too much of a bargain to ignore at 78.5c. With most of BAF's assets now independantly valued, a defensive earnings profile and a discount to reported NTA close to 30% I couldn't resist having a go. I think there is a good margin of safety in this investment. Even if the actual NTA of BAF turned out to be closer $0.95 (15% less than currently reported) and they only achieve returns of 6% p.a, I will make a 7.3% return per year at my purchase price of 78.5 cents.

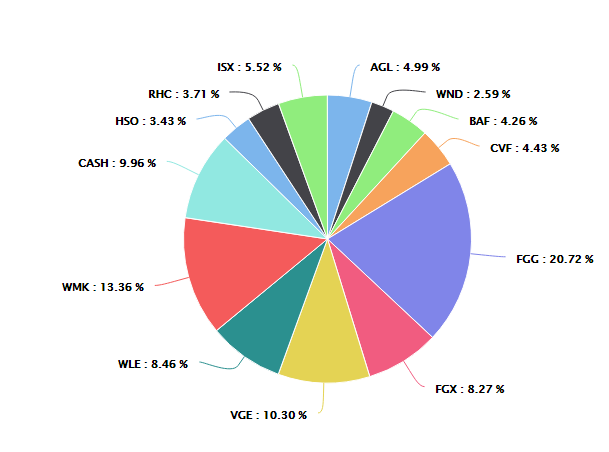

CURRENT PORFOLIO

Dodging bullets...

You will see inmy last post I mentioned interest in CTL- I'm glad I refrained. Looks messy.

Thinking of buying:

UOS- structure slightly confuses me but a bit of value here in an emerging market. Need to get a better understanding of exactly what I'm buying.

GNX- Interesting. Lots of debt and it will be a while until this investment bears fruit. No doubt if everything goes to plan here that 30c is a bargain. Revenue from initial Kidston Project is encouraging.

WND- Copped a hiding for relaeasing some escrowed shares. I still like this one. Considering topping up.

FOD- I like their product, does that make it a good investment? (NO!). But there might be something here. It's a bit rough around the edges but defenitely has potential.

VTH- Like the theme here, valuation looks sensible.

Thinking of selling:

ISX- sold one parcel and may look to sell another on strength. I have held for ages and I think the valuation is quite high considering the risk I am taking. I would rather have them at around 3% of my portfolio.

Other Notes:

My overall Wealth is currently split with 60% in the portfolio discussed above and 40% in fixed interest elsewhere (saving for property)