January Investment Report

January was a disappointing month for my investment portfolio. It looked as though I would outperform the ASX200 until holdings in my portfolio showed weakness whilst the ASX200 rallied in late January. Generally my portfolio tends to have a low correlation to the ASX200 and I hope that when the market flattens out or declines my portfolio will outperform. I am not worried at the moment however if I start producing negative returns or fail to outperform a bear market I will start to reconsider my investment strategies.

WMK is testing my patience and I will be very interested in this months performance update to see whether the ~6% share price drop is justified, I'm still looking for performance to pick up and the discount to NTA to disappear before selling -but these guys have been stinking it up lately.

WLE did not increase inline with the rest of the market towards the end of this month and I am again interested to see the performance update. I'm still looking to sell WLE when it trades at a small premium to NTA. All other Wilson LICs trade at sizable premiums to NTA.

AGL also drifted down on no noticeable news that I found- this stock is a long term hold and I'm not at all worried about short term price movements.

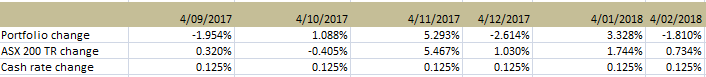

Monthly Performance (taken at the 4th of every month)

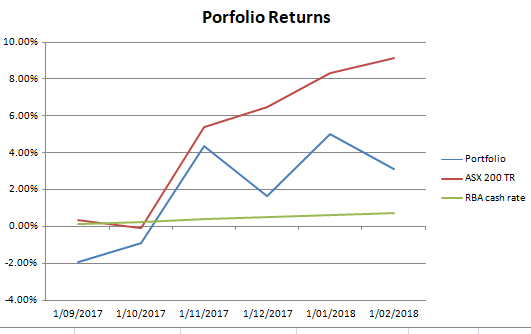

Cumulative Performance

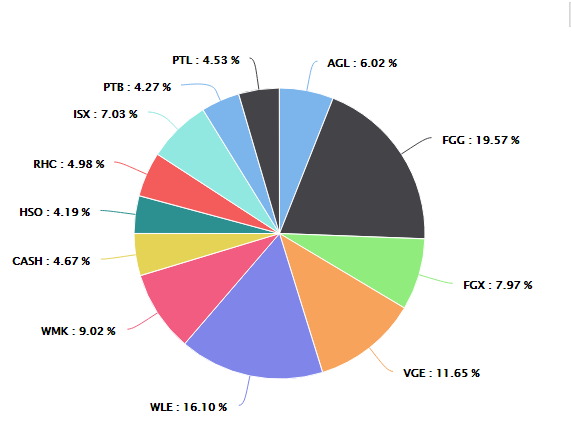

Allocations

Buying Watchlist

WND- Touched on this in my first report. Share price has decreased further since. If it edges lower to around $1.45 I will definitely pull the trigger (all else being equal).

CGC- Needs to drop further but like the business. More on this in another post.

Cash or Cash equivalents- I would like to be holding around 20%. Volatility seems to be really picking up and I want to be able to act on any opportunities that present themselves.

Selling Watchlist

WMK- This was only ever a short/medium term trade. Recent performance has been rubbish for the type of fund that it is. Hopefully either of improved performance (recently recruited a new manager) or declining markets (market neutral strategy should see it hold up) see it trading back closer to NTA and I will be selling out for a quick 10-20% profit. (avg price~84c). Hopefully recent selling is just impatience and not a sign of continued poor performance. Looking to free up cash by selling this one.

WLE- Portfolio has been performing quite well and I expect this to trade at a premium sometime in the future. Happy to hold until it does- it gives me good exposure to the ASX200.

PTL- touched on in last months report. At the moment my thinking is that downside risk far outweighs upside at the

current share price.

ISX- may look to reduce my weighting and sell a small package on some strength- things are starting to come along but positive cash flow may still be a while off.

Overall Investment Allocations:

Investment Portfolio:84%

Acorns Portfolio (conservative): 14%

Trading Account:2%

Positions : Tried a pairs trade with equity indexes, managed to short the SP500 and ASX200 on Friday and over the weekend, however I was long Japan and Euro markets as well. All in all the trade was profitable, however I put it more down to luck than skill.

I'm currently long gold again (closed out same position for a small profit last moth), just as a hedge against increased volatility.