A Comprehensive Review Of Acorns.

Acorns is an investment and savings app that allows users to invest amounts as small as $5 at a time into a diversified portfolio of Exchange Traded Funds. Users of Acorns have their bank account linked to Acorns and are able to set reoccurring deposits, invest lump sums or use the 'round up' feature to invest money into their Acorns Portfolio. Acorns also provides a "found money" feature, which rewards users with a deposit into their account for shopping with certain companies which are partnered with Acorns. I have so far had no problems regarding transparency and security with Acorns in the nine months I have been using it.

Acorns generates revenue by the account fees it charges. For accounts above $5000 it charges 0.275% p.a deducted monthly from the Acorns account balance. For accounts below $5000, Acorns charges a fixed monthly fee of $1.25 which is deducted from the users bank account. Acorns also generates revenue from sales through the 'found money' feature.

Is Acorns good for saving?

If you are someone who struggles to save for whatever reason, then the round up feature may be a helpful way for you to build up some savings. For example, you buy lunch and it costs you $8.20. Acorns will round this up to $9 and invest the 80 cents difference into your account. This can be a very good set and forget tactic if you struggle to save. Yes you will be paying $15 a year in account fees, however you will be saving money that you otherwise would not have. I believe that in general the returns on your portfolio should exceed the fees anyway. On average my round ups have been at least $10 a week and I am not an extravagant spender. There's $520 of savings a year. Now imagine you set reoccurring weekly deposits of $20 per week. Now you have saved another $1040. In a year you have saved $1560- enough for a holiday or enough for your acorns account to now work well as a long term investment. This is money that someone who struggles with saving may otherwise not have saved.

Is Acorns Cost effective?

The main alternative to gaining exposure to the similar share market exposure with a small amount of money is buying am LIC or ETF directly through an online broker. Keep in mind that the with Acorns YOU CAN INVEST MORE AT ANY TIME AT VERY LITTLE OR NO EXTRA COST. This is a major advantage Acorns Users have. If you buy shares directly through an online broker, you would have to pay brokerage every time you buy and sell. You could save up $2000 and invest in an ETF or LIC and gain diverse investment exposure, however you would then have to save up another $2000 to buy more of that ETF and pay brokerage (minimum of $9.50) again. On top of this Acorns allows you to switch Portfolios at anytime for free, another reason why I believe it is highly cost effective at most balances as long as you keep adding to your portfolio with a view to build your account up to more than $2000. Acorns is at its most efficient cost wise if your balance is over $5,000.

What are you investing in?

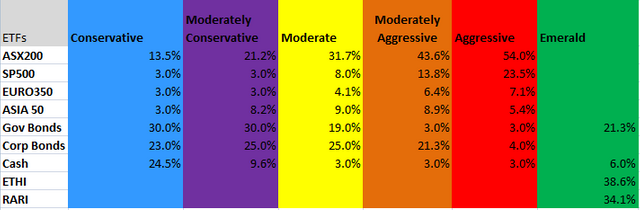

Acorns invests users funds into preset portfolios of ETFs. There are currently 6 portfolios to choose from. The ETFs are :

STW- ASX200 (largest 200 publicly listed Australian companies)

IVV-S&P500 (largest 500 publicly listed American companies)

IAA- S&P ASIA 50 (largest 50 publicly listed Asian companies)

IEU- S&P Europe 350 (largest 50 publicly listed European companies)

IAF- Australian Composite Bond Index (Government bonds mostly)

RCB- Australian Corporate Bonds.

AAA- Australian Cash

ETHI- 100 ethically screened International companies

RARI- Australian socially responsible companies

Here is a graphic of the different portfolios and what they comprise of:

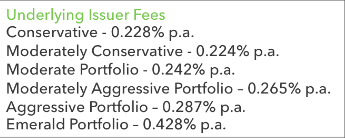

The ETFs do have their own fees that you incur indirectly by investing with Acorns. I argue that you would incur these fees if you invested straight into the ETF anyway so they are really not an issue. The indirect costs are shown below. These do not come out of your balance, they are factored into the ETF prices that are used too calculate your account balance.

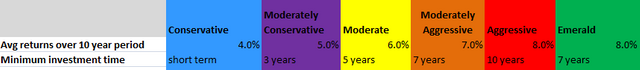

There is something for anyone regardless of risk tolerance and time horizon. Currently I have my account set to conservative because I think Global share markets are on the expensive side and also because I may need the funds shortly. There is the opportunity for a user of Acorns to switch between portfolios in an effort to try and generate better returns than the market. For example, If share markets fall by 20% my conservative portfolio might only decrease in value by 3%. I might then decide that I will try and take advantage of cheaper stocks and switch to the Emerald Portfolio and and take advantage of a recovery. This is obviously quite hard to do in reality, however is is an option for those who are knowledgeable and wish to take a somewhat active approach to managing their Acorns portfolio.

The Emerald Portfolio is probably my favorite over all because of its focus on more ethical and socially responsible companies. In my opinion companies that are more ethically and socially responsible will also produce better returns for investors in years to come. I also like the conservative portfolio and moderate portfolio because of their cost effective exposure to bonds as well as their even spread between international equities.

Acorns is definitely better for long term investors (10 years +) . If you have a shorter time horizon you should choose a less risky portfolio. The table below shows roughly what I think is a good a minimum time frame for investing and a rough approximate of expected returns (after fees) you could expect in a long time period (10 years +). Obviously if you are just using acorns to save smaller amounts then a more defensive allocation is probably best option in order to avoid your savings being eroded- imagine if the market crashed whilst you had an aggressive portfolio and you lost 40% of your savings that you were planning on using shortly. You may also be willing to risk it in case the market surges as it has done recently. Just be informed of the risks. This is all just my opinion so please form your own views.

Sure, 8% doesn't sound like much and it won't make you rich quickly, but with regular investment over time the results are suprising. The following table shows account balances assuming a $2000 starting balance, regular weekly investments and returns of 8% p.a.

Does Acorns create a tax nightmare?

Not at all. A statement is given about one month after the end of financial year which has all the information you need for your tax return.

When is Acorns worth it?

If you need a seamless way to help you save.

If you want a cost effective, simple and well diversified investment portfolio.

If you want to start small and build your way up.

If you want to be able to invest savings as you go, not waiting until you have saved enough to buy more shares as you would normally have to.

If you want a set and forget type investment arrangement.

When is Acorns not a good idea?

If you do not understand that your balance could fluctuate a lot and their is potential to lose money, especially in shorter time frames.

If you think Acorns is responsible for any losses you make.

If you expect amazing returns that will make you rich in a short period of time.

If you have a small, static balance (less than $2000 without adding to it with some regularity).

How could Acorns potentially improve?

Look at using some different and less expensive ETFs. Vanguard ETFs have been neglected for some reason and I think they would be useful. VGE could replace IAA and VAF could replace the bond ETFs.

Replace RARI with FAIR in the emerald portfolio. FAIR has a better screening process, less allocation to banks etc.

Acorns may face some challenges keeping funds under management in the event of a stock market crash/ bear market. It is important that users of Acorns are well educated to avoid a massive outflow of funds from novice or amateur investors in the face of a declining stock market. To counter this Acorns could offer some sort of savings account which does not have fees but makes Acorns revenue on interest margins.

Have an automatic IRR calculator on each account.

This post is merely my opinion, please do your own due diligence or seek professional help before making any investment decisions.

For more detail have a look at the PDS. It may answer some of your questions.

https://acornsau.com.au/product-disclosure-statement/

If you think you might like to try Acorns use this referral link for a $2.50 bonus.

app.acornsau.com.au/invite/83RTC9