January Investment Report

I am a 21 year old who has recently graduated and has a keen interest in Economics and Investment. The purpose of these posts is to create discussion/insight into the world of the average investor. I have been investing for three years and whilst I have lots to learn, I am confident that I can add something to the community by making these posts.

The following is a breakdown of my Investment Portfolio in terms of performance, allocations and potential buy/sell decisions I will be making in the near future. All performance figures are before tax.

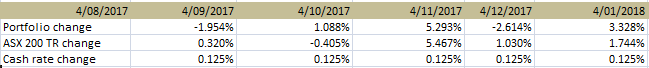

Monthly performance

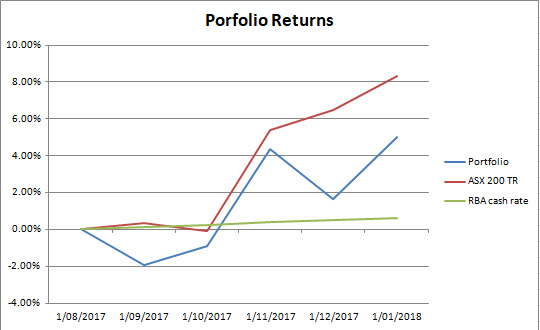

Cumulative performance

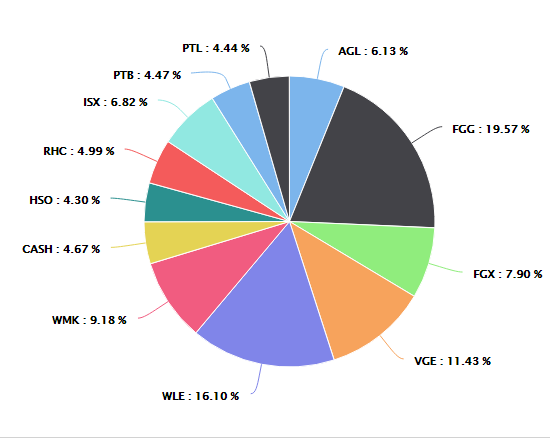

Allocations (as of 16/1/2018)

Considering Buying:

Windlab (WND)- Looking cheap and love the business. The stock lacks liquidity and I think this might be why it is a bit cheap.

More international exposure- LIC or ETF.

Selling Watchlist

WLE- Looking for it to trade at a 5% premium to pre tax NTA.

PTL- Recent profit downgrade surprised me. Valuation looking a bit stretched unless the performance improves dramatically for the second half of FY2018

In addition to my investment portfolio I also like to use acorns to invest and save money for big items like housing and holidays. I believe that it is very effective for both of investing and saving. I may explain why I think this is in a later post. I also have a small portion of my capital in a trading account for speculating/hedging.

Overall Investment allocations:

Investment portfolio: 85%

Acorns Portfolio: 13%

Allocation: Conservative

Trading account : 2%

Positions (as of 16/1/18): Long gold.

Congratulations @retailinvestor, you have decided to take the next big step with your first post! The Steem Network Team wishes you a great time among this awesome community.

The proven road to boost your personal success in this amazing Steem Network

Do you already know that awesome content will get great profits by following these simple steps, that have been worked out by experts?