June Investment Report

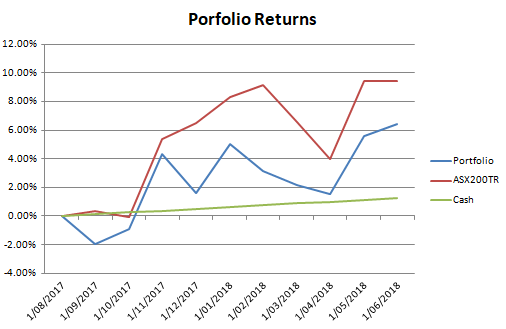

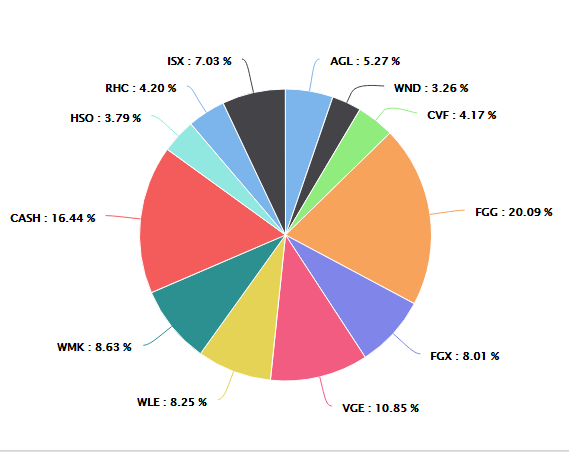

Whilst in the 10 months since I have been tracking my performance I have underperformed the index, I still believe that in the long term I can outperform. In recent months I have taken profits on some of my medium term holdings in order to increase my cash weighting. I can tolerate not being able to beat the market whilst it is rising, what I won't accept is not being able to take advantage of oppurtunnities when they arise.

My most recent sell is PTB. I bought a small parcel a couple of years ago with the idea that I was buying an average company at a cheap price (8x, 13% gross yield). I have made about 35% on my initial investment here and the company now looks less attractive (12x, 11% gross yield) and I'm skeptical of EPS being able to grow substantially in the future. The company has struggled with cash flow in the past two years and the DRP has a large dilutionary impact. This combined with the fact that PTB is quite susceptable to economic conditions (high risk) was the reason I decided that PTB is fully valued.

Recent buys: CVF- a little bit of exposure to Afterpay and a healthy performance history coupled with a good discount to NTA was my reason for buying.

On my radar at the moment:

GNX- lots of debt which concerns me, but I like the industry and they should be generating positive cash flow and paying down debt very soon. Plenty of upside possible here with other developments likely to become commercial. At around 25c I'd be looking to take a 2% position.

CTL- Very very risky. Might be some value here though. Would only be looking to outlay about 1% of my porfolio here.

HBRD- Interesting exposure, could be a good way to make the most of banks which have profits that are going nowhere fast

IXI- Once it becomes domociled in Australia I might be interested. I like the thematic. I do have Ethical concerns here though.

WND/RHC/AGL- Top up opportunities?

I will resteem your post to over 72,500 followers. Read my profile @a-a-a