Listed Investment Companies....

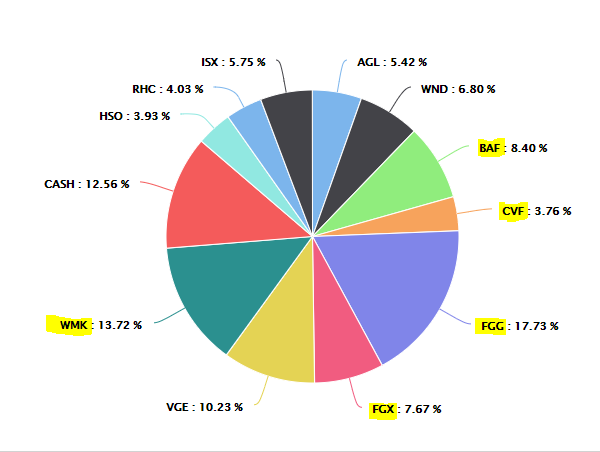

As you can see , I tend to alllocate a large portion of my portfolio towards Listed Investment Companies (LICs). Why?

LICs are subject to misprcing in the same way that all other stocks are. Buying opportunities are most often created due to investors having short term mindsets and the pursuit of higher returns. Whilst you will never become a millionaire overnight , buying the right LIC at the right price can produce impressive risk adjusted returns that really make a difference over a longer period of time.

How to I assess LICS

I look to three main areas:

If the stock is trading at a discount or premium to Net Tangible Assets (NTA)

Directors acting in the interests of shareholders

Investment Management

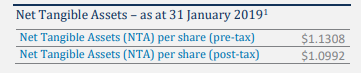

Discount/Premium to NTA

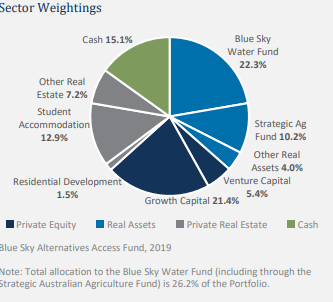

This one is quite straight forward, determining the approximate discount or premium to NTA is key part of the buying decision for any LIC. Be careful when taking NTA at face value. It is worth considering the underlying investments and taking the balance sheet (tax assets etc) of the LIC into account. Generally the reported NTA of LICs that invest in listed securities are quite reliable, however a LIC like BAF which holds investments in assets like property funds, water rights, venture capital and other unlisted assets are worth being cautious with. Carrying values of investments such as those that BAF holds should be frequently reviewed by independent sources and are subject to certain underlying asumptions about risk when calculating their values.

With a current shareprice of around $0.85, BAF is currently trading a very attractive discount to NTA of around 20-25%. This discount formed when the investment manager (Blue Sky BLA) had their reputation trashed and the reported value of the assets in BAF's portfolio were called into question. Since then, most assets in BAF's portfolio have been independently valued and I am satisfied that there is still a very material discount between BAF's current share price and the underlying value of the portfolio.

Directors acting in the interest of shareholders

Directors acting in the best interests of shareholders is essential. When looking to buy an LIC due to it trading at a discount to NTA, you will at least in part be relying on good capital mangement policies employed by management to narrow the gap between share price and NTA in order to produce attractive returrns. Initiatives that can be undertaken by directors to address a discount to NTA include:

Share Buybacks

Directors "showing faith" by making on market purchases

Changing investment managers

Accepting takeover bids at an attractive price

Looking at mergers to increase efficiency and liquidity

Considering delisting to an unlisted fund structure so investors can realise the value of the underlying incvestments.

Optimising FUM to a more efficient size (this can improve liquidity as well)

BAF has undertaken both a share buyback program and is also looking at a change in direction with regards to investment managers. These are both pleasing initiatives and are reasons I continue to hold BAF with some conviction.

It is worth noting that some LICs trade at a premium to NTA. A perfect example of this is WAM. For as long as I can remember, WAM has consistantly traded at a premium to NTA of around 20% . Geoff Wilson has used some very effective capital management initiaitives in this time. They include:

Creating a share purchase plan at a premium to the current NTA but at a discount to the current share price. This boosts NTA but allows existing investors to obtain shares at a discount to the current share price.

Taking over troubled LICs that trade at a discount to NTA.

WAM has recently used both of these strategies as ways to creat value despite the huge premium to NTA that the share price has been trading at.

*Investment management

In this area there are a number of factors to consider:

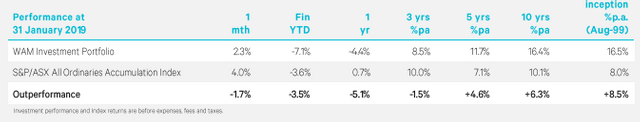

Performance track record (Net of Fees)

Focus and viability of strategy

Fee structure (how future fees will likely influence returns)

Satisfactory past performance is important. A good track record should give an investor confidence, however it is worth noting that past performance is not an indicator of future performance. Many funds may have one or two exceptional years on the back of a few great investments. It is worth noting that there are few funds that have produced consistantly strong returns over long periods of time, with most reverting to the mean following periods of extrememly strong performance. It is also worth noting whether the investment manager reports performance before or after fees and taxes.

WAM is renowned for it's exceptional track record, however it is worth noting that they report performance before fees and taxes. Even despite this, WAM does have a very good track record.

This brings into discussion the impact of management fees charged by the investment manager. Different fees are charged by different managers based on the strategy they employ. LICs like AFIC (AFI), Argo (ARG) and Milton (MLT) which hold mostly large cap stocks with a buy and hold strategy have very low fees ranging from 0.1% to 0.2%. Boutique funds with more active strategies like WAM for instance tend to charge around 1% plus an outperformance fee, which they are only paid when they outperform a certain benchmark and have recouped all proir losses.

Wilson Asset Management currently charges 1% p.a plus an out performance fee of 20% for most of its funds. This is roughly the industry standard. Considering that you can buy an index fund for 0.07%, you really need to be confident in the investment manager to justify fees that are this high. After Fees, more often than not an index fund will come out on top.

Last of all, make sure the manager is clear on their strategy and has a strong focus. When a manager tries to do things outside it's circle of competence, it normally results in poor performance. Take WMK for example, where the investment

manager electred to try and be market neutral across both Australian and Overseas Equities. As a result of not sticking to their area of competence (Australia) and not having the expertise or resources to make good decisions both overseas and domestically, returns deteriated to an unsatisfactory level. Luckily in this instance the directors have decided to delist the fund, giving shareholders a chance to exit the investment at NTA.

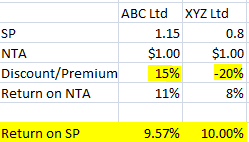

Because performance is calculated by taking the movement in NTA and adding on dividends, whether you buy a LIC at a discount or premium to NTA will impact your returns.

Making the simplifying assumption that directors elect to pay all returns out to sharholders, in the above scenario the fund that achieves the worse returns (relative to NTA) actually gives the shareholder a better return on investment.

I am confident that I understand what factors influence the share price of an LIC, however quantifying these factors and determining to what extent each of them influences long term investor returns is a very different story...

Perhaps one day I will try and make some sort of quantitative model to determine whether to buy hold or sell a LIC..... until then I will continue to value them with mostly qualitative measures, keeping an especially sharp eye out for a discount to NTA and a potential catalyst to narrow that discount.

I have briefly summarised my opinion on current LIC holdings in my portfolio below:

WMK- HOLD

I am going to await the opportunity to realise my investment at NTA in a few months time. As I touched on earlier, the board has decided to turn this LIC into an unlisted fund, meaning at the current NTA I should still get another 3-4% return when this happens. I will come out of this infront, even despite the terrible investment performance.

FGG/FGX- HOLD

Not sure that the investment performance deserves the premium to NTA that the SP currently trades at, however the fact that the only fees paid go to charity to make this a good place to park your money. The boards interests are alligned with Shareholders as well. Will consider selling if the premium increases further.

BAF- BUY

A contrarian buy, there is some value here and directors seem to now be doing what is best by the shareholders. Exposure to this sort off asset class is also an appeal.

CVF- HOLD

Performance history is good- mainly because of there investment in Afterpay from what I can tell. I like that their strategy will mean returns aren't correlated with the overall market. A recent resignation in the invesment team has got the market a bit nervous about this one. The 20% disount to NTA and at very worst solid past performance are enough to keep me sticking around.

Congratulations @retailinvestor! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click here to view your Board

If you no longer want to receive notifications, reply to this comment with the word

STOPHello @retailinvestor! This is a friendly reminder that you have 3000 Partiko Points unclaimed in your Partiko account!

Partiko is a fast and beautiful mobile app for Steem, and it’s the most popular Steem mobile app out there! Download Partiko using the link below and login using SteemConnect to claim your 3000 Partiko points! You can easily convert them into Steem token!

https://partiko.app/referral/partiko