Update-

The last three months have seen the markets become a tad more rational. Fear surrounding rising interest rates in America and the potential negative consequences of a trade war have restored some rationality to share markets globally. Locally, tightening credit conditions have seen the housing market take a dose of reality.

Whilst no massive warning signs are present and US economic data appears strong, the threat of rising inflation and the trade off of rising interest rates will spell difficult times ahead. Emerging Markets appear to be in for a turbulent ride- with US dollar denominated debt looking like it will get more and more expensive.

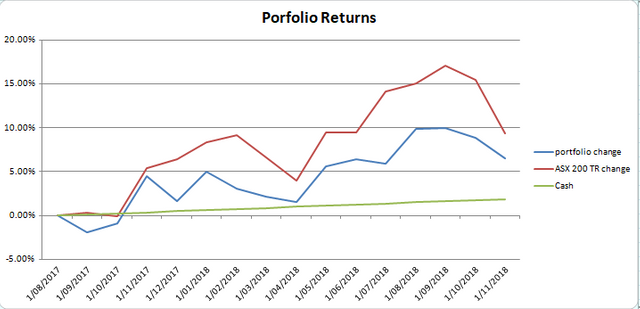

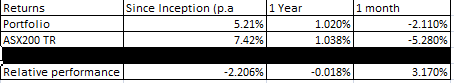

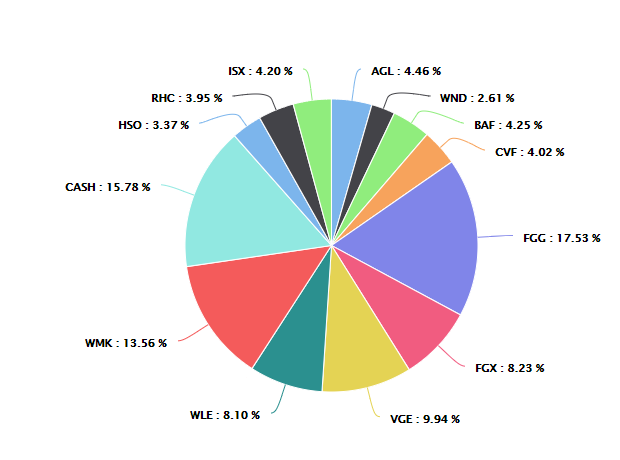

As expected, my portfolio has held up quite well in the market turbulence that has been present lately. Defensive investments, a decent cash weighting and taking advantage of a FGG share placement (arbitrage) have been the main reasons for my out performance.

Buying Watchlist:

BAF- New investment managers circling here and even offers coming in for some of their assets. I have no doubt that if Wilson was to become the manager that value will be created here. Provided that current management do not part with assets below their book value I think the hefty discount (over 20%) to NTA that BAF is trading at provides me with an opportunity to increase my exposure to alternative assets- an attractive asset class in current market conditions.

WND- This one slips under the radar but I think there is great long term value to be created here. Market bit nervous about the lumpy nature the cash flows that the company currently generates. Cashflows should slowly become more consistent as WND gains more reoccuring revenue sources.

WMK- Management are conscious of the discount to NTA, I think there might be something in the works behind the scenes. Again happpy with a market neutral invesment strategy in current market conditions even if it does mean 5% returns for a few years.

FGX- SPP announced. Will look to maintain current holding and take advantage of arbitrage oppurtunities that present themselves (as they did with FGG).

Selling Watchlist

ISX- Not sure what to make of this. I was lucky enough to sell a parcel around 20c a couple of months ago.

Management have a lot of work to do to show that they have any credability at all. Recent announcements have been positive however this is nothing new. The next quarter needs to be cash flow positive at the very least. I will look to decrease my holding to around 2% of my total allocation on some strength- with the hope that management still know what they are doing....

RHC- Not sure about the recent aquisition and leverage levels. Leverage of 2.9x is very high. Given that it is only 4% of my portfolio and it is still generating strong cash flows, is geographically well diversified and has an underlying business that should be quite resilient I will keep holding. Watching out for more warning signs.

Congratulations @retailinvestor! You received a personal award!

Click here to view your Board

Do not miss the last post from @steemitboard: