Cannabis Spending is THROUGH THE ROOF – Invest Today or Get Left Behind!

It’s 2019, and anyone who’s been reading the financial news knows that cannabis isn’t just a plant anymore: it’s a medicine, a popular form of recreation, and most of all, it’s an incredibly lucrative business. For investors who’ve been waiting for the right opportunity, this is a call to action and your chance to get in before the cannabis movement passes you by.

Just like buying Amazon stock when it was a few dollars per share or buying gold when it was a couple hundred dollars per ounce, you’re getting one more opportunity to take an early position in a hyper-growth industry with legalized cannabis.

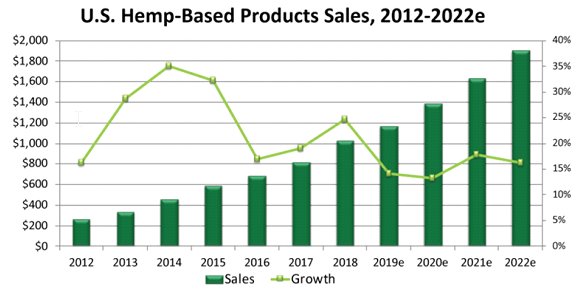

Cultivation, processing, marketing, branding, and distribution… each part of the cannabis product life cycle is extremely profitable right now. With state-by-state decriminalization in progress, the United States has been an absolute hotbed of sales activity and will continue to grow in this area through at least 2022:

Courtesy: Hemp Business Journal

One thing I’ll never do, however, is just jump into a stock without researching it carefully and making sure it’s not overpriced. That’s the problem with most cannabis stocks nowadays: retail investors have already bid up the share price, and if you buy now, you’ll be paying too much.

Not every cannabis stock is overpriced, though, and there’s actually one that’s trading well below fair value. Better yet, the company has every touch point in the cannabis ecosystem covered, from the cultivator all the way down to the consumer.

The company is called C21 Investments Inc. (CSE: CXXI), and they’re offering supreme shareholder value by providing solutions throughout the cannabis supply chain, including quality manufacturing, brand extension, and distribution and retail channels, as we see it.

This is what’s known in the business as vertical integration, and it’s very difficult to achieve but tremendously profitable when done properly. By covering all the bases in the cannabis ecosystem, C21 is mitigating risk while also ensuring brand integrity – a definite advantage because millennials and other consumers have shown a marked preference for premium-quality cannabis brands.

C21’s business model involves strategic acquisitions of carefully vetted cannabis brands that are highly recognized in the United States and internationally. These are brands that have already demonstrated a proven track record of success, such as Eco Firma Farms in Oregon.

Another example is Phantom Farms, which has massive outdoor cannabis cultivation facilities totaling 80,000 square feet, with an additional 40,000 square feet under development, as well as a 5,600-square-foot facility that includes a wholesale distribution warehouse and extraction laboratory, plus a 7,700-square-foot, state-of-the-art indoor grow facility.

Other future holdings include Swell Companies, which is under a definitive agreement to get acquired, and whose products are distributed to over 325 dispensaries throughout Oregon; Silver State Relief, the leading cannabis cultivation, processing, and retail-branded product company in northern Nevada.

C21 has the recognized brands, experienced management, and more than enough capital to serve North America and the world’s huge appetite for cannabis products.

CXXI shares will only be underpriced for so long, and I’m preparing for a big move as more U.S. states and international regions decriminalize cannabis and allow market penetration. As this happens, C21 will be first on the scene – and if you own the shares, you’ll be the first to profit.

Best Regards,

Brad Robbins

President, PureBlockchainWealth.com

93% Of Investors Generate Annual Returns, Which Barely Beat Inflation.

Wealth Education and Investment Principles Are Hidden From Public Database On Purpose!

Build The Knowledge Base To Set Yourself Up For A Wealthy Retirement and Leverage The Relationships We Are Forming With Proven Small-Cap Management Teams To Hit Grand-Slams!

This work is based on SEC filings, current events, interviews, corporate press releases and what we’ve learned as financial journalists. It may contain errors and you shouldn’t make any investment decision based solely on what you read here. It’s your money and your responsibility. Wallace Hill Partners LTD, a Canadian company, which is owned by the same individuals as Pure Blockchain Wealth, has been compensated three hundredthousand u.s. dollars, five hundred thousand canadian dollars and one million, right hundred thousand RSUs, directly by c21 investments, for a three year marketing agreement. The information herein is not intended to be personal legal or investment advice and may not be appropriate or applicable for all readers. If personal advice is needed, the services of a qualified legal, investment or tax professional should be sought.

Please read our full disclaimer at PureBlockchainWealth.com/disclaimer

Original Article Available HERE

Warning! This user is on my black list, likely as a known plagiarist, spammer or ID thief. Please be cautious with this post!

If you believe this is an error, please chat with us in the #cheetah-appeals channel in our discord.