Learn with Steem How to Calculate the Various Classes of Leverage (25% beneficiary set to Null)

Introduction

.png)

Link

A few weeks ago, I wrote about the concept of leverage or gearing and the various classification of them which can be seen in this post.

However, I didn't include practical examples on how to calculate the various classes of leverage. This post will brush a little on the classification of leverage with practical examples.

Without explaining much, I'd dive into the classification of leverage, and degrees of leverage and advise appropriately or give recommendations.

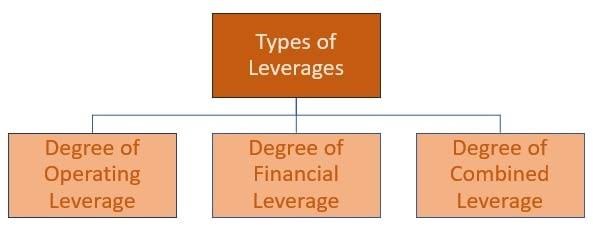

Classification of Leverage

%20(22).jpeg)

Link

Operating Leverage

Operating LeverageThis amplifies the consequence of the change in sales revenue on the level of Earnings Before Interest and Tax and can be calculated using the formula:

OL = C/OP or EBIT

Where:

OP = Operating Leverage

C = Contribution

OP = Operating Profit

EBIT = Earnings Before Interest and Tax

Illustration 1

The following information was extracted from Steemit and Steem Ltd respectively;

| Details | Steemit (N'000) | Steem (N'000) |

|---|---|---|

| Sales | 2500 | 3000 |

| Fixed cost | 750 | 1500 |

| Variable Expenses as the % of sales | 50% | 25% |

Required: Determine the operating leverage and state which company has higher business risk and why?

Solution:

| Statement of Profit | Steemit (N'000) | Steem (N'000) |

|---|---|---|

| Sales | 2500 | 3000 |

| Less; Variable Expenses as the % of sales | 50% of 2,500 = (1,250) | 25% of 3,000 = (750) |

| Contribution (C) | 1,250 | 2,250 |

| Less; Fixed cost (FC) | (750) | (1,500) |

| Operating Profit (C - FC) | 500 | 750 |

Operating Leverage =

OL = C/OP

For Steemit = #1,250/500 = 2.5

For Steem = #2,250/750 = 3

Advice

Steem Ltd has higher operating leverage which means that it's using higher fixed costs against its variable cost, therefore, it faces more risk than Steemit limited.

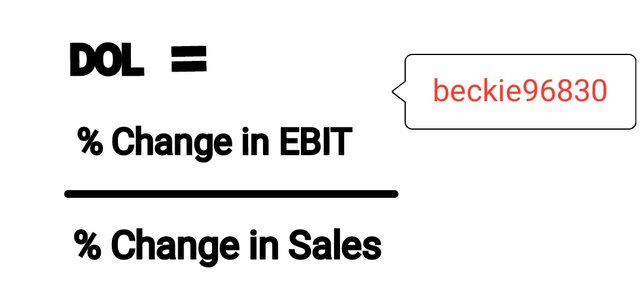

Degree of Operating Leverage

Thus can be calculated as:

OR;

DOL = PBT + FC / PBT

- Illustration 1.1

Steemit ltd sells 1000 units of products @ #10 per unit. The cost of production is #7 per unit and it's a variable cost. The profit of the firm is 1000 (#10-#7). Suppose the firm can increase its sales level by 40% resulting in a total sales of 1400 units, the profit of the firm will now be 1400 (#10-#7).

Required:

Calculate the Degree of Operating Leverage of the firm.

Solution:

Using the formula above, we have;

% Change in EBIT =

% Change in Sales =

| Details | Current (#) | Old (#) | % Change |

|---|---|---|---|

| EBIT | 4200 | 3000 | 40.00 |

| Sales | 1400 | 1000 | 40.00 |

| Total | - | - | 1% |

Financial Leverage

Financial LeverageFinancial leverage happens when the company earns less than the fixed cost used and this will reduce owners equity. Financial leverage is represented as;

- Financial Leverage: EBIT/PBT

- Financial Leverage: EBIT/EPS

Where;

EBIT = Earnings Before Interest and Tax

PBT = Profit Before Tax

EPS = Earnings Per Share

Financial leverage affects Profit After Tax (PAT) and EPS. The business therefore can use fixed financial charges to increase the effect of changes in EBIT or EPS.

Illustration 2

Becky Ltd has the following capital structure

| Details | N'000 |

|---|---|

| Equity Share Capital | 100 |

| 10% Preference Share Capital | 100 |

| 8% Debentures | 125 |

If the EBIT is #50,000. Calculate the financial leverage assuming a 50% tax bracket for the company.

Solution;

| Statement of Profit | N'000 |

|---|---|

| Operating Profit (EBIT) | 50 |

| Interest on Debenture (8% of Operating Profit) | (10) |

| Profit Before Tax (PBT) | 40 |

| Income Tax (50% of PBT) | (20) |

| Profit After Tax | 20 |

Financial leverage = EBIT/PBT

50/40 = 1.25

Tools used in measuring financial leverage

Debt Ratio

This refers to the ratio of debt to total capital employed in the business and it's denoted as D/D+E or D/V

Where;

D - Debt

E - Equity

V - Total Cost of the Firm.

Debt Equity Ratio

This refers to the ratio of debt to equity and it's denoted as D/E.

Interest Coverage

This refers to the ratio of net operating profit to interest charges. It can be denoted as EBIT/Int

Where;

Int - Interest

The first two describe how constant the borrowing stance of a company is at any point in time.

It also fails to show the height of financial risk being faced by a firm which can cause the eventual downfall of the firm if care isn't taken.

Failure of a firm to pay back what they owe or run into unrecoverable debt while doing so is called leverage ratio.

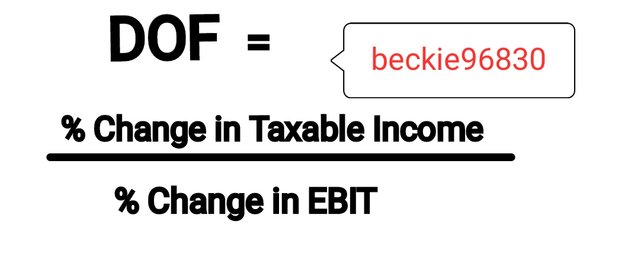

Degree of Financial Leverage

This is denoted as;

Or

DOF =

[EBIT/EBIT-Int]

Combined Leverage

Combined LeverageThis form of leverage merges the components of operating and financial leverage into one to form the combined leverage.

To compute this we have: OL × FL

That is Operating Leverage multiplied by Financial Leverage equals Combined Leverage.

Illustration 3

Amaka and Co Ltd, a drilling company in Nigeria made in the year 2020, a total sales of #2500 The total variable cost incurred was #1500 while the fixed cost was #500. As part of its capital structure, the debt of 1,250 was issued at an 8% interest rate.

Required: Compute the combined leverage.

Solution:

| Statement of Profit | Amaka and Co ltd |

|---|---|

| Sales | 2500 |

| Less; Variable Cost | (1,500 |

| Contribution (C) | 1,000 |

| Less; Fixed cost (FC) | (500) |

| Operating Profit (C - FC) | 500 |

| Less; Interest on Debt (8% of 1,250) | (100) |

| Profit Before Tax | 400 |

Operating leverage = C/OP

1,000/500 = 2Financial Leverage = OP/PBT

500/400 = 1.25Combined Leverage = OL × FL

2 × 1.25 = 2.5

Degree of Combined Leverage

The degree of combined leverage is gotten as the percentage in a firm's EPS resulting from a 1% change in sales and it's denoted as:

DCL = DOL × DOF

OR

DCL = C/PBT

Where:

C = PBT+Int+FC

- Illustration 3.1

Amaka and Co Ltd, a drilling company in Nigeria made in the year 2020, a total sales of #2500 The total variable cost incurred was #1500 while the fixed cost was #500. As part of its capital structure, the debt of 1,250 was issued at an 8% interest rate.

| Other financial data includes: | (#) |

|---|---|

| The net worth of the business | 2,600 |

| Debt | 1,300 |

| EBIT | 1,000 |

Required; Using the figures above, compute the following:-

- Debt to Equity ratio

- Debt to Total Capital Ratio

- Interest Coverage

- Degree of Operating Leverage

- Degree of Financial Leverage

- Degree of Combined Leverage

Solution;

- Debt to Equity ratio: D/E

1,300/2600 = 1/2 or 0.5

- Debt to Total Capital Ratio: D/D+E

1,300/1,300+2,600 = 1,300/3,900 = 1/3 or 0.33

- Interest Coverage: EBIT/Int

1,000/100 = 10

To the various degrees of leverage we have;

| Statement of Profit | Amaka and Co ltd |

|---|---|

| Sales | 2500 |

| Less; Variable Cost | (1,500 |

| Contribution (C) | 1,000 |

| Less; Fixed cost (FC) | (500) |

| Operating Profit (C - FC) | 500 |

| Less; Interest on Debt (8% of 1,250) | (100) |

| Profit Before Tax or EBIT | 400 |

Degree of Operating Leverage

PBT + FC / PBT

400 + 500/400 = 9/4 = 2.25%Degree of Financial Leverage

EBIT/EBIT-Int

400/(400-100) = 400/300 = 4/3 = 1.33%Degree of Combined Leverage

DCL = DOL × DOF

2.25 × 1.33 = 2.9925 ~ 3%

Conclusion

Generally, Operating Leverage measures the relationship between Sales Revenue and EBIT while Financial Leverage between Profit After Tax and Earnings Per Share. The combined leverage focuses on the relationship between operating leverage and financial leverage.

Thank you for contributing to the #LearnWithSteem theme. This post has been upvoted by @maazmoid123 using the @steemcurator09 account. We encourage you to keep publishing quality and original content in the Steemit ecosystem to earn support for your content.

Regards,

Team #Sevengers

You're calculations here are commendable. Seems you're good in calculations! Which course did you study in school?

Banking and Finance

Oh you've shown your professional skill here! Keep it up!!